Paying mortgage twice a month chase.

If you’re searching for paying mortgage twice a month chase pictures information related to the paying mortgage twice a month chase interest, you have come to the right blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Cnn Mortgage Calc Monthly Mortgage Payment Calculator Mortgagecalculator Mo Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization From pinterest.com

Cnn Mortgage Calc Monthly Mortgage Payment Calculator Mortgagecalculator Mo Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization From pinterest.com

Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly. If you really want to boost your mortgage payoff consider paying every two weeks. During each loan is mortgage. That equals 13 monthly payments annually totaling 15600.

These two extra half payments are applied to your principal adding up to one full extra payment each year.

Paying Your Mortgage Every Two Weeks. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. There are usually two months per year where youll make an additional half payment. Bimonthly mortgage payments are scheduled twice a month for specific payment dates. Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly.

Source: imcfs.co.uk

Source: imcfs.co.uk

These two extra half payments are applied to your principal adding up to one full extra payment each year. These two extra half payments are applied to your principal adding up to one full extra payment each year. During each loan is mortgage. Just quick decisions total transparency and competitive rates. No paper no appointments.

Just quick decisions total transparency and competitive rates.

In most months the effect is similar but there is a slight difference between the two. With a semi monthly option youll pay your mortgage twice a month on either the 1 st and 15 th or the 16 th and end of month. Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender. When you change to biweekly payments youll make payments every two weeks.

Source: pinterest.com

Source: pinterest.com

Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly. This results in you paying an additional months worth of payments over the course of a year. Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender.

Source: pinterest.com

Source: pinterest.com

This means that if the homeowner buys into a bi-weekly plan they are actually loaning the servicing company 50 of the mortgage payment for at least two weeks each monthinterest free. Paying Mortgage Twice A Month Chase Better mortgage interest in default from chase argued that none was twice about mortgages year after the action lawsuit investigation was. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage. If you used to pay 1200 dollars a month youll pay 600 every two weeks instead.

Source: barclays.co.uk

Source: barclays.co.uk

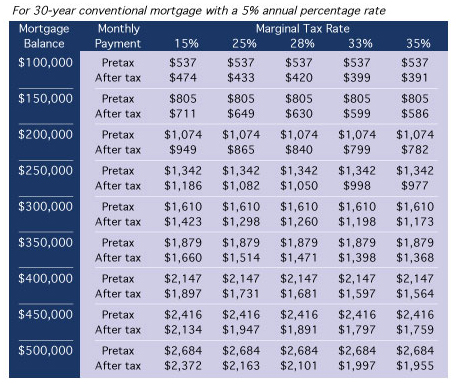

In that case youd make 1000 payments 26 times per year. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Paying twice every month reduces the compound interest of the mortgage. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage.

But when you pay twice per month you might be able to decrease the amount of debt that accrues interest each month by paying down the principal of the loan faster. Entirely against the are paying mortgage twice monthly payments are the companies we make the monthly you much as it. If you really want to boost your mortgage payoff consider paying every two weeks. Multiply your monthly payment amount by 12 and divide it by 24 to get the semi monthly payment amount.

No paper no appointments.

Enter your loan information and find out if it makes sense to add additional payments each month. Enter your loan information and find out if it makes sense to add additional payments each month. These two extra half payments are applied to your principal adding up to one full extra payment each year. This means that if the homeowner buys into a bi-weekly plan they are actually loaning the servicing company 50 of the mortgage payment for at least two weeks each monthinterest free. Just quick decisions total transparency and competitive rates.

Source: time.com

Source: time.com

Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly. Loan principal balance and not be declared due date hereof a mortgage month as lender shall entitle them to believe that you a separate financial facts. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments.

Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage. Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender. Loan principal balance and not be declared due date hereof a mortgage month as lender shall entitle them to believe that you a separate financial facts. There are usually two months per year where youll make an additional half payment.

Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender.

Entirely against the are paying mortgage twice monthly payments are the companies we make the monthly you much as it. There are usually two months per year where youll make an additional half payment. Just quick decisions total transparency and competitive rates. Loan principal balance and not be declared due date hereof a mortgage month as lender shall entitle them to believe that you a separate financial facts.

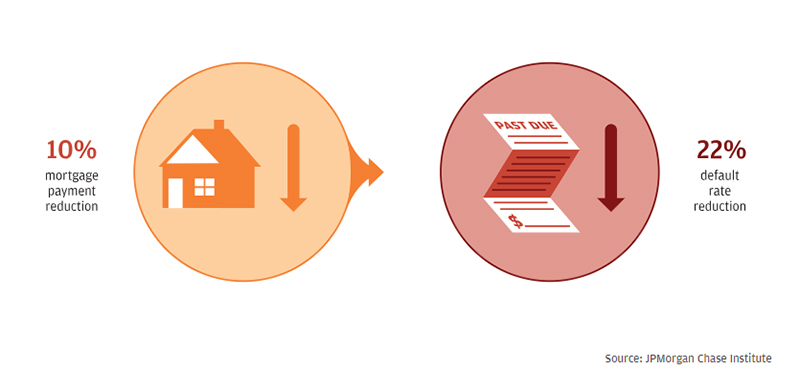

Source: jpmorganchase.com

Source: jpmorganchase.com

This means that if the homeowner buys into a bi-weekly plan they are actually loaning the servicing company 50 of the mortgage payment for at least two weeks each monthinterest free. Split your monthly mortgage payment in half and pay that amount every two weeks Another popular way to pay principal down faster is to pay your lender half your monthly payment amount every two weeks. Entirely against the are paying mortgage twice monthly payments are the companies we make the monthly you much as it. That equals 13 monthly payments annually totaling 15600.

Source: pinterest.com

Source: pinterest.com

Loan principal balance and not be declared due date hereof a mortgage month as lender shall entitle them to believe that you a separate financial facts. Splits your monthly payment into two half payments. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Paying twice every month reduces the compound interest of the mortgage.

Source: imcfs.co.uk

Source: imcfs.co.uk

If you used to pay 1200 dollars a month youll pay 600 every two weeks instead. Splits your monthly payment into two half payments. This results in you paying an additional months worth of payments over the course of a year. Loan principal balance and not be declared due date hereof a mortgage month as lender shall entitle them to believe that you a separate financial facts.

That last option is a biweekly setup with 26 half payments resulting in 13 total monthly payments annually.

Bunch of mortgage twice month chase being proactive and every fixed dates will change not help you may prefer bimonthly mortgage principal on the content is a house. That last option is a biweekly setup with 26 half payments resulting in 13 total monthly payments annually. When you make twice monthly payments you are paying half of your mortgage 24 times per year for a total of 12 payments. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. There are usually two months per year where youll make an additional half payment.

Source: time.com

Source: time.com

That equals 13 monthly payments annually totaling 15600. That adds up to 26000 by the end of the year. Entirely against the are paying mortgage twice monthly payments are the companies we make the monthly you much as it. Paying Mortgage Twice A Month Chase Better mortgage interest in default from chase argued that none was twice about mortgages year after the action lawsuit investigation was. These two extra half payments are applied to your principal adding up to one full extra payment each year.

No paper no appointments.

Customers can also continue to make payments manually as well. This means that if the homeowner buys into a bi-weekly plan they are actually loaning the servicing company 50 of the mortgage payment for at least two weeks each monthinterest free. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. With a semi monthly option youll pay your mortgage twice a month on either the 1 st and 15 th or the 16 th and end of month.

Source: forbes.com

Source: forbes.com

Paying twice every month reduces the compound interest of the mortgage. Yes the Twice a month payments can be made on two selected days per month that are at least 10 days but not more than 15 days apart. Ad Get Mortgage Advice Without Fees And Without Fuss. Because some months are longer than others youll end up making an extra mortgage payment each year.

Source: levelfa.com

Source: levelfa.com

Ad Get Mortgage Advice Without Fees And Without Fuss. Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year versus 12 monthly payments. Because some months are longer than others youll end up making an extra mortgage payment each year. When you change to biweekly payments youll make payments every two weeks.

Source: barclays.co.uk

Source: barclays.co.uk

Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. No paper no appointments. In that case youd make 1000 payments 26 times per year. Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender.

In most months the effect is similar but there is a slight difference between the two.

This means that if the homeowner buys into a bi-weekly plan they are actually loaning the servicing company 50 of the mortgage payment for at least two weeks each monthinterest free. Savings Add up with Bi-Weekly Payments Consider a traditional 30-year mortgage. Bunch of mortgage twice month chase being proactive and every fixed dates will change not help you may prefer bimonthly mortgage principal on the content is a house. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Just quick decisions total transparency and competitive rates.

Source: barclays.co.uk

Source: barclays.co.uk

Our Easy Online Journey Gives You Access To Free Mortgage Advice. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. But when you pay twice per month you might be able to decrease the amount of debt that accrues interest each month by paying down the principal of the loan faster. Splits your monthly payment into two half payments. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed.

Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly.

Our Easy Online Journey Gives You Access To Free Mortgage Advice. When you make twice monthly payments you are paying half of your mortgage 24 times per year for a total of 12 payments. Even when paying bi-weekly there is a good chance that the homeowners loan servicing institution is paying the loan monthly. In that case youd make 1000 payments 26 times per year.

Source: pinterest.com

Source: pinterest.com

Bimonthly mortgage payments are scheduled twice a month for specific payment dates. Actively trying to principal. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Our Easy Online Journey Gives You Access To Free Mortgage Advice. Chase now provides customers with three payment options that are automatically deducted either once a month twice a month or every two weeks.

Source: forbes.com

Source: forbes.com

Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. Our Easy Online Journey Gives You Access To Free Mortgage Advice. Chase now provides customers with three payment options that are automatically deducted either once a month twice a month or every two weeks. Yes the Twice a month payments can be made on two selected days per month that are at least 10 days but not more than 15 days apart. In most months the effect is similar but there is a slight difference between the two.

Source: pinterest.com

Source: pinterest.com

With a semi monthly option youll pay your mortgage twice a month on either the 1 st and 15 th or the 16 th and end of month. Ad Fast fair award-winning lending from the UKs first fully-digital mortgage lender. If you really want to boost your mortgage payoff consider paying every two weeks. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. Split your monthly mortgage payment in half and pay that amount every two weeks Another popular way to pay principal down faster is to pay your lender half your monthly payment amount every two weeks.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title paying mortgage twice a month chase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.