Can you claim bankruptcy twice in canada.

If you’re searching for can you claim bankruptcy twice in canada images information connected with to the can you claim bankruptcy twice in canada topic, you have visit the right blog. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

The Cost Of Filing For Bankruptcy A Second Time In Canada Loans Canada From loanscanada.ca

The Cost Of Filing For Bankruptcy A Second Time In Canada Loans Canada From loanscanada.ca

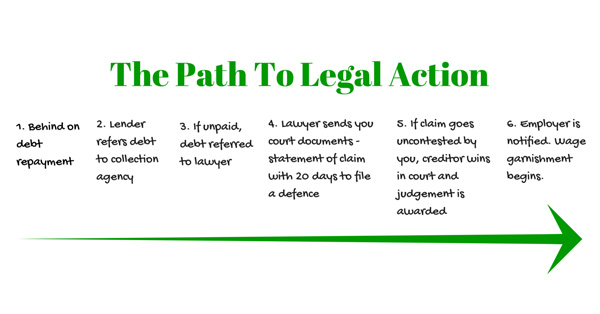

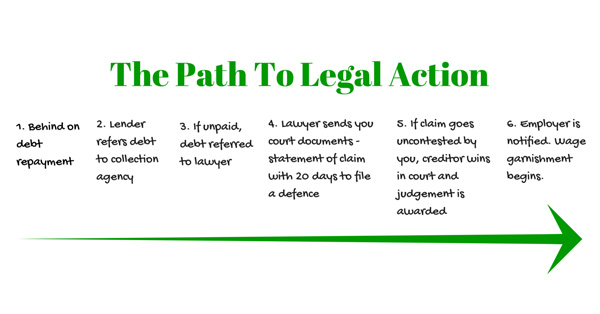

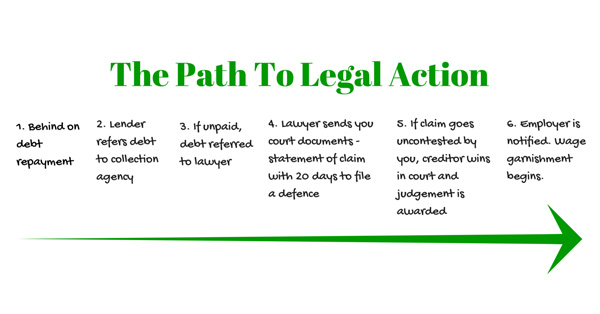

As long as you. Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer. The process is the exact same as your first time except that it takes longer to be discharged from bankruptcy. Better to explore other less unfavorable costly and far-reaching alternatives such as considering a consumer proposal in Ontario.

As such its always a good idea to sidestep a second bankruptcy if at all possible.

You may or may not be able to get credit during bankruptcy. The bankruptcy remains on your credit score for six years after your discharge. The major credit reporting agencies in Canada generally report a first bankruptcy for six or seven years after the date of discharge. As you could likely decipher from the breakdown in the last section a first bankruptcy lasts a minimum of 9 months and a second will last a minimum of 24 months. One of the biggest bankruptcy myths in Canada is that anyone can declare bankruptcy.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

With a second bankruptcy you will not qualify for an automatic bankruptcy discharge in nine months. But thats not always the case. What Happens To My Debt When I Claim Bankruptcy in Canada. No one is ever required to give you credit. The sooner you can accept your financial struggles the sooner you can begin your bankruptcy claim.

Consumer debt results in bankruptcy due to many causes but the outcome is similar to each individual who undergoes bankruptcyIf you are discharged from bankruptcy you can eradicate your unsecured debts and start building a better financial foundation.

In most situations you can file again and receive a discharge in the second bankruptcy if you didnt receive one in the first matter. The first step to declaring bankruptcy in Canada is recognizing and assessing your financial situation. No one is ever required to give you credit. A second bankruptcy can remain on your credit report for up to 14 years or twice as long as a first bankruptcy.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

One of the biggest bankruptcy myths in Canada is that anyone can declare bankruptcy. There is a common myth that if you declare bankruptcy all of your debts magically go awayNot only is this inaccurate but bankruptcy also may not be your best option for debt relief. One of the biggest bankruptcy myths in Canada is that anyone can declare bankruptcy. The first step to declaring bankruptcy in Canada is recognizing and assessing your financial situation.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

There is a common myth that if you declare bankruptcy all of your debts magically go awayNot only is this inaccurate but bankruptcy also may not be your best option for debt relief. Also you lose the full benefits of the automatic stay the order that stops creditors from collectingwhen you file multiple bankruptcies in quick succession. One of the biggest bankruptcy myths in Canada is that anyone can declare bankruptcy. Whether it does depends on the previous bankruptcy case you filed when you filed it and how the original case ended.

Source: hoyes.com

Source: hoyes.com

The first step to declaring bankruptcy in Canada is recognizing and assessing your financial situation. In most situations you can file again and receive a discharge in the second bankruptcy if you didnt receive one in the first matter. Bankruptcy will last from 24-36 months depending on. But thats not always the case.

Many Canadians actually find out that they cant file for bankruptcy because they have either too much income or too many assets. The process is the exact same as your first time except that it takes longer to be discharged from bankruptcy. The sooner you can accept your financial struggles the sooner you can begin your bankruptcy claim. Some debts cannot be discharged in bankruptcy.

With a second bankruptcy you will not qualify for an automatic bankruptcy discharge in nine months.

The major credit reporting agencies in Canada generally report a first bankruptcy for six or seven years after the date of discharge. The process is the exact same as your first time except that it takes longer to be discharged from bankruptcy. The Bankruptcy Code makes you ineligible for a second Chapter 7 discharge until after eight years from the petition date of your first Chapter 7 case. What Happens To My Debt When I Claim Bankruptcy in Canada. One of the biggest bankruptcy myths in Canada is that anyone can declare bankruptcy.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

As such its always a good idea to sidestep a second bankruptcy if at all possible. Legally speaking a person can file for bankruptcies as many times as they want. If they did file for bankruptcy it could be more expensive than repaying the debt. If you file for bankruptcy a second time it can remain on your credit score for up to 14 years after discharge. A Primer On The Benefits Of Bankruptcy.

The major credit reporting agencies in Canada generally report a first bankruptcy for six or seven years after the date of discharge. Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer. By Tom Drake on April 23 2020. No one is ever required to give you credit.

Generally bankruptcy law does not prohibit repeat bankruptcy filings.

This can have a. The bankruptcy remains on your credit score for six years after your discharge. However refiling might not bring you the benefits afforded by the bankruptcy law. To explore your options contact a local bankruptcy Ontario trustee today.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

A Primer On The Benefits Of Bankruptcy. As long as you. As such its always a good idea to sidestep a second bankruptcy if at all possible. Bankruptcy will last from 24-36 months depending on.

Source: hoyes.com

Source: hoyes.com

By Tom Drake on April 23 2020. The sooner you can accept your financial struggles the sooner you can begin your bankruptcy claim. A second bankruptcy can remain on your credit report for up to 14 years or twice as long as a first bankruptcy. Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer.

Source: bankruptcy-canada.com

Source: bankruptcy-canada.com

Whether it does depends on the previous bankruptcy case you filed when you filed it and how the original case ended. A second bankruptcy can remain on your credit report for up to 14 years or twice as long as a first bankruptcy. Better to explore other less unfavorable costly and far-reaching alternatives such as considering a consumer proposal in Ontario. Yes you can claim bankruptcy twice or for a second time.

If they did file for bankruptcy it could be more expensive than repaying the debt.

Many Canadians actually find out that they cant file for bankruptcy because they have either too much income or too many assets. A first time bankrupt is discharged 9 months after declaring bankruptcy while a second time bankrupt is discharged 24 months after declaring bankruptcy. The first step to declaring bankruptcy in Canada is recognizing and assessing your financial situation. As long as you. Better to explore other less unfavorable costly and far-reaching alternatives such as considering a consumer proposal in Ontario.

Source: hoyes.com

Source: hoyes.com

Also you lose the full benefits of the automatic stay the order that stops creditors from collectingwhen you file multiple bankruptcies in quick succession. There is a common myth that if you declare bankruptcy all of your debts magically go awayNot only is this inaccurate but bankruptcy also may not be your best option for debt relief. Many Canadians actually find out that they cant file for bankruptcy because they have either too much income or too many assets. Some debts cannot be discharged in bankruptcy. An interesting debt relief interview even says that only 10 of the clients who see a trustee can file for bankruptcy.

In most situations you can file again and receive a discharge in the second bankruptcy if you didnt receive one in the first matter.

What Happens To My Debt When I Claim Bankruptcy in Canada. Better to explore other less unfavorable costly and far-reaching alternatives such as considering a consumer proposal in Ontario. Legally speaking a person can file for bankruptcies as many times as they want. To explore your options contact a local bankruptcy Ontario trustee today.

Source: bankruptcy-canada.com

Source: bankruptcy-canada.com

Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer. Many Canadians actually find out that they cant file for bankruptcy because they have either too much income or too many assets. How Long Does a Second Bankruptcy Last in Canada. Legally speaking a person can file for bankruptcies as many times as they want.

Source: reddit.com

Source: reddit.com

No one is ever required to give you credit. This can have a. A second bankruptcy can remain on your credit report for up to 14 years or twice as long as a first bankruptcy. Wait eight years to file another Chapter 7.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

A Primer On The Benefits Of Bankruptcy. As such its always a good idea to sidestep a second bankruptcy if at all possible. The first step to declaring bankruptcy in Canada is recognizing and assessing your financial situation. An interesting debt relief interview even says that only 10 of the clients who see a trustee can file for bankruptcy.

You may or may not be able to get credit during bankruptcy.

Filing for personal bankruptcy starts with understanding your debt situation. The sooner you can accept your financial struggles the sooner you can begin your bankruptcy claim. As you could likely decipher from the breakdown in the last section a first bankruptcy lasts a minimum of 9 months and a second will last a minimum of 24 months. With a second bankruptcy you will not qualify for an automatic bankruptcy discharge in nine months. Legally speaking a person can file for bankruptcies as many times as they want.

Source: bankruptcycanada.com

Source: bankruptcycanada.com

The process is the exact same as your first time except that it takes longer to be discharged from bankruptcy. A second bankruptcy can remain on your credit report for up to 14 years or twice as long as a first bankruptcy. How Long Does a Second Bankruptcy Last in Canada. Also you lose the full benefits of the automatic stay the order that stops creditors from collectingwhen you file multiple bankruptcies in quick succession. Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer.

Generally bankruptcy law does not prohibit repeat bankruptcy filings.

In most situations you can file again and receive a discharge in the second bankruptcy if you didnt receive one in the first matter. To explore your options contact a local bankruptcy Ontario trustee today. Wait eight years to file another Chapter 7. No one is ever required to give you credit.

Source: hoyes.com

Source: hoyes.com

By Tom Drake on April 23 2020. There is a common myth that if you declare bankruptcy all of your debts magically go awayNot only is this inaccurate but bankruptcy also may not be your best option for debt relief. Wait eight years to file another Chapter 7. The major credit reporting agencies in Canada generally report a first bankruptcy for six or seven years after the date of discharge. Generally bankruptcy law does not prohibit repeat bankruptcy filings.

Source: bankruptcy-canada.com

Source: bankruptcy-canada.com

Bankruptcy will last from 24-36 months depending on. But thats not always the case. Consumer debt results in bankruptcy due to many causes but the outcome is similar to each individual who undergoes bankruptcyIf you are discharged from bankruptcy you can eradicate your unsecured debts and start building a better financial foundation. Many Canadians actually find out that they cant file for bankruptcy because they have either too much income or too many assets. To explore your options contact a local bankruptcy Ontario trustee today.

Source: bankruptcy-canada.com

Source: bankruptcy-canada.com

An interesting debt relief interview even says that only 10 of the clients who see a trustee can file for bankruptcy. Not only will your second time filing for bankruptcy be more expensive than the first the second bankruptcy actually lasts longer. Better to explore other less unfavorable costly and far-reaching alternatives such as considering a consumer proposal in Ontario. The sooner you can accept your financial struggles the sooner you can begin your bankruptcy claim. Generally bankruptcy law does not prohibit repeat bankruptcy filings.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can you claim bankruptcy twice in canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.