Can you file a tax extension twice.

If you’re searching for can you file a tax extension twice images information connected with to the can you file a tax extension twice keyword, you have visit the right blog. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

0y7n Zwpfal9fm From

0y7n Zwpfal9fm From

If you file a tax extension it will further delay your full payment. The last tax year started on 6 April 2020 and ended on 5 April 2021. Taxpayers may file additional tax return documents for multiple past tax returns. An extension moves the filing deadline from Tax Day to October 15 but it doesnt give you extra time to pay taxes you might owe on that return.

An extension does not give you more time to pay.

However until you file a 2020 tax return the IRS wont have your new income or dependent information on file. However until you file a 2020 tax return the IRS wont have your new income or dependent information on file. You could request a second extension of time to file your income tax return with the IRS up until 2005. If you file a tax extension it will further delay your full payment. According to TurboTax you can even amend a return that you have amended in the past.

Source: toptaxdefenders.com

Source: toptaxdefenders.com

Taxpayers may file additional tax return documents for multiple past tax returns. They can also make extension payments electronically at wwwAZTaxesgov. Once you file an extension you will have until. 5 This isnt the case anymore but the amount of extra time you get works out to be the same that it used to be. Companies that are eligible and cite issues around COVID-19 in their application will.

If youre racing to make the April 18 tax deadline but cant get to them on time relax.

If not you can check with your state tax authority to find out. Getting an extension to file your taxes is pretty simple. May 6 2019 - Explore Tax Office Associatess board Tax Extensions on Pinterest. See more ideas about tax extension tax filing taxes.

Source: in.pinterest.com

Source: in.pinterest.com

If youre racing to make the April 18 tax deadline but cant get to them on time relax. You can file Form 4868 on your. According to TurboTax you can even amend a return that you have amended in the past. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

Source: pinterest.com

Source: pinterest.com

According to TurboTax you can even amend a return that you have amended in the past. Some of the services in the IRS Free File program should handle that as well. The difference is that you only have to ask once these days rather than twice. If youre racing to make the April 18 tax deadline but cant get to them on time relax.

Source: cnet.com

Source: cnet.com

Form 7004 - Multiple Extensions Filed in the Same Tax Year part of E-File A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically. Updated May 31 2021. An extension of time to file your return does not grant you any extension of time to pay your taxes. If not you can check with your state tax authority to find out.

An extension moves the filing deadline from Tax Day to October 15 but it doesnt give you extra time to pay taxes you might owe on that return. Filing two federal tax returns. Individuals making tax payments with their extension requests must use Form 204 to ensure proper credit to their accounts. Companies that are eligible and cite issues around COVID-19 in their application will.

Taxpayers may file additional tax return documents for multiple past tax returns.

Filing two federal tax returns. The federal government has moved the tax filing deadline from. Getting an extension to file your taxes is pretty simple. Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file. Some of the services in the IRS Free File program should handle that as well.

Source: toptaxdefenders.com

Source: toptaxdefenders.com

E-file Your Extension Form for Free. Dont forget to make a payment with your extension if you think you will owe tax. Sometimes people unintentionally file their tax returns twice. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. May 6 2019 - Explore Tax Office Associatess board Tax Extensions on Pinterest.

Individuals making tax payments with their extension requests must use Form 204 to ensure proper credit to their accounts. Sometimes people unintentionally file their tax returns twice. An extension does not give you more time to pay. Getting an extension to file your taxes is pretty simple.

They can also make extension payments electronically at wwwAZTaxesgov.

Dont forget to make a payment with your extension if you think you will owe tax. An extension does not give you more time to pay. The Old Procedure vs. An extension moves the filing deadline from Tax Day to October 15 but it doesnt give you extra time to pay taxes you might owe on that return.

Source: pinterest.com

Source: pinterest.com

E-file Your Extension Form for Free. The difference is that you only have to ask once these days rather than twice. May 6 2019 - Explore Tax Office Associatess board Tax Extensions on Pinterest. You could request a second extension of time to file your income tax return with the IRS up until 2005.

Source: in.pinterest.com

Source: in.pinterest.com

May 6 2019 - Explore Tax Office Associatess board Tax Extensions on Pinterest. While you can print and mail Form 4868 its recommended to e-file the form since you need to file this form by April 15. An extension of time to file your return does not grant you any extension of time to pay your taxes. The federal government has moved the tax filing deadline from.

Source:

Source:

The tax extension deadline for 2020 returns is the same date as the regular tax deadline. The difference is that you only have to ask once these days rather than twice. Let the IRS know you want the extension says Scholl. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

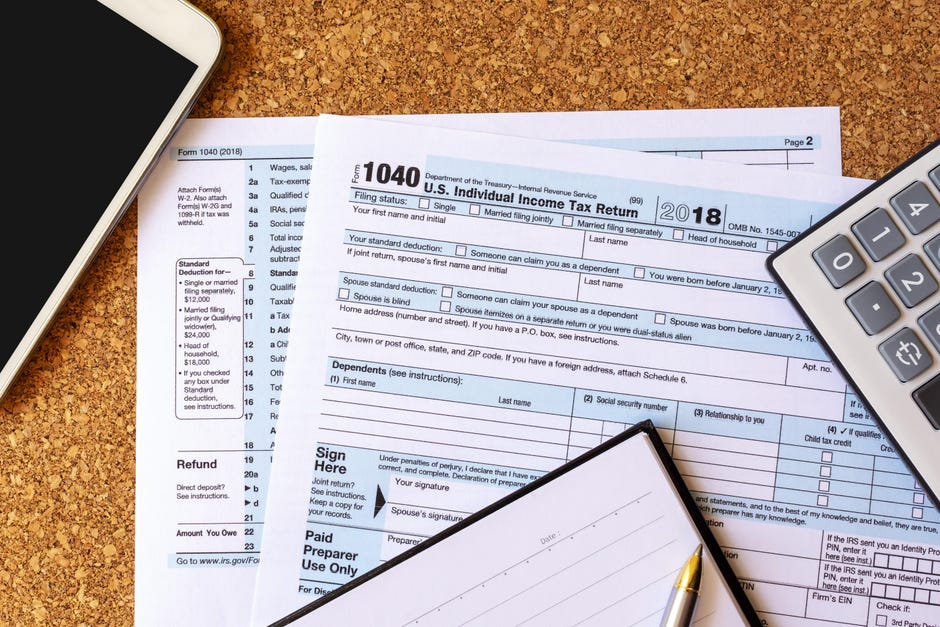

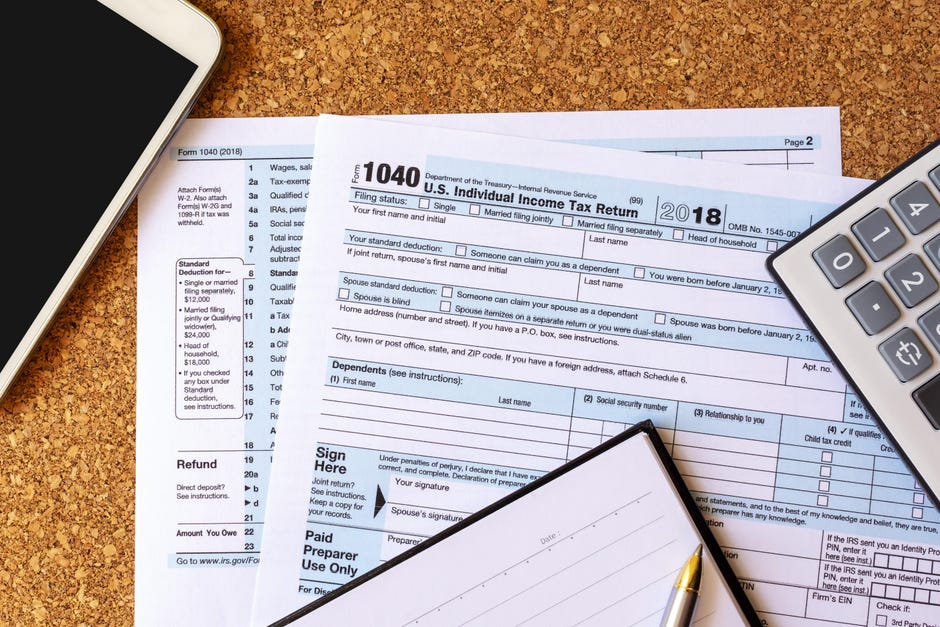

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service IRS to give you additional time to file your personal tax return.

See more ideas about tax extension tax filing taxes. 5 This isnt the case anymore but the amount of extra time you get works out to be the same that it used to be. To qualify for a federal tax extension you must file the appropriate forms by the standard tax filing. While you can print and mail Form 4868 its recommended to e-file the form since you need to file this form by April 15. Let the IRS know you want the extension says Scholl.

Source: pinterest.com

Source: pinterest.com

If you put off paying tax you owe you could end up paying penalties and interest. Companies that are eligible and cite issues around COVID-19 in their application will. Theres usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on. The difference is that you only have to ask once these days rather than twice. Let the IRS know you want the extension says Scholl.

However until you file a 2020 tax return the IRS wont have your new income or dependent information on file.

If you need more time to file your accounts you may be able to apply for a 3-month extension. While you can print and mail Form 4868 its recommended to e-file the form since you need to file this form by April 15. If youre racing to make the April 18 tax deadline but cant get to them on time relax. See more ideas about tax extension tax filing taxes.

Source: pinterest.com

Source: pinterest.com

See more ideas about tax extension tax filing taxes. They can also make extension payments electronically at wwwAZTaxesgov. Companies that are eligible and cite issues around COVID-19 in their application will. Form 7004 - Multiple Extensions Filed in the Same Tax Year part of E-File A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically.

Source: cnet.com

Source: cnet.com

Form 7004 - Multiple Extensions Filed in the Same Tax Year part of E-File A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically. The difference is that you only have to ask once these days rather than twice. Theres usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on. If you file a tax extension it will further delay your full payment.

Source: pinterest.com

Source: pinterest.com

An extension of time to file your return does not grant you any extension of time to pay your taxes. Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file. Sometimes people unintentionally file their tax returns twice. Getting an extension of time to file your federal tax return is truly automatic by just taking a simple step.

How to file tax extensionHow to fill out form 4868What is IRS form 4868taxextensionThe deadlines for individuals to file and pay most federal income taxe.

An extension does not give you more time to pay. If you put off paying tax you owe you could end up paying penalties and interest. How to file tax extensionHow to fill out form 4868What is IRS form 4868taxextensionThe deadlines for individuals to file and pay most federal income taxe. An extension does not give you more time to pay. 5 This isnt the case anymore but the amount of extra time you get works out to be the same that it used to be.

Source:

Source:

Form 7004 - Multiple Extensions Filed in the Same Tax Year part of E-File A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically. Tax forms and submission can be confusing for many people. The difference is that you only have to ask once these days rather than twice. Some of the services in the IRS Free File program should handle that as well. The tax extension deadline for 2020 returns is the same date as the regular tax deadline.

See more ideas about tax extension tax filing taxes.

For instance if you qualify for a tax credit that you forgot to take on past returns you may benefit from amending all of your returns that are less than three years old. An extension moves the filing deadline from Tax Day to October 15 but it doesnt give you extra time to pay taxes you might owe on that return. The difference is that you only have to ask once these days rather than twice. While you can print and mail Form 4868 its recommended to e-file the form since you need to file this form by April 15.

Source: toptaxdefenders.com

Source: toptaxdefenders.com

Taxpayers may file additional tax return documents for multiple past tax returns. Dont forget to make a payment with your extension if you think you will owe tax. See more ideas about tax extension tax filing taxes. 5 This isnt the case anymore but the amount of extra time you get works out to be the same that it used to be. Once you file an extension you will have until.

Source: hrblock.com

Source: hrblock.com

Theres usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on. If not you can check with your state tax authority to find out. The Old Procedure vs. However until you file a 2020 tax return the IRS wont have your new income or dependent information on file. Individuals making tax payments with their extension requests must use Form 204 to ensure proper credit to their accounts.

Source: pinterest.com

Source: pinterest.com

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service IRS to give you additional time to file your personal tax return. The Old Procedure vs. Theres usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on. Getting an extension to file your taxes is pretty simple. Some of the services in the IRS Free File program should handle that as well.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you file a tax extension twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.