Depositing same check twice.

If you’re looking for depositing same check twice images information related to the depositing same check twice topic, you have come to the right blog. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

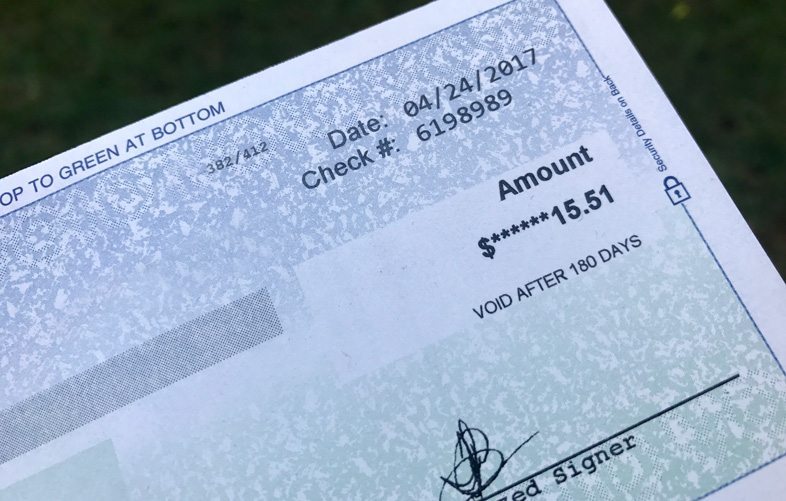

What Happens When You Deposit A Post Dated Check Early Mybanktracker From mybanktracker.com

What Happens When You Deposit A Post Dated Check Early Mybanktracker From mybanktracker.com

Print this out and bring it to the bank. Check recipients who do that get to keep the paper check rather than hand it over to a teller or an ATM. I cashed the check there. Deposit it once via remote capture and then cash it at a party store or check cashing place.

Most banks will have check photos available online.

Cashing the same check twice The situation goes like this. Most banks are good at catching double presentment if its attempted at the same banking institution through the same device for example the same check deposited twice over the same. Dont spend the money because that will put you in overdraft. Did you deposit it in the SAME bank twice or two different banks. They were tipped off by an employee.

Source: nerdwallet.com

Source: nerdwallet.com

Dont spend the money because that will put you in overdraft. Now if you did the deposit on line the bank will not take the cheque because it has already been deposited. Thats the scary part. If the double dipping occurred through an electronic substitute check they can point to the Check 21 Act specifically 12 USC 5004 and argue that the double-dippers bank is properly accountable. Deposit it once via remote capture and then cash it at a party store or check cashing place.

While you may have to initially pay out twice for that check you should be reimbursed by the bank.

Make sure you actually did mobile deposit the check 1st time then re-deposit it in person 2nd time. You have told them about it and they will probably fix it as soon as they figure it out. So today at 4pm almost 2 weeks later I received a call from HR saying that I cashed my check twice and they will sue me. Thats the scary part.

Source: youtube.com

Source: youtube.com

When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. They should have an image of the 2nd deposit on file. With the rise in popularity and usage of mobile deposit apps the opportunity for checks to be double deposited increases as well. Upon checking my account BOFA cleared it.

Source: bobsullivan.net

Source: bobsullivan.net

Use the same account you used on the second deposit to reverse it. Today is 10219 and just noticed same check number presented but bounced 2 days ago. They would have paid it again if I had money In the acct. That means the check can be deposited a second time a problem known in banking as double presentment.

Source: mybanktracker.com

Source: mybanktracker.com

Thats the scary part. With the rise in popularity and usage of mobile deposit apps the opportunity for checks to be double deposited increases as well. Check deposited twice If you mean that you have deposited the check twice and you still have the money - thats where it settled - then write a check to the person who wrote you a check. Did you deposit it in the SAME bank twice or two different banks.

Then several months later still in possession of the paper check they take it to a branch or an ATM and cash it again. I totally could have missed it Rosales said. Dont spend the money because that will put you in overdraft. Today is 10219 and just noticed same check number presented but bounced 2 days ago.

Most banks will have check photos available online.

You dont have to deposit into your bank account twice. Depositing the same check twice is called double presentment If done intentionally double presentment is considered a form of check fraud that could lead to state or federal penalties. We call this bank as the collecting bank and also the presenting bank. You dont have to deposit into your bank account twice. So I explained what had happened and was advised to pay it fast.

Source: nerdwallet.com

Source: nerdwallet.com

Cashing the same check twice The situation goes like this. I cashed the check there. While it may present a bit of a hassle for staffing companies you should rest assured that the liability does not lie with you in issuing the payroll check that was double deposited. They should have an image of the 2nd deposit on file. If the same bank its not a big deal.

What if you deposit the check once and then forget and deposit it againWh. In India when one deposits a cheque the same remains in the custody of the bank where the depositor is maintaining herhis account. Dont spend the money because that will put you in overdraft. Now if you did the deposit on line the bank will not take the cheque because it has already been deposited.

Use the same account you used on the second deposit to reverse it.

What if you deposit the check once and then forget and deposit it againWh. They should have an image of the 2nd deposit on file. Answer was NO bc once it has been presented they try it twice and then send it back. Make sure you actually did mobile deposit the check 1st time then re-deposit it in person 2nd time.

Source:

Source:

So today at 4pm almost 2 weeks later I received a call from HR saying that I cashed my check twice and they will sue me. I cashed the check there. Deposited check twice accidentally under investigation for cheque fraud. What if you deposit the check once and then forget and deposit it againWh.

Source: mybanktracker.com

Source: mybanktracker.com

With the rise in popularity and usage of mobile deposit apps the opportunity for checks to be double deposited increases as well. I cashed the check there. With the rise in popularity and usage of mobile deposit apps the opportunity for checks to be double deposited increases as well. Thats the scary part.

Source:

Source:

Cashing the same check twice The situation goes like this. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. I cashed the check there. What if you deposit the check once and then forget and deposit it againWh.

They were tipped off by an employee.

When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. Thats the scary part. Then several months later still in possession of the paper check they take it to a branch or an ATM and cash it again. Cashing the same check twice The situation goes like this. Deposited check twice accidentally under investigation for cheque fraud.

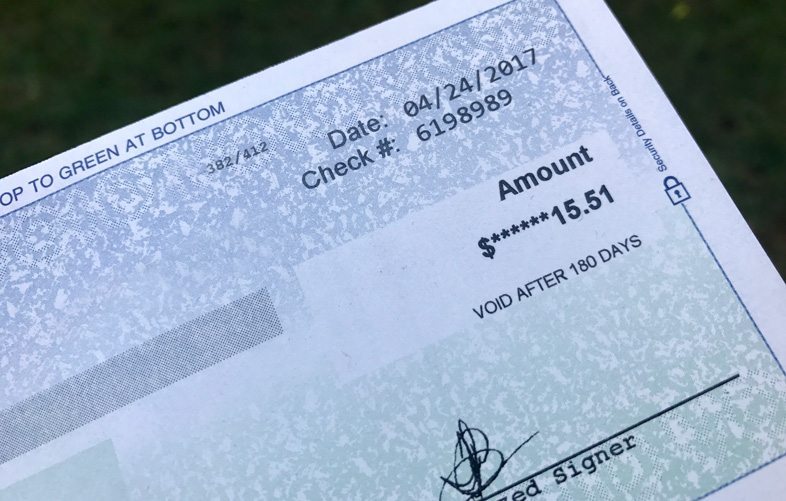

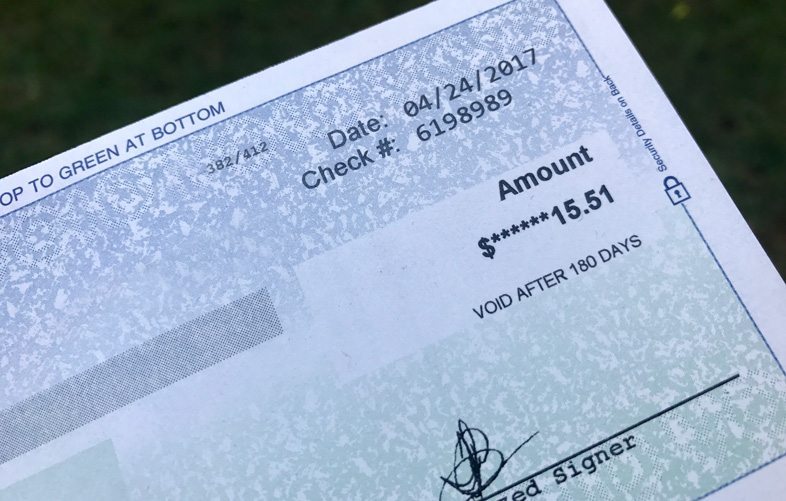

Source: getrichslowly.org

Source: getrichslowly.org

That means the check can be deposited a second time a problem known in banking as double presentment. Depositing the same check twice is called double presentment If done intentionally double presentment is considered a form of check fraud that could lead to state or federal penalties. They would have paid it again if I had money In the acct. Then several months later still in possession of the paper check they take it to a branch or an ATM and cash it again. You have told them about it and they will probably fix it as soon as they figure it out.

Print this out and bring it to the bank.

They were tipped off by an employee. I totally could have missed it Rosales said. When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. Upon checking my account BOFA cleared it.

Source: getrichslowly.org

Source: getrichslowly.org

Couldnt reach the plumber to see if it was an accident or fraud so I asked the banker to put a stop payment on it. They would have paid it again if I had money In the acct. Cashing the same check twice The situation goes like this. In the Martens case the double deposits known in the industry as double presentment happened 17 times.

Source: thebankofglenburnie.com

Source: thebankofglenburnie.com

Staffing agencies payroll agencies or PEOs who issue a twice-cashed check are sometimes asked to make good on the same payment twice. Check deposited twice If you mean that you have deposited the check twice and you still have the money - thats where it settled - then write a check to the person who wrote you a check. So today at 4pm almost 2 weeks later I received a call from HR saying that I cashed my check twice and they will sue me. In India when one deposits a cheque the same remains in the custody of the bank where the depositor is maintaining herhis account.

Source:

Source:

Today is 10219 and just noticed same check number presented but bounced 2 days ago. We call this bank as the collecting bank and also the presenting bank. I dont know why they didnt call me first. They would have paid it again if I had money In the acct.

Most banks are good at catching double presentment if its attempted at the same banking institution through the same device for example the same check deposited twice over the same.

So I explained what had happened and was advised to pay it fast. I cashed the check there. They should have an image of the 2nd deposit on file. I dont know why they didnt call me first. If the same bank its not a big deal.

Source: firstquarterfinance.com

Source: firstquarterfinance.com

Today is 10219 and just noticed same check number presented but bounced 2 days ago. So today at 4pm almost 2 weeks later I received a call from HR saying that I cashed my check twice and they will sue me. When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. Most banks will have check photos available online. If you go to Shad.

Thats the scary part.

That means the check can be deposited a second time a problem known in banking as double presentment. If you go to Shad. When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. Did you deposit it in the SAME bank twice or two different banks.

Source: youtube.com

Source: youtube.com

Use the same account you used on the second deposit to reverse it. You dont have to deposit into your bank account twice. Make sure you actually did mobile deposit the check 1st time then re-deposit it in person 2nd time. Deposited check twice accidentally under investigation for cheque fraud. They should have an image of the 2nd deposit on file.

Source: nerdwallet.com

Source: nerdwallet.com

While it may present a bit of a hassle for staffing companies you should rest assured that the liability does not lie with you in issuing the payroll check that was double deposited. Couldnt reach the plumber to see if it was an accident or fraud so I asked the banker to put a stop payment on it. We call this bank as the collecting bank and also the presenting bank. Thats the scary part. Staffing agencies payroll agencies or PEOs who issue a twice-cashed check are sometimes asked to make good on the same payment twice.

Source: getrichslowly.org

Source: getrichslowly.org

I dont know why they didnt call me first. When the same check is deposited twice at the same financial institution its likely to be caught and rejected by the bank. While it may present a bit of a hassle for staffing companies you should rest assured that the liability does not lie with you in issuing the payroll check that was double deposited. Most banks are good at catching double presentment if its attempted at the same banking institution through the same device for example the same check deposited twice over the same. You have told them about it and they will probably fix it as soon as they figure it out.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title depositing same check twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.