Filed tax return twice.

If you’re searching for filed tax return twice pictures information linked to the filed tax return twice keyword, you have come to the right blog. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

How Business Owners Can Avoid Double Taxation Smartasset From smartasset.com

How Business Owners Can Avoid Double Taxation Smartasset From smartasset.com

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Download a new tax return. In India to file a return for the same AY twice you need to signify that the second return is a Revised Return and give reference number of the original return. What happens if youre late filing your tax return.

Therefore the possibility of two returns being filed for the same year accidentally is not possible.

These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing. Download a new tax return. A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him. It can create a delay in releasing your refund. Choose the tax year for the return you want to amend.

Source: livemint.com

Source: livemint.com

Choose Tax return options. Once a return has. If the info is different IRS will chage your return with the most recently received return. Go into the tax return make the corrections and file it again. What if I filed my return twice once by mail the other by e-file.

The only thing you can do is then Request another Correction or if you submit the documents SARS will take care of it and issue an assessment based on what you submitted.

These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing. A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him. If you miss the deadline to file your self-assessment tax return HMRC could automatically charge you 100. Once a return has.

Source: livemint.com

Source: livemint.com

Prepare and File Accounts Tax and VAT Returns From a Single Platform. How to amend a paper tax return. Choose the tax year for the return you want to amend. Download a new tax return.

Source: smartasset.com

Source: smartasset.com

If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. You do not normally pay tax when you sell an asset apart from on UK property. Go into the tax return make the corrections and file it again. If it has a double-taxation agreement with the UK you can claim tax relief in the UK to avoid being taxed twice.

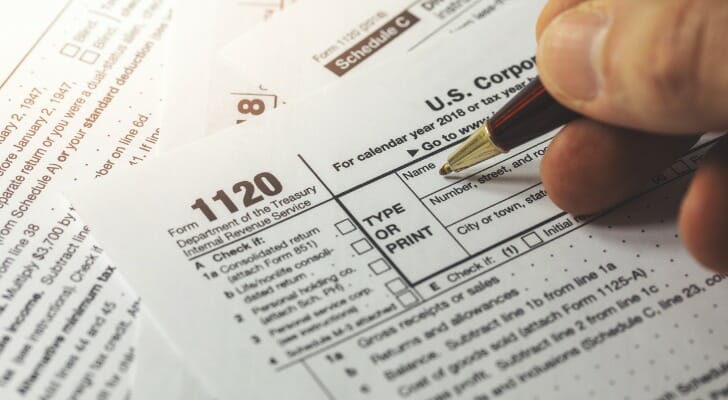

Source: wealthfactory.com

Source: wealthfactory.com

HMRC must have received your tax return by 31 October 2021 for paper forms and midnight on 31 January 2022 for online returns. Once a return has. Therefore the possibility of two returns being filed for the same year accidentally is not possible. Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice.

You should call the IRS and see if your return has been received before sending in a. If they contain the same info IRS will make no changes. It can only be a revised return. Once the IRS determines that a return with any of these numbers for the current tax year has already been filed.

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system.

If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. This information includes your Social Security number your spouses Social Security number if you filed a joint return and any dependents Social Security numbers. Prepare and File Accounts Tax and VAT Returns From a Single Platform. The only thing you can do is then Request another Correction or if you submit the documents SARS will take care of it and issue an assessment based on what you submitted. Register for Self Assessment if youre self-employed or a sole trader not self-employed or.

Source: smartasset.com

Source: smartasset.com

Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. HMRC must have received your tax return by 31 October 2021 for paper forms and midnight on 31 January 2022 for online returns. What happens if youre late filing your tax return. Choose the tax year for the return you want to amend.

The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations. Go into the tax return make the corrections and file it again. Go into the tax return make the corrections and file it again. You do not normally pay tax when you sell an asset apart from on UK property.

Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS.

Register for Self Assessment if youre self-employed or a sole trader not self-employed or. You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system. Filing two original returns with the IRS creates a duplicate filing situation. Choose the tax year for the return you want to amend.

Source: livemint.com

Source: livemint.com

You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system. You should call the IRS and see if your return has been received before sending in a. It can only be a revised return. What happens when a tax return is filed twice.

Source: wealthfactory.com

Source: wealthfactory.com

Filing two federal tax returns. If they contain the same info IRS will make no changes. Go into the tax return make the corrections and file it again. You should call the IRS and see if your return has been received before sending in a.

Source: livemint.com

Source: livemint.com

If it has a double-taxation agreement with the UK you can claim tax relief in the UK to avoid being taxed twice. Additionally if there is a refund due submitting two returns will slow down your receiving your refund because a person will need to investigate why two returns. Filing two federal tax returns. Both returns paper or e-file must be reviewed.

If it has a double-taxation agreement with the UK you can claim tax relief in the UK to avoid being taxed twice.

Once the IRS determines that a return with any of these numbers for the current tax year has already been filed. The last tax year started on 6 April 2020 and ended on 5 April 2021. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. It can create a delay in releasing your refund. How to amend a paper tax return.

Source: livemint.com

Source: livemint.com

Once the IRS determines that a return with any of these numbers for the current tax year has already been filed. The statute of limitations for federal income tax purposes is 3 years but California has a 4 year statute of limitations. Go into the tax return make the corrections and file it again. These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing. Choose Tax return options.

A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him.

If the info is different IRS will chage your return with the most recently received return. Go into the tax return make the corrections and file it again. These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing. If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system.

Source: happyschools.com

Source: happyschools.com

The last tax year started on 6 April 2020 and ended on 5 April 2021. You should call the IRS and see if your return has been received before sending in a. If they contain the same info IRS will make no changes. Tax forms and submission can be confusing for many people.

Source: livemint.com

Source: livemint.com

It can only be a revised return. Filing two federal tax returns. What happens if youre late filing your tax return. Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice.

Source: livemint.com

Source: livemint.com

If you miss the deadline to file your self-assessment tax return HMRC could automatically charge you 100. Sometimes people unintentionally file their tax returns twice. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Therefore the possibility of two returns being filed for the same year accidentally is not possible.

You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system.

You should call the IRS and see if your return has been received before sending in a. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him. If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Go into the tax return make the corrections and file it again.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

The last tax year started on 6 April 2020 and ended on 5 April 2021. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. Therefore the possibility of two returns being filed for the same year accidentally is not possible. It can only be a revised return. HMRC must have received your tax return by 31 October 2021 for paper forms and midnight on 31 January 2022 for online returns.

You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system.

It can create a delay in releasing your refund. Sometimes people unintentionally file their tax returns twice. Ordinarily if youre more than a day late the potential fines only get worse. If the info is different IRS will chage your return with the most recently received return.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

This information includes your Social Security number your spouses Social Security number if you filed a joint return and any dependents Social Security numbers. If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Tax forms and submission can be confusing for many people. Ordinarily if youre more than a day late the potential fines only get worse. Prepare and File Accounts Tax and VAT Returns From a Single Platform.

Source: marketrealist.com

Source: marketrealist.com

Filing twice may cause confusion and may be misinterpreted as an attempt to recover a refund twice. How to amend a paper tax return. Bearklaw777 You cannot file a return with someone else when you already filed a return. HMRC must have received your tax return by 31 October 2021 for paper forms and midnight on 31 January 2022 for online returns. Filing two federal tax returns.

Source: livemint.com

Source: livemint.com

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. It can create a delay in releasing your refund. Go into the tax return make the corrections and file it again. Choose Tax return options.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title filed tax return twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.