Why are dividends taxed twice.

If you’re searching for why are dividends taxed twice pictures information linked to the why are dividends taxed twice keyword, you have come to the right site. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

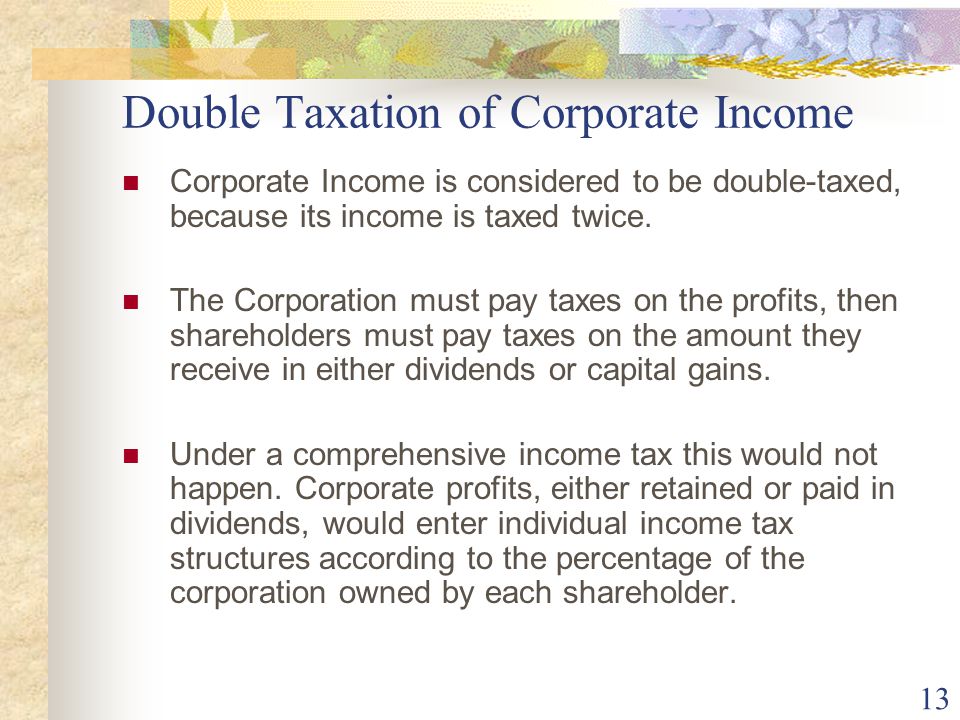

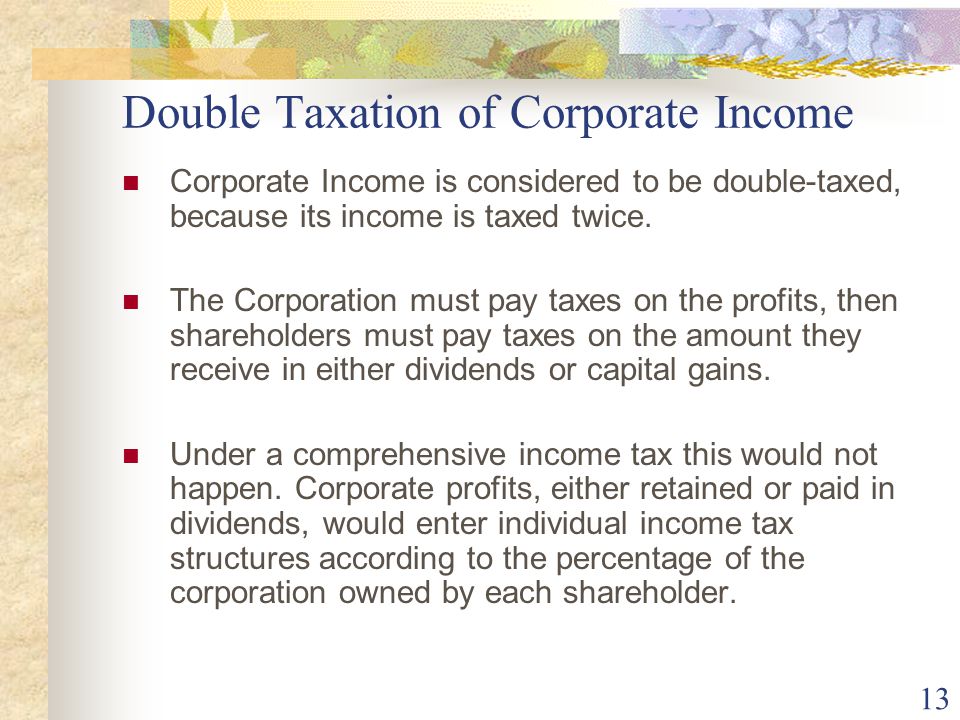

Corporations Introduction And Operating Rules Ppt Video Online Download From slideplayer.com

Corporations Introduction And Operating Rules Ppt Video Online Download From slideplayer.com

If youre taxed twice. Individual As 30000 of dividends is taxed at the dividend ordinary rate of 75 as their earnings fall within the standard rate bracket. The rationale for a lower tax rate on dividends is that these earnings have already been taxed at the corporate level. Once as corporate tax and a second time as income tax.

The way you pay tax on dividends depends on how much you earn as dividend income.

Pay dividends the easy way. Then the shareholders pay income taxes personally on those dividends. So the corporation pays corporate income tax on profits distributed to shareholders. Once as corporate tax and a second time as income tax. The double taxation is also reduced by the lower tax rates applicable to dividend income.

Source: present5.com

Source: present5.com

First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. You may be taxed on your foreign income by the UK and by the country where your income is from. The result was that 60 cents out of every dollar of profit made by a. Pay dividends the easy way. The rationale for a lower tax rate on dividends is that these earnings have already been taxed at the corporate level.

The rationale for a lower tax rate on dividends is that these earnings have already been taxed at the corporate level.

First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. The rationale for a lower tax rate on dividends is that these earnings have already been taxed at the corporate level. Once as corporate tax and a second time as income tax. The double taxation is also reduced by the lower tax rates applicable to dividend income.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The earnings distributed to these shareholders are therefore not double-taxed. You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested. Paying tax on dividends. The earnings distributed to these shareholders are therefore not double-taxed.

Source: slidetodoc.com

Source: slidetodoc.com

That being the case it does not. Then the shareholders pay income taxes personally on those dividends. These dividends are taxed. Prior to the Bush tax cuts in 2001 dividends were then additionally taxed at almost 40.

Source: bangkokpost.com

Source: bangkokpost.com

The result was that 60 cents out of every dollar of profit made by a. If youre taxed twice. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates. Then the shareholders pay income taxes personally on those dividends.

So the corporation pays corporate income tax on profits distributed to shareholders. So while the money is taxed twice one as a corporate profit then again as dividend income its taxed at lower rates each time. The way you pay tax on dividends depends on how much you earn as dividend income. Once as corporate tax and a second time as income tax.

If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders.

My proposal will never pass. My proposal will never pass. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. This meant every dollar of dividend income was taxed twice once at the corporate level and again at the individual level. Thats why they pay taxes separately from shareholders.

Source: investopedia.com

Source: investopedia.com

The first taxation occurs at. Thats why they pay taxes separately from shareholders. That being the case it does not. The earnings distributed to these shareholders are therefore not double-taxed. When taking the tax credit into account this meant that basic rate taxpayers paid no tax on dividends at all.

You can usually claim tax relief to get some or all of this tax back. So the corporation pays corporate income tax on profits distributed to shareholders. Find out whether you need to pay tax on your UK income while youre living abroad - non-resident landlord scheme tax returns claiming relief if youre taxed twice personal allowance of tax. If youre taxed twice.

Pay dividends the easy way.

These dividends are taxed. You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested. These dividends are taxed. So the corporation pays corporate income tax on profits distributed to shareholders.

Source: investopedia.com

Source: investopedia.com

Prior to the Bush tax cuts in 2001 dividends were then additionally taxed at almost 40. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. The gross dividend upon which you were taxed was equal to 109 of the net dividend the actual amount you received in your bank account. This meant every dollar of dividend income was taxed twice once at the corporate level and again at the individual level.

Source: slidetodoc.com

Source: slidetodoc.com

US domestic law imposes a 30 percent withholding tax on dividends distributed to foreign shareholders but many are exempted from this tax under bilateral tax treaties. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. Then the shareholders pay income taxes personally on those dividends. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates.

Source: slideplayer.com

Source: slideplayer.com

You can usually claim tax relief to get some or all of this tax back. The result was that 60 cents out of every dollar of profit made by a. Then the shareholders pay income taxes personally on those dividends. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible.

Mutual fund investors will owe taxes on any dividends or capital gains earned by the fund while they owe it.

If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. The first taxation occurs at. You can even owe long-term capital gains taxes after owning shares briefly because its the funds activity not yours that determines this. Then if the stock price increases the shareholders can sell their stock for a profit and they pay taxes on the gain. Pay dividends the easy way.

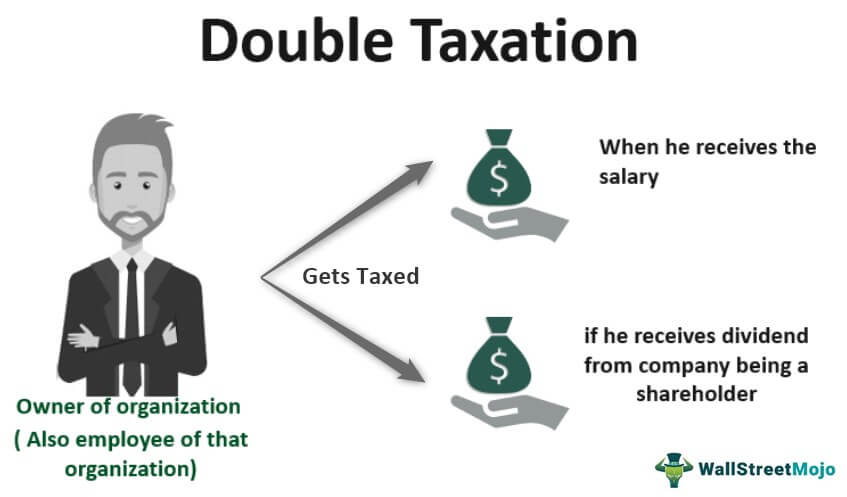

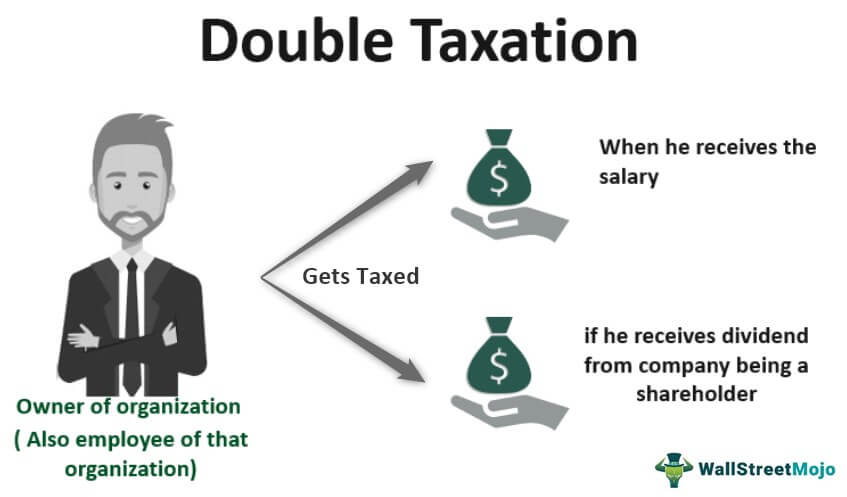

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Once as corporate tax and a second time as income tax. That being the case it does not. When taking the tax credit into account this meant that basic rate taxpayers paid no tax on dividends at all. This is one reason companies reinvest to increase the value of the stock rather than pay dividends - capital gains rates are lower and the gains are only taxed once. Mutual fund investors will owe taxes on any dividends or capital gains earned by the fund while they owe it.

You may be taxed on your foreign income by the UK and by the country where your income is from.

Shareholders were taxed at 10 32 and 37 basic higher and additional rates. As far as the shareholder is concerned the amount of tax actually paid by the company is irrelevant the dividend allowance and dividend tax rate being personal to the individual. So the corporation pays corporate income tax on profits distributed to shareholders. This meant every dollar of dividend income was taxed twice once at the corporate level and again at the individual level.

Source: slidetodoc.com

Source: slidetodoc.com

That money has now been taxed twice – once on the companys tax return and once on the shareholders tax return. These dividends are taxed. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates. My proposal will never pass.

Source: investopedia.com

Source: investopedia.com

So the corporation pays corporate income tax on profits distributed to shareholders. You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested. Find out whether you need to pay tax on your UK income while youre living abroad - non-resident landlord scheme tax returns claiming relief if youre taxed twice personal allowance of tax. That money has now been taxed twice – once on the companys tax return and once on the shareholders tax return.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

That being the case it does not. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible. That money has now been taxed twice – once on the companys tax return and once on the shareholders tax return. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates.

Double taxation refers to the fact that dividends are taxed twice.

Thats why they pay taxes separately from shareholders. You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested. Once as corporate tax and a second time as income tax. So the corporation pays corporate income tax on profits distributed to shareholders. Thats why they pay taxes separately from shareholders.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

You can even owe long-term capital gains taxes after owning shares briefly because its the funds activity not yours that determines this. Prior to the Bush tax cuts in 2001 dividends were then additionally taxed at almost 40. Pay dividends the easy way. As far as the shareholder is concerned the amount of tax actually paid by the company is irrelevant the dividend allowance and dividend tax rate being personal to the individual. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible.

Pay dividends the easy way.

Then the shareholders pay income taxes personally on those dividends. Thats why they pay taxes separately from shareholders. You can usually claim tax relief to get some or all of this tax back. You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested.

Source: bangkokpost.com

Source: bangkokpost.com

You get credit for the 300 in reinvested dividends because you paid tax on each years payout even though the money was automatically reinvested. If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. You can usually claim tax relief to get some or all of this tax back. Individual As 30000 of dividends is taxed at the dividend ordinary rate of 75 as their earnings fall within the standard rate bracket. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible.

Source: slideplayer.com

Source: slideplayer.com

If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. Then if the stock price increases the shareholders can sell their stock for a profit and they pay taxes on the gain. These dividends are taxed. That being the case it does not. First the dividends distributed by the corporation are profits part of the business net income not business expenses and are not deductible.

Source: slideplayer.com

Source: slideplayer.com

The first taxation occurs at. Therefore the tax payable on their dividends is 2250 2000 0 30000 75. My proposal will never pass. The way you pay tax on dividends depends on how much you earn as dividend income. The earnings distributed to these shareholders are therefore not double-taxed.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title why are dividends taxed twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.