Why are corporations taxed twice.

If you’re looking for why are corporations taxed twice images information linked to the why are corporations taxed twice keyword, you have visit the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Double Taxation From investopedia.com

Double Taxation From investopedia.com

Conservatives claim that income from corporate dividends is taxed twice first when the corporation pays its taxes if it does pay taxes and. For NYC-resident shareholders of S corporations this can produce a situation where income is taxed twice. In most parts of the world the top 10 of the people own 90 of the corporations. Then the profits shared between the shareholders as the dividend is taxed again at the recipients rate.

Corporate shareholders often complain that theyre being double taxed because of this system.

Corporate shareholders often complain that theyre being double taxed because of this system. Most people and businesses want to avoid the double taxation problem whenever possible. It usually occurs when income is taxed at both the corporate and personal levels. Conservatives claim that income from corporate dividends is taxed twice first when the corporation pays its taxes if it does pay taxes and. This allows state and federal.

Source: co.pinterest.com

Source: co.pinterest.com

Double Taxation in corporations must pay income tax at a corporate rate even before distributing the profits to the shareholders. Governments all over the world want to tax high earners. But it can appear as if your income is taxed twice this way. It predominantly occurs with larger older corporations. Thats why they pay taxes separately from shareholders.

Double Taxation in corporations must pay income tax at a corporate rate even before distributing the profits to the shareholders.

Why do corporations pay taxes twice. Hence when a corporation is taxed the wealthy 10 of the people are the ones being taxed. Conservatives claim that income from corporate dividends is taxed twice first when the corporation pays its taxes if it does pay taxes and. In other words if the personal income tax was the only tax applied to the profits of large currently taxable corporations then two-thirds of those profits would never be taxed.

Source: ar.pinterest.com

Source: ar.pinterest.com

It usually occurs when income is taxed at both the corporate and personal levels. Corporations are generally held by wealthy people. Conservatives claim that income from corporate dividends is taxed twice first when the corporation pays its taxes if it does pay taxes and. Taxes are paid to the government either willingly or unwillingly by the citizens.

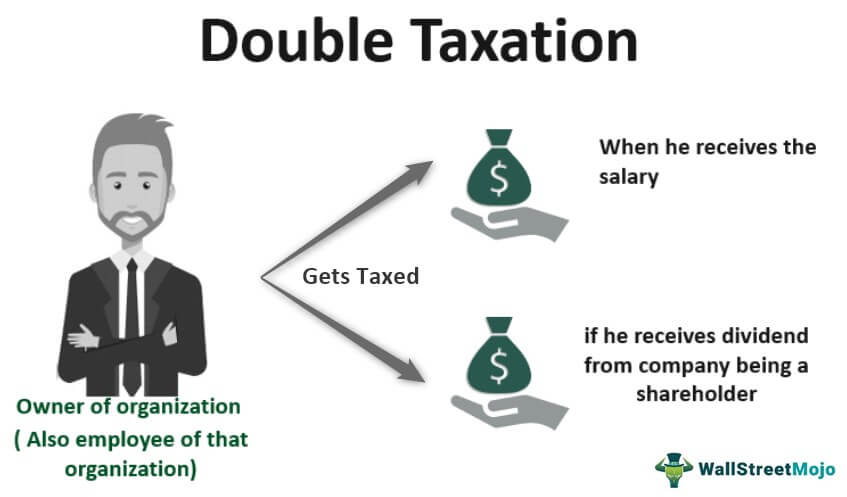

Source: wallstreetmojo.com

Source: wallstreetmojo.com

This allows state and federal. Taxes are paid to the government either willingly or unwillingly by the citizens. You may have been persuaded that it is more tax efficient to run your business through a limited company rather than as a sole trader. Again the corporation pays taxes once.

Source: in.pinterest.com

Source: in.pinterest.com

Again the corporation pays taxes once. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates. Unfortunately the concept of double taxation is a consequence of certain tax legislation. This allows state and federal.

You may have been persuaded that it is more tax efficient to run your business through a limited company rather than as a sole trader. The first taxation occurs at. Economists argue that under the current system individual shareholders get taxed twicefirst under the corporate income tax and again under the personal income tax. Corporations including LLCs as well as S corporations are considered separate legal entities from their owners.

The corporation is taxed on its earnings or profits then the shareholders are taxed again on dividends they receive from those earnings.

Corporations including LLCs as well as S corporations are considered separate legal entities from their owners. For NYC-resident shareholders of S corporations this can produce a situation where income is taxed twice. Corporate shareholders often complain that theyre being double taxed because of this system. In other words if the personal income tax was the only tax applied to the profits of large currently taxable corporations then two-thirds of those profits would never be taxed. Income earned by C-corporations named after the relevant subchapter of the Internal Revenue Code is subject to the corporate income tax at a 21.

Source: ar.pinterest.com

Source: ar.pinterest.com

Thats why they pay taxes separately from shareholders. Double taxation refers to paying taxes twice for the same earned income. Why do corporations pay taxes twice. Thats why they pay taxes separately from shareholders. But in practice not all corporate income is taxed at the entity level and many corporate shareholders are exempt from income tax.

NYC does not recognize federal or New York State S corporation elections and so S corporations are subject to the General Corporation Tax. This is the reason that they levy heavy taxes on corporations. C-corporations pay entity-level tax on their income and their shareholders pay tax again when the income is distributed. Corporations including LLCs as well as S corporations are considered separate legal entities from their owners.

But it can appear as if your income is taxed twice this way.

Conservatives claim that income from corporate dividends is taxed twice first when the corporation pays its taxes if it does pay taxes and. If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. Taxes are paid to the government either willingly or unwillingly by the citizens. Double taxation refers to paying taxes twice for the same earned income.

Source: investopedia.com

Source: investopedia.com

But it can appear as if your income is taxed twice this way. Why should corporations pay taxes. The corporation is taxed on its earnings or profits then the shareholders are taxed again on dividends they receive from those earnings. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders individual rates.

Source: in.pinterest.com

Source: in.pinterest.com

Most people and businesses want to avoid the double taxation problem whenever possible. Thus the corporate profits are taxed twice. Governments all over the world want to tax high earners. Why do corporations pay taxes twice.

Source: in.pinterest.com

Source: in.pinterest.com

Recently Ive been seeing lots of people in the news and on reddit saying something to the effect of Company X made over 10 billion dollars last year and paid only 3 in tax but I earned only 20000 and had to pay 20. In most parts of the world the top 10 of the people own 90 of the corporations. The corporation is taxed on its earnings or profits then the shareholders are taxed again on dividends they receive from those earnings. It predominantly occurs with larger older corporations.

Hence when a corporation is taxed the wealthy 10 of the people are the ones being taxed.

Recently Ive been seeing lots of people in the news and on reddit saying something to the effect of Company X made over 10 billion dollars last year and paid only 3 in tax but I earned only 20000 and had to pay 20. Then the profits shared between the shareholders as the dividend is taxed again at the recipients rate. The corporation is taxed on its earnings or profits then the shareholders are taxed again on dividends they receive from those earnings. Corporate shareholders often complain that theyre being double taxed because of this system. But in practice not all corporate income is taxed at the entity level and many corporate shareholders are exempt from income tax.

Source: investopedia.com

Source: investopedia.com

Why should corporations pay taxes. In other words if the personal income tax was the only tax applied to the profits of large currently taxable corporations then two-thirds of those profits would never be taxed. Double Taxation in corporations must pay income tax at a corporate rate even before distributing the profits to the shareholders. Governments all over the world want to tax high earners. Why should corporations pay taxes.

Taxes are paid to the government either willingly or unwillingly by the citizens.

Income earned by C-corporations named after the relevant subchapter of the Internal Revenue Code is subject to the corporate income tax at a 21. The first taxation occurs at. Again the corporation pays taxes once. Most people and businesses want to avoid the double taxation problem whenever possible.

Source: in.pinterest.com

Source: in.pinterest.com

Two-thirds of the profits that corporations pay out today as stock dividends go to tax-exempt entities like retirement plans and university endowments. It usually occurs when income is taxed at both the corporate and personal levels. If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. Thats why they pay taxes separately from shareholders.

Source: investopedia.com

Source: investopedia.com

Corporation Tax is imposed on all corporations at a rate of 885. Unfortunately the concept of double taxation is a consequence of certain tax legislation. Thats why they pay taxes separately from shareholders. For NYC-resident shareholders of S corporations this can produce a situation where income is taxed twice.

Source: co.pinterest.com

Source: co.pinterest.com

Two-thirds of the profits that corporations pay out today as stock dividends go to tax-exempt entities like retirement plans and university endowments. Corporations including LLCs as well as S corporations are considered separate legal entities from their owners. You may have been persuaded that it is more tax efficient to run your business through a limited company rather than as a sole trader. NYC does not recognize federal or New York State S corporation elections and so S corporations are subject to the General Corporation Tax.

The first taxation occurs at.

Economists argue that under the current system individual shareholders get taxed twicefirst under the corporate income tax and again under the personal income tax. Two-thirds of the profits that corporations pay out today as stock dividends go to tax-exempt entities like retirement plans and university endowments. Thats why they pay taxes separately from shareholders. Double Taxation in corporations must pay income tax at a corporate rate even before distributing the profits to the shareholders. Again the corporation pays taxes once.

Source: ar.pinterest.com

Source: ar.pinterest.com

It predominantly occurs with larger older corporations. Corporations including LLCs as well as S corporations are considered separate legal entities from their owners. Corporations are generally held by wealthy people. C-corporations pay entity-level tax on their income and their shareholders pay tax again when the income is distributed. Unfortunately the concept of double taxation is a consequence of certain tax legislation.

This allows state and federal.

In other words if the personal income tax was the only tax applied to the profits of large currently taxable corporations then two-thirds of those profits would never be taxed. But it can appear as if your income is taxed twice this way. Why should corporations pay taxes. Corporations including LLCs as well as S corporations are considered separate legal entities from their owners.

Source: in.pinterest.com

Source: in.pinterest.com

But in practice not all corporate income is taxed at the entity level and many corporate shareholders are exempt from income tax. Most people and businesses want to avoid the double taxation problem whenever possible. Thus the corporate profits are taxed twice. It usually occurs when income is taxed at both the corporate and personal levels. Corporations are generally held by wealthy people.

Source: ar.pinterest.com

Source: ar.pinterest.com

This allows state and federal. It predominantly occurs with larger older corporations. If the company decides to pay out dividends the earnings are taxed twice by the government because of the transfer of the money from the company to the shareholders. Recently Ive been seeing lots of people in the news and on reddit saying something to the effect of Company X made over 10 billion dollars last year and paid only 3 in tax but I earned only 20000 and had to pay 20. You may have been persuaded that it is more tax efficient to run your business through a limited company rather than as a sole trader.

Source: investopedia.com

Source: investopedia.com

It usually occurs when income is taxed at both the corporate and personal levels. Two-thirds of the profits that corporations pay out today as stock dividends go to tax-exempt entities like retirement plans and university endowments. Again the corporation pays taxes once. NYC does not recognize federal or New York State S corporation elections and so S corporations are subject to the General Corporation Tax. Most people and businesses want to avoid the double taxation problem whenever possible.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title why are corporations taxed twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.