Profits of a large corporation are taxed twice.

If you’re searching for profits of a large corporation are taxed twice images information related to the profits of a large corporation are taxed twice keyword, you have visit the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

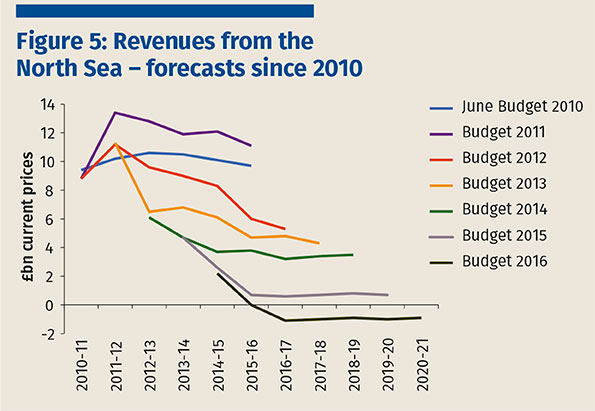

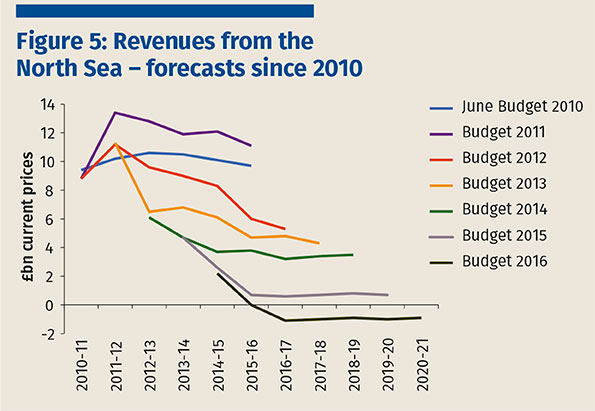

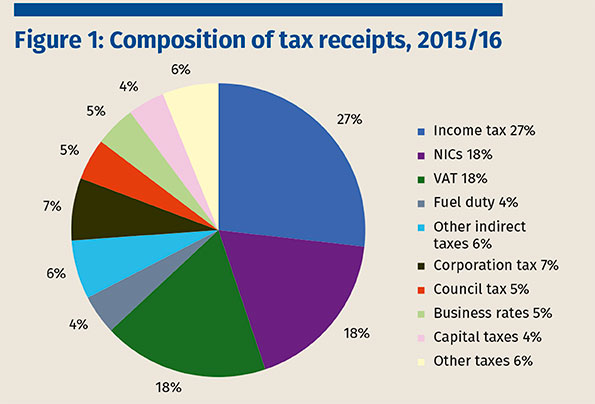

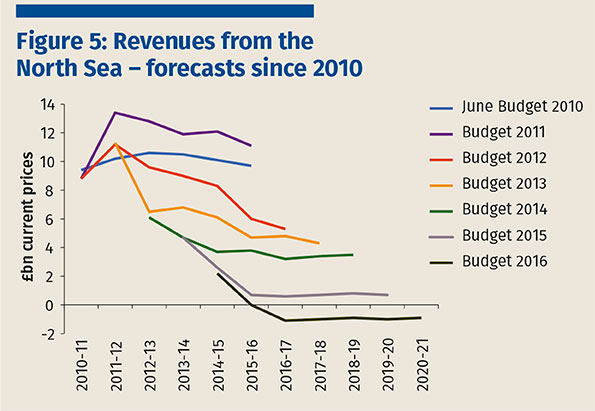

The Changing Composition Of Uk Tax Revenues From taxjournal.com

The Changing Composition Of Uk Tax Revenues From taxjournal.com

It is economically efficient to reduce the amount of retained earnings. Asked Aug 9 2018 in Economics by KayKay. True profits of a large corporation are taxed twice once a corporate income and again as personal income of stockholders. Corporate profits are taxed twice.

Asked Aug 14 2017 in Economics by ChemicalNoise.

Answered Aug 14. Profits of a large corporation are taxed twice once as corporate income and again as personal income of. Asked May 1 2016 in Business by Reckless. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. If the company does not pay dividends but the value of the stock goes up the stockholder will pay capital gains tax when he or she sells the stock.

If the company does not pay dividends but the value of the stock goes up the stockholder will pay capital gains tax when he or she sells the stock. This means that dividends are taxed twice once to the. Profits of a large corporation are taxed twice once as corporate income and again as personal income of. Corporate profits are taxed twice. Once as the corporations profits and then again.

B the government wants to minimize the amount of tax paid on capital gains.

This is because the corporation is taxed when they earn the profit but then the stockholders are taxed as it is paid out as incomeearnings. A taxes are collected on profits before profits are distributed to shareholders. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. True The amount paid for stock is the most a shareholder can lose in the corporate form of ownership.

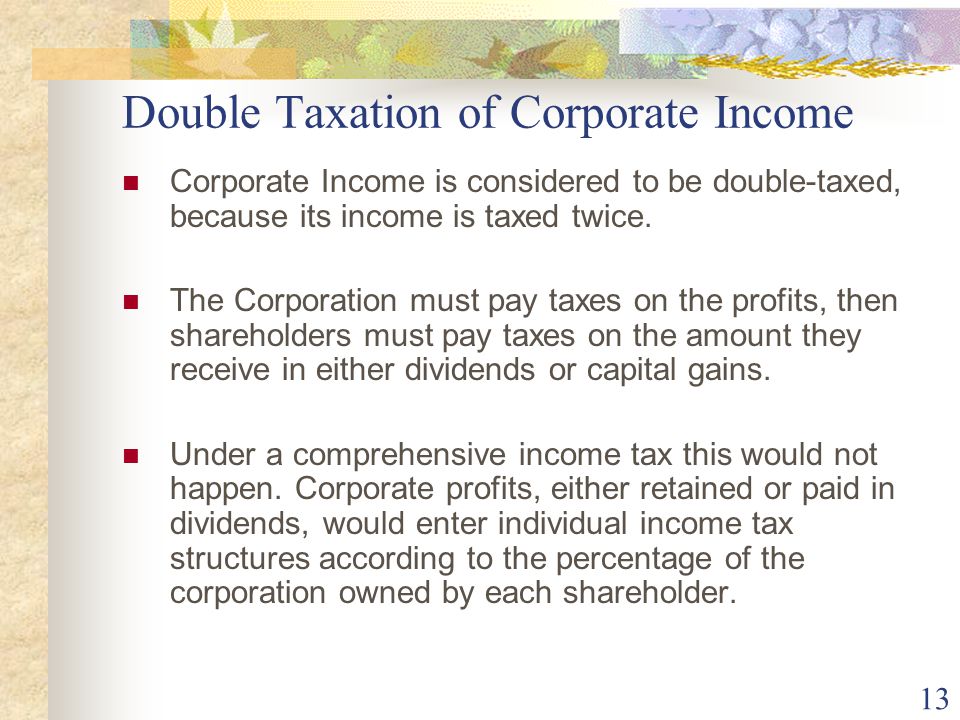

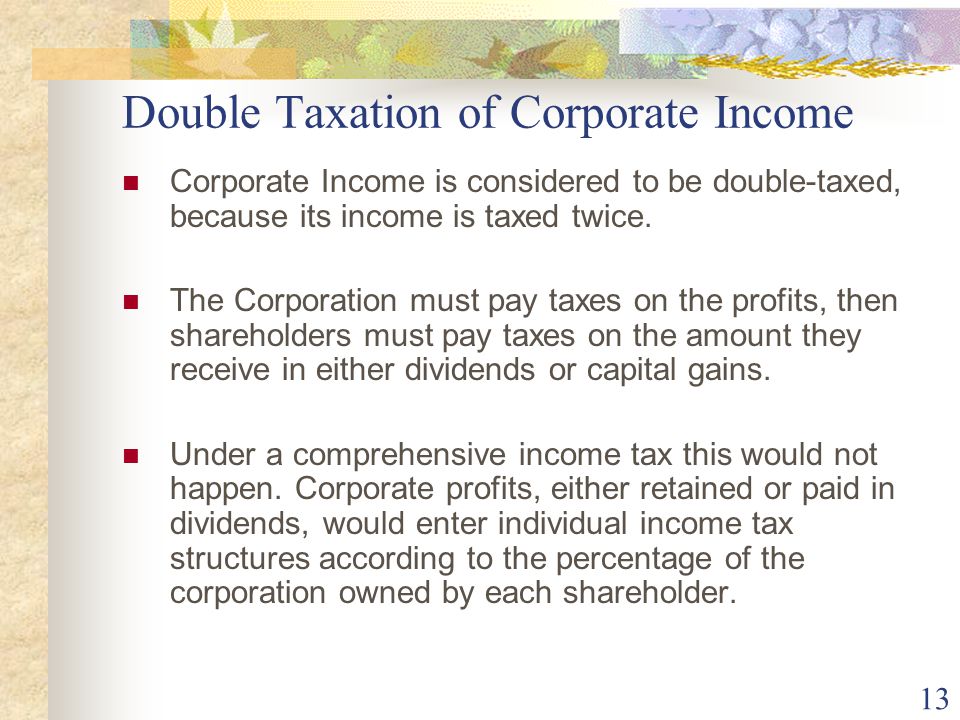

Source: slideplayer.com

Source: slideplayer.com

This means that dividends are taxed twice once to the. Corporate profits are taxed twice because. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. Asked May 1 2016 in Business by Reckless.

Source: investopedia.com

Source: investopedia.com

Asked May 1 2016 in Business by Reckless. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. Corporate profits are taxed twice because. Thus the corporate profits Corporate Profits Corporate profit or profit after tax is the net income received from the business after deducting direct expenses indirect expenses and all the applicable taxes from the total revenue generated by the company during the year.

Source: pulse.ncpolicywatch.org

Source: pulse.ncpolicywatch.org

And because dividends unlike salaries and bonuses are not tax-deductible the corporation must also pay taxes on them. By signing up youll get thousands of step-by-step solutions to your homework questions. When the shareholders pay taxes on their dividends. This is because the corporation is taxed when they earn the profit but then the stockholders are taxed as it is paid out as incomeearnings.

Thus the corporate profits Corporate Profits Corporate profit or profit after tax is the net income received from the business after deducting direct expenses indirect expenses and all the applicable taxes from the total revenue generated by the company during the year. A C-corporations earnings are taxed twice. Corporate profits are taxed by the corporate income tax first. True profits of a large corporation are taxed twice once a corporate income and again as personal income of stockholders.

True profits of a large corporation are taxed twice once a corporate income and again as personal income of stockholders.

The government wants to minimize the amount of tax paid on capital gains. The government wants to minimize the amount of tax paid on capital gains. This means that dividends are taxed twice once to the. Capital gains are not indexed to the rate of inflation. Choice of Organizational Form.

Source: slideplayer.com

Source: slideplayer.com

Asked Apr 24 2020 in Economics by douglong424. Asked Aug 14 2017 in Economics by ChemicalNoise. Choice of Organizational Form. Read more are taxed twice. Corporate profits are taxed twice because.

If a corporation distributes dividends to the owners rare for small corporations where the owners work for the corporation the owners must report and pay personal income tax on these amounts. C it is economically efficient to. Capital gains are not indexed to the rate of inflation. Corporate profits are taxed twice.

Answered Aug 14.

Double taxation is a tax principle referring to income taxes paid twice on the same source of income. Profits of a large corporation are taxed twice once as corporate income and again as personal income of. Answered Aug 14 2017 by Trina. Once as the corporations profits and then again.

Source: investopedia.com

Source: investopedia.com

Once as the corporations profits and then again. Double taxation is a tax principle referring to income taxes paid twice on the same source of income. Indicate whether the statement is true or false. Choice of Organizational Form.

Source: taxjournal.com

Source: taxjournal.com

Read more are taxed twice. 1 on a question Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. This is because the corporation is taxed when they earn the profit but then the stockholders are taxed as it is paid out as incomeearnings. Asked May 1 2016 in Business by Reckless.

Source: taxadvisermagazine.com

Source: taxadvisermagazine.com

If a corporation distributes dividends to the owners rare for small corporations where the owners work for the corporation the owners must report and pay personal income tax on these amounts. If the company does not pay dividends but the value of the stock goes up the stockholder will pay capital gains tax when he or she sells the stock. Double taxation can encourage businesses to organize as pass-through businesses S-corporations partnerships limited liability companies or sole proprietorships instead of C-corporations. The government wants to minimize the amount of tax paid on capital gains.

Pass-through profits are taxed only once at a top rate of 37 percent or 296 percent if eligible for the 20 percent Section 199A deduction.

Double taxation is a tax principle referring to income taxes paid twice on the same source of income. Read more are taxed twice. Indicate whether the statement is true or false. Second dividends paid out of profits are taxed as personal income of the stockholders. Once as the corporations profits and then again.

Source: mises.org

Source: mises.org

Second dividends paid out of profits are taxed as personal income of the stockholders. It is economically efficient to reduce the amount of retained earnings. Asked May 1 2016 in Business by Reckless. Taxation in corporations is not affected by the Taxation principle a corporation that. Corporate profits are taxed by the corporate income tax first.

This means that dividends are taxed twice once to the.

Asked Aug 9 2018 in Economics by KayKay. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. Asked May 1 2016 in Business by Reckless. Corporate profits are taxed twice because.

Source: slideplayer.com

Source: slideplayer.com

It can occur when income is taxed at both the corporate level and personal level. True profits of a large corporation are taxed twice once a corporate income and again as personal income of stockholders. True The amount paid for stock is the most a shareholder can lose in the corporate form of ownership. Thus the corporate profits Corporate Profits Corporate profit or profit after tax is the net income received from the business after deducting direct expenses indirect expenses and all the applicable taxes from the total revenue generated by the company during the year.

Source: taxadvisermagazine.com

Source: taxadvisermagazine.com

1 on a question Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. Double taxation is a tax principle referring to income taxes paid twice on the same source of income. C it is economically efficient to. A taxes are collected on profits before profits are distributed to shareholders.

Source: pulse.ncpolicywatch.org

Source: pulse.ncpolicywatch.org

A C-corporations earnings are taxed twice. By signing up youll get thousands of step-by-step solutions to your homework questions. True The amount paid for stock is the most a shareholder can lose in the corporate form of ownership. Choice of Organizational Form.

Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders.

Corporate profits are taxed by the corporate income tax first. Asked Apr 24 2020 in Economics by douglong424. Double taxation can encourage businesses to organize as pass-through businesses S-corporations partnerships limited liability companies or sole proprietorships instead of C-corporations. Read more are taxed twice. Second dividends paid out of profits are taxed as personal income of the stockholders.

Source: taxjournal.com

Source: taxjournal.com

Choice of Organizational Form. Corporate profits are taxed twice because. If a corporation distributes dividends to the owners rare for small corporations where the owners work for the corporation the owners must report and pay personal income tax on these amounts. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. False - the answers to brainsanswerscouk.

Double taxation is a tax principle referring to income taxes paid twice on the same source of income.

Once as the corporations profits and then again. 1 on a question Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. A taxes are collected on profits before profits are distributed to shareholders. True The amount paid for stock is the most a shareholder can lose in the corporate form of ownership.

Source: pulse.ncpolicywatch.org

Source: pulse.ncpolicywatch.org

Profits of a large corporation are taxed twice once as corporate income and again as personal income of. Profits of a large corporation are taxed twice once as corporate income and again as personal income of. A C-corporations earnings are taxed twice. Double taxation can encourage businesses to organize as pass-through businesses S-corporations partnerships limited liability companies or sole proprietorships instead of C-corporations. Second dividends paid out of profits are taxed as personal income of the stockholders.

Source: taxjournal.com

Source: taxjournal.com

Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. This is because the corporation is taxed when they earn the profit but then the stockholders are taxed as it is paid out as incomeearnings. Asked Aug 9 2018 in Economics by KayKay. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders.

Source: slideplayer.com

Source: slideplayer.com

Thus the corporate profits Corporate Profits Corporate profit or profit after tax is the net income received from the business after deducting direct expenses indirect expenses and all the applicable taxes from the total revenue generated by the company during the year. If the company does not pay dividends but the value of the stock goes up the stockholder will pay capital gains tax when he or she sells the stock. False - the answers to brainsanswerscouk. Choice of Organizational Form. Profits of a large corporation are taxed twice once as corporate income and again as personal income of stockholders.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title profits of a large corporation are taxed twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.