Making mortgage payments twice a month.

If you’re looking for making mortgage payments twice a month images information linked to the making mortgage payments twice a month keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

Are Biweekly Mortgage Payments A Good Idea Clever Girl Finance From clevergirlfinance.com

Are Biweekly Mortgage Payments A Good Idea Clever Girl Finance From clevergirlfinance.com

The payment option commonly called bi-monthly is a bi-weekly payment option. Flexible Payment Options Retain 100 Ownership Of Your Home. Because depending on the particulars of your loan there is a good chance that the company receiving your mortgage payment isnt the company that holds the loan. When you make twice monthly payments you are paying half of your mortgage 24 times per year for a total of 12 payments.

Either to reduce next months payment by the amount youve overpaid or to keep payments the same and reduce your mortgage term instead.

Light Heavy Refurb Finance. Either to reduce next months payment by the amount youve overpaid or to keep payments the same and reduce your mortgage term instead. On a 200000 repayment mortgage with a 25-year term at 45 interest the monthly repayment is 1110 so thats 13300 a year. Paying a mortgage twice per month will improve the homeowners credit. However some lenders offer a bi-monthly payment service to homebuyers.

Source: time.com

Source: time.com

When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. Shorten the term to 20 years and the monthly repayment rises to 1265 15200 a year. Dont Waste Time or Money. Therefore if your monthly payment is 1500 a month you would pay 18000 a year with monthly payments. By making payments every other week you are actually paying an additional loan payment each year.

This isnt really true.

Bimonthly mortgage payments are scheduled twice a month for specific payment dates. See what lenders see with checkmyfile and find out how you rate. No paper no appointments. Just quick decisions total transparency and competitive rates.

Source: id.pinterest.com

Source: id.pinterest.com

For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. Buy Before You Sell. See what lenders see with checkmyfile. However the homeowner can achieve the same effect on a monthly plan by utilizing electronic bill payment or an automatic bank draft.

Source: pinterest.com

Source: pinterest.com

Ad Fast fair award-winning lending from the UKs first fully digital mortgage lender. The payment option commonly called bi-monthly is a bi-weekly payment option. Although youre paying twice per. See what lenders see with checkmyfile.

Source: pinterest.com

Source: pinterest.com

Bimonthly mortgage payments are scheduled twice a month for specific payment dates. Ad Fast fair award-winning lending from the UKs first fully digital mortgage lender. Ad Mortgage Life Insurance Tailored To You Your Budget. Check Your Eligibility Now.

Paying a mortgage twice per month will improve the homeowners credit. Just quick decisions total transparency and competitive rates. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay. Talk To Insurance Experts Now.

Flexible Payment Options Retain 100 Ownership Of Your Home.

Talk To Insurance Experts Now. On a 200000 repayment mortgage with a 25-year term at 45 interest the monthly repayment is 1110 so thats 13300 a year. No paper no appointments. See what lenders see with checkmyfile and find out how you rate. Just quick decisions total transparency and competitive rates.

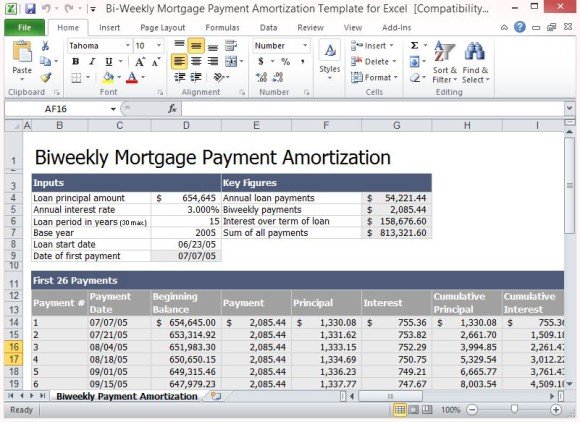

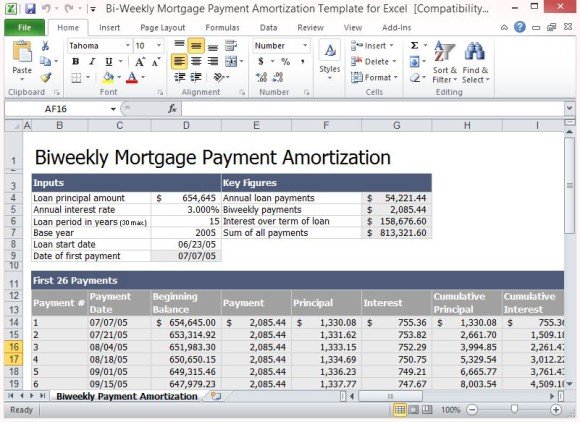

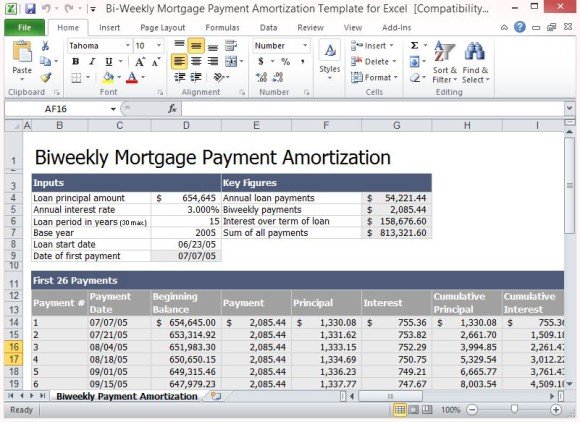

Source: free-power-point-templates.com

Source: free-power-point-templates.com

Ad Fast fair award-winning lending from the UKs first fully digital mortgage lender. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay. See what lenders see with checkmyfile. Although youre paying twice per.

When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. By making payments every other week you are actually paying an additional loan payment each year. When you make an overpayment your lender may offer you two options. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay.

Banks use an automatic bank draft for bi-weekly plans which means all mortgage payments will be on time.

Talk To Insurance Experts Now. Either to reduce next months payment by the amount youve overpaid or to keep payments the same and reduce your mortgage term instead. When you make an overpayment your lender may offer you two options. Light Heavy Refurb Finance.

Source: pinterest.com

Source: pinterest.com

Light Heavy Refurb Finance. Banks use an automatic bank draft for bi-weekly plans which means all mortgage payments will be on time. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. See what lenders see with checkmyfile.

Source: clevergirlfinance.com

Source: clevergirlfinance.com

See what lenders see with checkmyfile and find out how you rate. Flexible Payment Options Retain 100 Ownership Of Your Home. This is something to watch for if you get it wrong it means your overpayment wont actually help you out that much. By making payments every other week you are actually paying an additional loan payment each year.

Source: pinterest.com

Source: pinterest.com

Ad Dont miss a single thing. This isnt really true. Get Free Expert Advice Let Us Take Care Of You During Your Application Process. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay.

Shorten the term to 20 years and the monthly repayment rises to 1265 15200 a year.

This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay. Just quick decisions total transparency and competitive rates. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. For instance your bimonthly mortgage payments might be due on the first day and the 15th day of every month. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay.

Source: clevergirlfinance.com

Source: clevergirlfinance.com

No paper no appointments. See what lenders see with checkmyfile. Get Free Expert Advice Let Us Take Care Of You During Your Application Process. See what lenders see with checkmyfile and find out how you rate. The payment option commonly called bi-monthly is a bi-weekly payment option.

Talk To Insurance Experts Now.

When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. Dont miss a single thing. Dont Waste Time or Money. Either to reduce next months payment by the amount youve overpaid or to keep payments the same and reduce your mortgage term instead.

Source: pinterest.com

Source: pinterest.com

Buy Before You Sell. Either to reduce next months payment by the amount youve overpaid or to keep payments the same and reduce your mortgage term instead. Exclusive Offers From All The Leading Providers - Plus Low Customer Fees Guaranteed. Ad Bridging Finance Mortgage.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay. No paper no appointments. Although youre paying twice per. Dont Waste Time or Money.

Source: clevergirlfinance.com

Source: clevergirlfinance.com

When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. When you make twice monthly payments you are paying half of your mortgage 24 times per year for a total of 12 payments. By making payments every other week you are actually paying an additional loan payment each year. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay.

This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay.

Ad Bridging Finance Mortgage. Just quick decisions total transparency and competitive rates. By making payments every other week you are actually paying an additional loan payment each year. Check Your Eligibility Now. Over 25 years the total amount you repay is 334500.

Source: pinterest.com

Source: pinterest.com

Light Heavy Refurb Finance. Over 25 years the total amount you repay is 334500. When you make biweekly payments you pay half of your mortgage payment 26 times for a total of 13 payments. If you made payments every other week you would end up paying 19500 for the year. Just quick decisions total transparency and competitive rates.

Shorten the term to 20 years and the monthly repayment rises to 1265 15200 a year.

Bimonthly mortgage payments are scheduled twice a month for specific payment dates. Flexible Payment Options Retain 100 Ownership Of Your Home. Buy Before You Sell. Get Free Expert Advice Let Us Take Care Of You During Your Application Process.

Source: id.pinterest.com

Source: id.pinterest.com

The payment option commonly called bi-monthly is a bi-weekly payment option. When you make an overpayment your lender may offer you two options. Ad Fast fair award-winning lending from the UKs first fully digital mortgage lender. Banks use an automatic bank draft for bi-weekly plans which means all mortgage payments will be on time. The payment option commonly called bi-monthly is a bi-weekly payment option.

Source: pinterest.com

Source: pinterest.com

Over 25 years the total amount you repay is 334500. Ad Find Out How Much Tax-Free Cash You Could Release From Your Home. Bimonthly mortgage payments are scheduled twice a month for specific payment dates. Ad 100 Impartial Advice - Our Fully Qualified Advisers Follow Strict Rules And Guidelines. Ad Dont miss a single thing.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

By making payments every other week you are actually paying an additional loan payment each year. Just quick decisions total transparency and competitive rates. This extra payment each year significantly reduces your principal balance which shortens the amount of time that you pay your mortgage and allows you to pay. On a 200000 repayment mortgage with a 25-year term at 45 interest the monthly repayment is 1110 so thats 13300 a year. Over 25 years the total amount you repay is 334500.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title making mortgage payments twice a month by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.