File tax return twice.

If you’re searching for file tax return twice images information connected with to the file tax return twice keyword, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

The country where you live might tax you on your UK income. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. On the main tax return SA100 you will need to complete box 201 which states If any of your businesses received coronavirus support payments such as CJRS SEISS you must put X in the box to declare that they have been included as taxable income when calculating profits in. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return.

You may not have to pay twice if the country youre resident in has a double-taxation.

Most tax return software programs show you the status of your return and will not allow you to e-file the same return again. If they contain the same info IRS will make no changes. On the main tax return SA100 you will need to complete box 201 which states If any of your businesses received coronavirus support payments such as CJRS SEISS you must put X in the box to declare that they have been included as taxable income when calculating profits in. You should call the IRS and see if your return has been received before sending in a second return. Once your Social Security Number has been used to file a return the IRS will.

Are not self-employed but you still send a tax return for example because you receive income from renting out a property. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. Prepare and File Accounts Tax and VAT Returns From a Single Platform. You should call the IRS and see if your return has been received before sending in a second return. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return.

Additionally if there is a refund due submitting two returns will slow down your receiving your refund because a person will need to investigate why two returns.

If your business has been affected by coronavirus COVID-19 you may be able to claim a grant through the Self-Employment Income Support Scheme. When you file your income tax return electronically the IRS will receive and begin processing it within 24 to 48 hours. Filing two original returns with the IRS creates a duplicate filing situation. You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system.

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Filing two federal tax returns isnt allowed. Once a return has.

Source: yourstory.com

Source: yourstory.com

Once a return has. The IRS typically uses error code 0515 or IND-515 to inform the sender. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return. Are not self-employed but you still send a tax return for example because you receive income from renting out a property.

Source: timesnownews.com

Source: timesnownews.com

Filing two federal tax returns isnt allowed. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. When you file your income tax return electronically the IRS will receive and begin processing it within 24 to 48 hours. If it has a double-taxation agreement with the UK you can claim tax relief in the UK to avoid being taxed twice.

Once a return has. Bearklaw777 You cannot file a return with someone else when you already filed a return. When you file your income tax return electronically the IRS will receive and begin processing it within 24 to 48 hours. If youre taxed twice You may be taxed on your UK income by the country where youre resident and by the UK.

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system.

If the info is different IRS will chage your return with the most recently received return. Sometimes people unintentionally file their tax returns twice. If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. The process of filing an second tax return to make changes to an original return is called amending a tax return.

Source: yourstory.com

Source: yourstory.com

Both returns paper or e-file must be reviewed. A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. If your business has been affected by coronavirus COVID-19 you may be able to claim a grant through the Self-Employment Income Support Scheme.

If it has a double-taxation agreement with the UK you can claim tax relief in the UK to avoid being taxed twice. Prepare and File Accounts Tax and VAT Returns From a Single Platform. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. You should call the IRS and see if your return has been received before sending in a second return.

Sometimes people unintentionally file their tax returns twice.

Once your Social Security Number has been used to file a return the IRS will. You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system. Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. Once a return has.

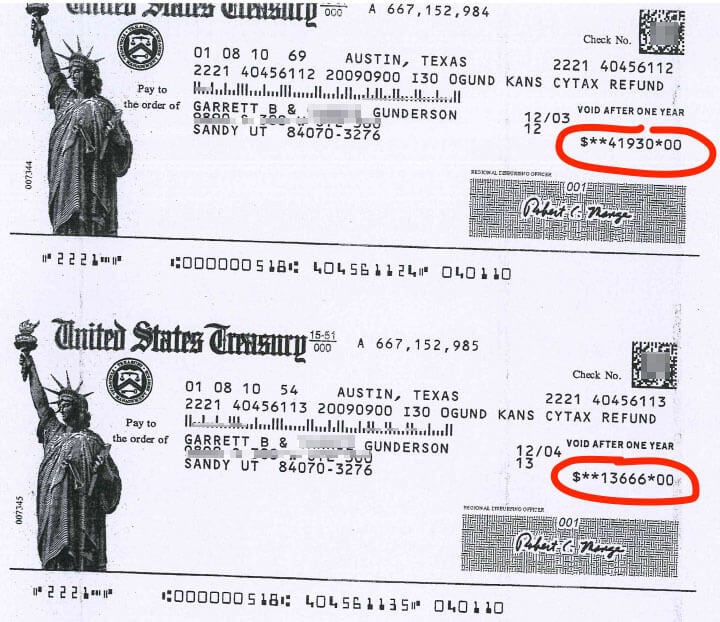

Source: fool.com

Source: fool.com

If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Once a return has. If the info is different IRS will chage your return with the most recently received return. Both returns paper or e-file must be reviewed.

Source: livemint.com

Source: livemint.com

You do not normally. These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return. A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him.

Source: yourstory.com

Source: yourstory.com

The IRS typically uses error code 0515 or IND-515 to inform the sender. Youll often need to pay the tax you owe in two chunks twice a year - a method known as payment on account. The process of filing an second tax return to make changes to an original return is called amending a tax return. Filing two federal tax returns isnt allowed.

It can create a delay in releasing your refund.

You may not have to pay twice if the country youre resident in has a double-taxation. If somehow you manage to e-file the same return twice the IRS will scan your return for duplicate information within the system. Youll often need to pay the tax you owe in two chunks twice a year - a method known as payment on account. You may not have to pay twice if the country youre resident in has a double-taxation. The country where you live might tax you on your UK income.

Source: marketrealist.com

Source: marketrealist.com

If your business has been affected by coronavirus COVID-19 you may be able to claim a grant through the Self-Employment Income Support Scheme. Youll often need to pay the tax you owe in two chunks twice a year - a method known as payment on account. Once a return has. If youre taxed twice You may be taxed on your UK income by the country where youre resident and by the UK. These rules are strictly enforced by the IRS and greatly regulate your options when it comes to tax filing.

The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations.

What if I filed my return twice once by mail the other by e-file. If the info is different IRS will chage your return with the most recently received return. Prepare and File Accounts Tax and VAT Returns From a Single Platform. Filing two federal tax returns isnt allowed.

We agreed and filed the return before 3101. You do not normally. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. E-file your return after mailing them may result in the IRS rejecting the e-filed return due to someone already filing using that name social security number and birthday.

Source: livemint.com

Source: livemint.com

You do not normally. If you attempt to file your return twice the IRS will reject the return and return it with an error code and explanation. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return. Once a return has.

Source: marketrealist.com

Source: marketrealist.com

Ad Powerful Integrations With The Main Invoicing Bookkeeping Solutions Kashflow by IRIS. File your tax return online or send a paper form. If the info is different IRS will chage your return with the most recently received return. Are not self-employed but you still send a tax return for example because you receive income from renting out a property.

Prepare and File Accounts Tax and VAT Returns From a Single Platform.

Filing two federal tax returns isnt allowed. File your tax return online or send a paper form. The country where you live might tax you on your UK income. Filing two federal tax returns isnt allowed. If the info is different IRS will chage your return with the most recently received return.

Source: timesnownews.com

Source: timesnownews.com

You wont get in trouble your Federal return with HR Block was rejected so you do not have two Federal returns in the IRS system. Prepare and File Accounts Tax and VAT Returns From a Single Platform. File your tax return online or send a paper form. If they contain the same info IRS will make no changes. Prepare and File Accounts Tax and VAT Returns From a Single Platform.

Are not self-employed but you still send a tax return for example because you receive income from renting out a property.

A new client who is computer illiterate and only has pension income with some simple self employment approached us in January saying that he normally files his tax return himself on paper but since he had missed the 3110 deadline and was unable to use a computer would we file the return for him. Prepare and File Accounts Tax and VAT Returns From a Single Platform. The IRS doesnt set a limit on the number of times you can file a return with a tax amendment for the same year but you are required to file within its statute of limitations. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return.

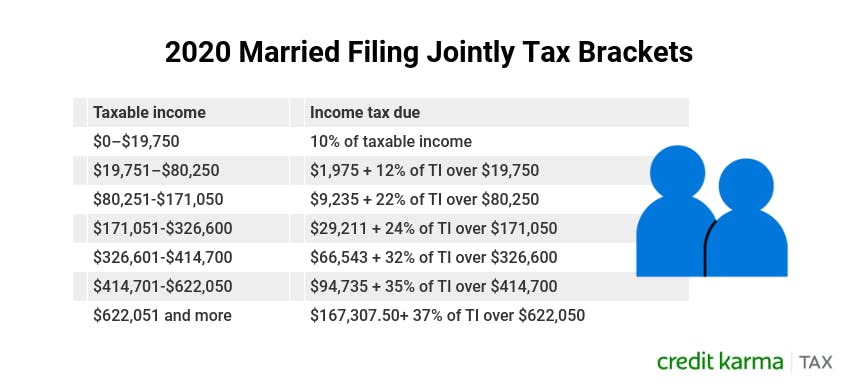

Source: creditkarma.com

Source: creditkarma.com

It can create a delay in releasing your refund. Filing two original returns with the IRS creates a duplicate filing situation. Bearklaw777 You cannot file a return with someone else when you already filed a return. If the info is different IRS will chage your return with the most recently received return. This guide explains how payment on account works as well as how to decide on your accounting period and many other aspects of self-assessment tax that youll need to consider when youre self-employed.

Source: fool.com

Source: fool.com

What if I filed my return twice once by mail the other by e-file. You may not have to pay twice if the country youre resident in has a double-taxation. You do not normally. We agreed and filed the return before 3101. Youll often need to pay the tax you owe in two chunks twice a year - a method known as payment on account.

Source: wealthfactory.com

Source: wealthfactory.com

Once a return has. Most tax return software programs show you the status of your return and will not allow you to e-file the same return again. This guide explains how payment on account works as well as how to decide on your accounting period and many other aspects of self-assessment tax that youll need to consider when youre self-employed. If your business has been affected by coronavirus COVID-19 you may be able to claim a grant through the Self-Employment Income Support Scheme. You may need to amend your tax return if you need to correct errors on the original return if you want to change your filing status or if youd like to take advantage of tax credits or deductions you failed to claim in the original return.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title file tax return twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.