Paying mortgage twice monthly.

If you’re looking for paying mortgage twice monthly images information linked to the paying mortgage twice monthly keyword, you have pay a visit to the right site. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Should You Pay Your Mortgage Biweekly Pros And Cons Nextadvisor With Time From time.com

Should You Pay Your Mortgage Biweekly Pros And Cons Nextadvisor With Time From time.com

Twice a month 12 total payment Every two weeks 12 total payment Weekly 14 total payment Payments made weekly every two weeks and twice a month are treated as partial payments and may not be applied to your mortgage until full payment is received. Ifyou doublethe payment the loanis paidoff in 109 months or nine years and one month. Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year versus 12 monthly payments. Therefore if your regular payment is 1500 a month you would pay 1625 each month instead.

Your mortgages interest rate.

For every large purchase you have to pay for theres a trick to try to make it less painful. The extra mortgage payments you would like to make. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year versus 12 monthly payments. Light Heavy Refurb Finance.

Source: theguardian.com

Source: theguardian.com

You can select overpaying your mortgage by the same amount each month paying. Some people also use tax refunds performance bonuses other similar streams to help create a 13th yearly payment. Talk To Insurance Experts Now. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. Your outstanding mortgage balance.

You can select overpaying your mortgage by the same amount each month paying.

Consider a traditional 30-year mortgage of 200000 with an interest rate of 65. Ad Mortgage Life Insurance Tailored To You Your Budget. You can select overpaying your mortgage by the same amount each month paying. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines.

Source: forbes.com

Source: forbes.com

The thought process behind biweekly mortgage payment plans is. A 100000 mortgagewith a 6 percent interest rate requires a paymentof 59955 for 30 years. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. Ad Fast fair award-winning lending from the UKs first fully digital mortgage lender.

Source: lendedu.com

Source: lendedu.com

The extra mortgage payments you would like to make. The general rule is that ifyou doubleyour required payment you will payyour 30-year fixed rate loanoff in less than ten years. Your mortgages interest rate. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments.

Source: theguardian.com

Source: theguardian.com

Consider a traditional 30-year mortgage of 200000 with an interest rate of 65. Some work better than others. Consider a traditional 30-year mortgage of 200000 with an interest rate of 65. The general rule is that ifyou doubleyour required payment you will payyour 30-year fixed rate loanoff in less than ten years.

The general rule is that ifyou doubleyour required payment you will payyour 30-year fixed rate loanoff in less than ten years. Talk To Insurance Experts Now. Ad Get Mortgage Advice Without Fees And Without Fuss. Your outstanding mortgage balance.

Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage of.

Ad Compare A Range Of Mortgages Online. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage of. Paying your mortgage every two weeks adds one full payment each year 13 payments based on 26 bi-weekly payments each year versus 12 monthly payments. The extra mortgage payments you would like to make.

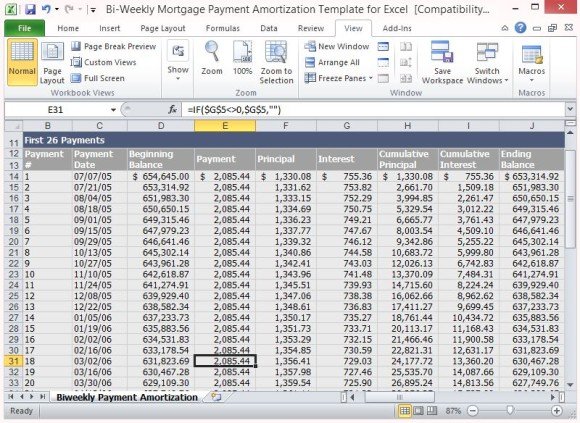

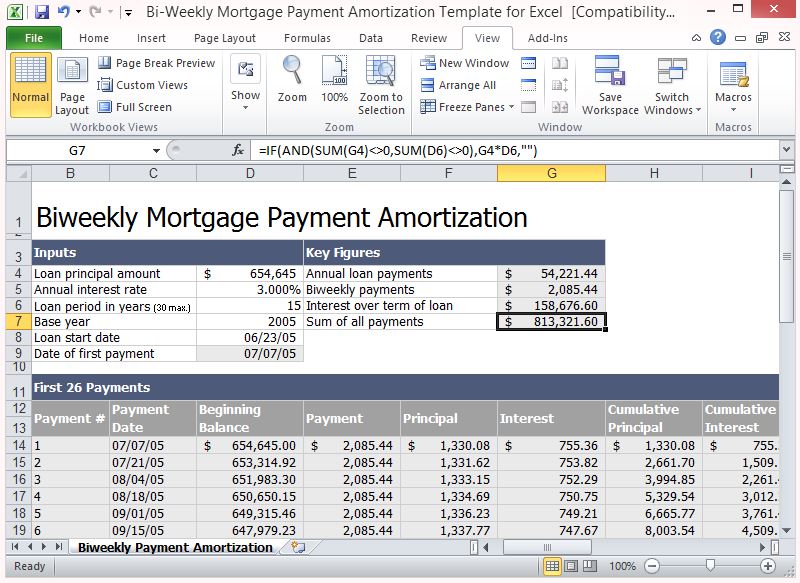

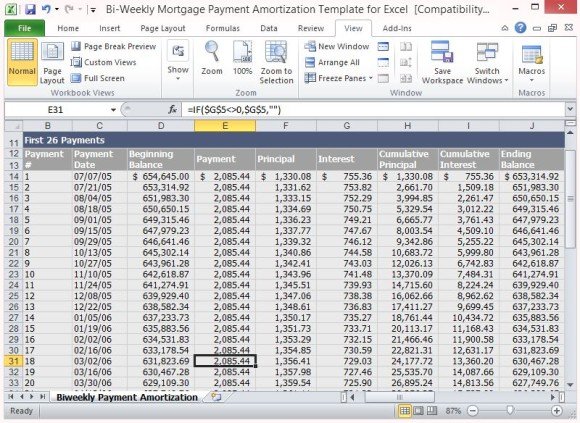

Source: free-power-point-templates.com

Source: free-power-point-templates.com

No paper no appointments. Your mortgages interest rate. Light Heavy Refurb Finance. Ifyou doublethe payment the loanis paidoff in 109 months or nine years and one month. Twice a month 12 total payment Every two weeks 12 total payment Weekly 14 total payment Payments made weekly every two weeks and twice a month are treated as partial payments and may not be applied to your mortgage until full payment is received.

Just quick decisions total transparency and competitive rates. The extra mortgage payments you would like to make. Savings add up with bi-weekly payments. Buy Before You Sell.

Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines.

Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year versus 12 monthly payments. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. Ifyou doublethe payment the loanis paidoff in 109 months or nine years and one month. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month.

Source: lendedu.com

Source: lendedu.com

Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. No paper no appointments. Just quick decisions total transparency and competitive rates.

Source: pinterest.com

Source: pinterest.com

Just quick decisions total transparency and competitive rates. No paper no appointments. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines.

Source: calculators.org

Source: calculators.org

Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage of. Normally that would require the homeowner to make a monthly payment of 126414. Ad Compare A Range Of Mortgages Online. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed.

Therefore if your regular payment is 1500 a month you would pay 1625 each month instead.

Buy Before You Sell. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. Ad Get Mortgage Advice Without Fees And Without Fuss. In most months the effect is similar but there is a slight difference between the two. Some people also use tax refunds performance bonuses other similar streams to help create a 13th yearly payment.

Source: time.com

Source: time.com

Bimonthly mortgage payments are scheduled twice a month for specific payment dates. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year versus 12 monthly payments. Just quick decisions total transparency and competitive rates. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments.

When you make twice monthly payments you are paying half of your mortgage 24 times per year for a total of 12 payments.

Normally that would require the homeowner to make a monthly payment of 126414. Paying your mortgage every two weeks adds one full payment each year 13 payments based on 26 bi-weekly payments each year versus 12 monthly payments. Consider a traditional 30-year mortgage of 200000 with an interest rate of 65. Ad Mortgage Life Insurance Tailored To You Your Budget.

Source: time.com

Source: time.com

Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. The general rule is that ifyou doubleyour required payment you will payyour 30-year fixed rate loanoff in less than ten years. Buy Before You Sell. Ad Get Mortgage Advice Without Fees And Without Fuss.

Source: lendedu.com

Source: lendedu.com

Find The Right Mortgage For You. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments.

Source: pinterest.com

Source: pinterest.com

You can select overpaying your mortgage by the same amount each month paying. Buy Before You Sell. For every large purchase you have to pay for theres a trick to try to make it less painful. Find The Right Mortgage For You.

Your outstanding mortgage balance.

Your mortgages interest rate. The thought process behind biweekly mortgage payment plans is. No paper no appointments. Ad Compare A Range Of Mortgages Online. Consider a traditional 30-year mortgage of 200000 with an interest rate of 65.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

Just quick decisions total transparency and competitive rates. All you need to do is enter. Your outstanding mortgage balance. A 100000 mortgagewith a 6 percent interest rate requires a paymentof 59955 for 30 years. Twice a month 12 total payment Every two weeks 12 total payment Weekly 14 total payment Payments made weekly every two weeks and twice a month are treated as partial payments and may not be applied to your mortgage until full payment is received.

Your outstanding mortgage balance.

Ad Bridging Mortgage Calculator Uk. Twice a month 12 total payment Every two weeks 12 total payment Weekly 14 total payment Payments made weekly every two weeks and twice a month are treated as partial payments and may not be applied to your mortgage until full payment is received. Some people also use tax refunds performance bonuses other similar streams to help create a 13th yearly payment. All you need to do is enter.

Source: pinterest.com

Source: pinterest.com

Light Heavy Refurb Finance. Find The Right Mortgage For You. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage of. Buy Before You Sell. All you need to do is enter.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

Just quick decisions total transparency and competitive rates. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. Your mortgages interest rate. Light Heavy Refurb Finance. Ad Get Mortgage Advice Without Fees And Without Fuss.

Source: time.com

Source: time.com

All you need to do is enter. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage of. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. You can select overpaying your mortgage by the same amount each month paying.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title paying mortgage twice monthly by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.