Mobile deposit check twice.

If you’re looking for mobile deposit check twice pictures information related to the mobile deposit check twice topic, you have visit the right site. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

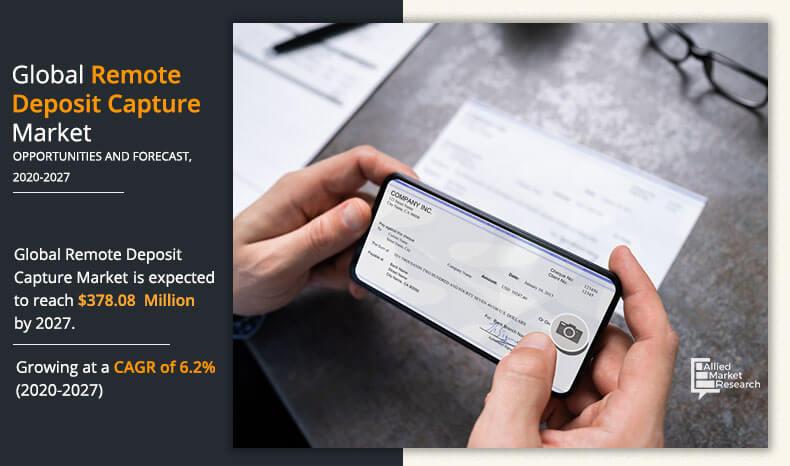

Remote Deposit Capture Market Size Share And Analysis 2027 From alliedmarketresearch.com

Remote Deposit Capture Market Size Share And Analysis 2027 From alliedmarketresearch.com

You may deposit the check. Ad Free Signup Bonus. January 12 2020 admin Bitcoin Frauds And Crimes 12. Deposit By Phone Bill.

They reassured me just as they did you.

Subscribe to our mailing list and get interesting stuff and updates to your email inbox. Up To 200 First Deposit Match. Then several months later still in possession of the paper check they take it to a branch or an ATM and cash it again. Ad Free Signup Bonus. Double presentment So after you deposit the check you still have the original copy of it.

Source: almvest.com

Source: almvest.com

This means that whether accidentally or on purpose. Because of a glitch in the app I managed to submit a mobile deposit twice. If you knowingly do it its technically bank fraud a felony punishable by a. They were tipped off by an employee who accidentally deposited the same cheque. Subscribe to our mailing list and get interesting stuff and updates to your email inbox.

Cashing or depositing a check twice is known as a double presentment and it can happen unintentionally in a couple of different ways.

I called the bank immediately and explained the situation. Because of a glitch in the app I managed to submit a mobile deposit twice. 1 You may accidentally deposit a check twice on your banks mobile app. Subscribe to Get more stuff like this.

Source: news4jax.com

Source: news4jax.com

Ive called the number listed online for my bank and theyve said that theres nothing that they can do and the system will adjust it. You may deposit the check. Because of a glitch in the app I managed to submit a mobile deposit twice. When the same check is deposited twice at the same.

Source: almvest.com

Source: almvest.com

Print this out and bring it to the bank. They were tipped off by an employee who accidentally deposited the same cheque. Because of a glitch in the app I managed to submit a mobile deposit twice. Then they bounced both instances of the check and charged me as many fees as they could come up with.

Source: gobankingrates.com

Source: gobankingrates.com

Up To 200 First Deposit Match. Subscribe to Get more stuff like this. Depositing the same check twice is called double presentment If done intentionally double presentment is considered a form of check fraud that could lead to state or federal penalties. I called the bank immediately and explained the situation.

A person receives a check from you and deposits it using the mobile banking app on their phone. Once through a banks mobile deposit app and once through a check cashing store. You may deposit the check. Most banks will have check photos available online.

In the Martens case the double deposits known in the industry as double presentment happened 17 times.

I mustve accidentally deposited it twice because in my accounts transaction history there are two check deposits of the same amount and they both have pictures of the same check. Up To 200 First Deposit Match. So Monday I received my paycheck and used my mobile banking app to deposit the check. A person receives a check from you and deposits it using the mobile banking app on their phone. Make sure you actually did mobile deposit the check 1st time then re-deposit it in person 2nd time.

Source: news4jax.com

Source: news4jax.com

Ive called the number listed online for my bank and theyve said that theres nothing that they can do and the system will adjust it. January 12 2020 admin Bitcoin Frauds And Crimes 12. Ive called the number listed online for my bank and theyve said that theres nothing that they can do and the system will adjust it. Print this out and bring it to the bank. They should have an image of the 2nd deposit on file.

Most banks will have check photos available online. It could be somebody deposits the same check by mobile into two different bank account at two different banks or that theyve deposited remotely using their mobile and then go to a store or check cashier and cash it said Nessa Feddis Vice President of the American Bankers Association. So Monday I received my paycheck and used my mobile banking app to deposit the check. Then they bounced both instances of the check and charged me as many fees as they could come up with.

If you knowingly do it its technically bank fraud a felony punishable by a.

The question becomes who is left to make good on these multiple transactions if the parties are unable to. What happens when you mobile deposit the same check twice. Once through a banks mobile deposit app and once through a check cashing store. January 12 2020 admin Bitcoin Frauds And Crimes 12.

Source: nerdwallet.com

Source: nerdwallet.com

I called the bank immediately and explained the situation. When the same check is deposited twice at the same. Still banks have historically been good at catching double presentment at the same institution using the same channel the same check deposited twice using the same mobile phone for example says analyst Bob Meara of Celent. They cash a paycheck on their mobile app then deposit the paper check a second time for duplicate payment.

Source: firstquarterfinance.com

Source: firstquarterfinance.com

January 12 2020 admin Bitcoin Frauds And Crimes 12. So Monday I received my paycheck and used my mobile banking app to deposit the check. Deposit By Phone Bill. If you knowingly do it its technically bank fraud a felony punishable by a.

Source: bobsullivan.net

Source: bobsullivan.net

They should have an image of the 2nd deposit on file. Ive called the number listed online for my bank and theyve said that theres nothing that they can do and the system will adjust it. Ad Free Signup Bonus. Cashing the same check twice The situation goes like this.

You may deposit the check.

Deposit By Phone Bill. Deposit By Phone Bill. A person receives a check from you and deposits it using the mobile banking app on their phone. The banks should have systems in place to prevent it from being deposited twice via a mobile deposit. Mobile deposit or remote deposit is a convenient way to skip a visit to your bank.

Source: almvest.com

Source: almvest.com

Up To 200 First Deposit Match. This means that whether accidentally or on purpose. Depositing the same check twice is called double presentment If done intentionally double presentment is considered a form of check fraud that could lead to state or federal penalties. Staffing agency clients are increasingly pointing to a fraud committed by disloyal short-term employees. Suppose the chip is a check and the employee tries to cash it twice.

Cashing or depositing a check twice is known as a double presentment and it can happen unintentionally in a couple of different ways.

Make sure you actually did mobile deposit the check 1st time then re-deposit it in person 2nd time. They cash a paycheck on their mobile app then deposit the paper check a second time for duplicate payment. Staffing agency clients are increasingly pointing to a fraud committed by disloyal short-term employees. I called the bank immediately and explained the situation.

Source: youtube.com

Source: youtube.com

Then they bounced both instances of the check and charged me as many fees as they could come up with. They cash a paycheck on their mobile app then deposit the paper check a second time for duplicate payment. Ad Free Signup Bonus. Because of a glitch in the app I managed to submit a mobile deposit twice.

Source: almvest.com

Source: almvest.com

Print this out and bring it to the bank. Ad Free Signup Bonus. When the same check is deposited twice at the same. A person receives a check from you and deposits it using the mobile banking app on their phone.

Source: nerdwallet.com

Source: nerdwallet.com

The check clears twice. A person receives a check from you and deposits it using the mobile banking app on their phone. You may deposit the check. Subscribe to Get more stuff like this.

A person receives a check from you and deposits it using the mobile banking app on their phone.

Who would you rather be Costanza or Timmy. Deposit By Phone Bill. When deposited in person the teller will keep the check so you cant deposit again. If you knowingly do it its technically bank fraud a felony punishable by a. Once through a banks mobile deposit app and once through a check cashing store.

Source: firstquarterfinance.com

Source: firstquarterfinance.com

They cash a paycheck on their mobile app then deposit the paper check a second time for duplicate payment. They reassured me just as they did you. You may deposit the check. Ive called the number listed online for my bank and theyve said that theres nothing that they can do and the system will adjust it. The question becomes who is left to make good on these multiple transactions if the parties are unable to.

Then they bounced both instances of the check and charged me as many fees as they could come up with.

Most banks will have check photos available online. They cash a paycheck on their mobile app then deposit the paper check a second time for duplicate payment. The banks should have systems in place to prevent it from being deposited twice via a mobile deposit. Who would you rather be Costanza or Timmy.

Source: gobankingrates.com

Source: gobankingrates.com

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. January 12 2020 admin Bitcoin Frauds And Crimes 12. It could be somebody deposits the same check by mobile into two different bank account at two different banks or that theyve deposited remotely using their mobile and then go to a store or check cashier and cash it said Nessa Feddis Vice President of the American Bankers Association. They should have an image of the 2nd deposit on file. If you knowingly do it its technically bank fraud a felony punishable by a.

Source: thebankofglenburnie.com

Source: thebankofglenburnie.com

Suppose the chip is a check and the employee tries to cash it twice. Because of a glitch in the app I managed to submit a mobile deposit twice. We respect your privacy and protect it seriously. Staffing agency clients are increasingly pointing to a fraud committed by disloyal short-term employees. I mustve accidentally deposited it twice because in my accounts transaction history there are two check deposits of the same amount and they both have pictures of the same check.

Source: youtube.com

Source: youtube.com

You may deposit the check. Most banks will have check photos available online. Cashing the same check twice The situation goes like this. When deposited in person the teller will keep the check so you cant deposit again. They reassured me just as they did you.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mobile deposit check twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.