Filing taxes twice by accident.

If you’re looking for filing taxes twice by accident images information related to the filing taxes twice by accident keyword, you have come to the ideal site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Income Tax Filing Taxes Tax Return From in.pinterest.com

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Income Tax Filing Taxes Tax Return From in.pinterest.com

I realized my mistake when I saw two withdrawals out of my account for. By continuing to use this site you consent to the use of cookies on your device as described. Usually the first one the IRS receives will get accepted and the second will be rejected. Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice.

Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice.

IRS accepted my return. Once again even if you are not ticketed and file a single car accident the claim will be considered an at-fault accident. Either type of damage caused by a car accident can potentially be deducted from your taxes. Does it create any problem as everywhere it says tax. By continuing to use this site you consent to the use of cookies on your device as described.

Source: pinterest.com

Source: pinterest.com

After she died it was up to me to file them for the year before her death and. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. If you want to file a claim on your car insurance you need collision coverage listed on your vehicle at the time of the accident. Prepare and File Accounts Tax and VAT Returns From a Single Platform. As a rule you will pay tax in the country where you are resident.

The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer.

IRS accepted my return. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Prepare and File Accounts Tax and VAT Returns From a Single Platform. You must pay Capital Gains Tax on.

Source: in.pinterest.com

Source: in.pinterest.com

Individuals who unintentionally file two tax returns wont get fined. The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations. Prepare and File Accounts Tax and VAT Returns From a Single Platform. I was worried my payment didnt go through eventually it did but I already used another 3rd party to pay it all down.

Source: pinterest.com

Source: pinterest.com

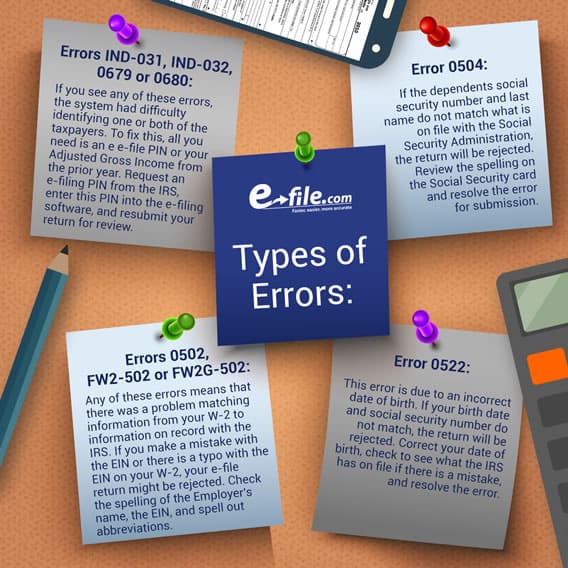

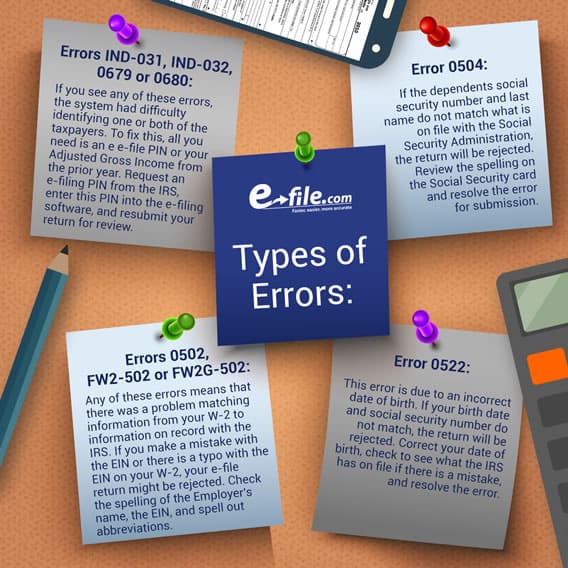

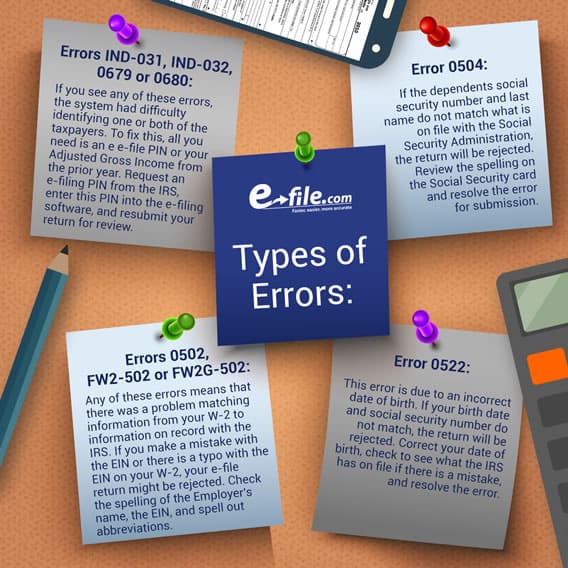

1 2. Does it create any problem as everywhere it says tax. The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer. The IRS typically uses error code 0515 or IND-515 to inform the sender.

Source: cnet.com

Source: cnet.com

After she died it was up to me to file them for the year before her death and. Accidentally paid my taxes twice. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. What happens if by accident I filed my taxes twice - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

What to Do if Youre Flagged. If you want to file a claim on your car insurance you need collision coverage listed on your vehicle at the time of the accident. The second filer will receive an electronic-filing error message or a notice from the IRS via USPS mail. The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer.

Once again even if you are not ticketed and file a single car accident the claim will be considered an at-fault accident.

Once again even if you are not ticketed and file a single car accident the claim will be considered an at-fault accident. Either type of damage caused by a car accident can potentially be deducted from your taxes. Hi Kelly I have a quick questionI used e file turbo tax- free editon and IRS rejected it on 15th so I sent my documents via postal mailMeanwhile on my second attempt to e file with paper sign. After she died it was up to me to file them for the year before her death and. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation.

Source: aarp.org

Source: aarp.org

The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations. The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer. This is the first warning that something is amiss. The second filer will receive an electronic-filing error message or a notice from the IRS via USPS mail. An Auditors job is to make sure that the taxpayer has paid the correct amount.

I was worried my payment didnt go through eventually it did but I already used another 3rd party to pay it all down. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice. Posted by 1 year ago.

The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations.

The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer. The second tax return thats filed using a Social Security number for a dependent whos already been claimed by someone else will trigger a red flag from DIF. Usually the first one the IRS receives will get accepted and the second will be rejected. This is the first warning that something is amiss.

Source: e-file.com

Source: e-file.com

Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice. The IRS typically uses error code 0515 or IND-515 to inform the sender. I used an HR block E-file to pay my taxes. This is the first warning that something is amiss.

Source: aarp.org

Source: aarp.org

Thus you would be exempt from tax in the country where you make the capital gain. Dont worry though because the IRS will only process one return with your information and will reject the other if youre guilty of accidentally filing your taxes twice. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. Does it create any problem as everywhere it says tax.

Source: pinterest.com

Source: pinterest.com

But since she died unexpectedly just before filing her taxes for the prior year she left the errand twice undone. By continuing to use this site you consent to the use of cookies on your device as described. After she died it was up to me to file them for the year before her death and. What happens if by accident I filed my taxes twice - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

By continuing to use this site you consent to the use of cookies on your device as described.

HR Block says that the consequence. As a rule you will pay tax in the country where you are resident. By continuing to use this site you consent to the use of cookies on your device as described. What happens if by accident I filed my taxes twice - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. The second filer will receive an electronic-filing error message or a notice from the IRS via USPS mail.

Source: pinterest.com

Source: pinterest.com

You must pay Capital Gains Tax on. For instance if an accident resulted in 40000 worth of damage and your insurance company covered 35000 then you will only be able to deduct up to 5000. After she died it was up to me to file them for the year before her death and. I was worried my payment didnt go through eventually it did but I already used another 3rd party to pay it all down. I realized my mistake when I saw two withdrawals out of my account for.

I used an HR block E-file to pay my taxes.

HR Block says that the consequence. Individuals who unintentionally file two tax returns wont get fined. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Posted by 1 year ago.

Source: pinterest.com

Source: pinterest.com

Accidentally paid my taxes twice. Prepare and File Accounts Tax and VAT Returns From a Single Platform. If you want to file a claim on your car insurance you need collision coverage listed on your vehicle at the time of the accident. In most cases you do not need to make a claim.

Source: in.pinterest.com

Source: in.pinterest.com

But since she died unexpectedly just before filing her taxes for the prior year she left the errand twice undone. If you want to file a claim on your car insurance you need collision coverage listed on your vehicle at the time of the accident. The IRS doesnt put a limit on the number of times that you can amend any particular years tax return as long as youre filing within the statute of limitations. Posted by 1 year ago.

Source: e-file.com

Source: e-file.com

The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations. In most cases you do not need to make a claim. 1 2. The second tax return thats filed using a Social Security number for a dependent whos already been claimed by someone else will trigger a red flag from DIF.

As a rule you will pay tax in the country where you are resident.

Accidentally paid my taxes twice. Individuals who unintentionally file two tax returns wont get fined. Does it create any problem as everywhere it says tax. Once again even if you are not ticketed and file a single car accident the claim will be considered an at-fault accident. By continuing to use this site you consent to the use of cookies on your device as described.

Source: in.pinterest.com

Source: in.pinterest.com

The IRS doesnt put a limit on the number of times that you can amend any particular years tax return as long as youre filing within the statute of limitations. But since she died unexpectedly just before filing her taxes for the prior year she left the errand twice undone. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. HR Block says that the consequence. Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice.

Usually the first one the IRS receives will get accepted and the second will be rejected.

The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax whichever is longer. IRS accepted my return. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. The IRS doesnt put a limit on the number of times that you can amend any particular years tax return as long as youre filing within the statute of limitations.

Source: e-file.com

Source: e-file.com

IRS accepted my return. Once a return has been rejected no information gets sent to. If you want to file a claim on your car insurance you need collision coverage listed on your vehicle at the time of the accident. But since she died unexpectedly just before filing her taxes for the prior year she left the errand twice undone. IRS accepted my return.

Source: pinterest.com

Source: pinterest.com

Posted by 1 year ago. However you can only deduct money that you actually had to pay. IRS accepted my return. For instance if an accident resulted in 40000 worth of damage and your insurance company covered 35000 then you will only be able to deduct up to 5000. Posted by 1 year ago.

Source: aarp.org

Source: aarp.org

An Auditors job is to make sure that the taxpayer has paid the correct amount. As a rule you will pay tax in the country where you are resident. The second tax return thats filed using a Social Security number for a dependent whos already been claimed by someone else will trigger a red flag from DIF. This is the first warning that something is amiss. Once a return has been rejected no information gets sent to.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title filing taxes twice by accident by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.