Can you borrow from 401k twice.

If you’re looking for can you borrow from 401k twice pictures information related to the can you borrow from 401k twice interest, you have pay a visit to the ideal site. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Why The Median 401 K Retirement Balance By Age Is Dangerously Low From financialsamurai.com

Why The Median 401 K Retirement Balance By Age Is Dangerously Low From financialsamurai.com

When you borrow money from your 401 k plan you can pay it back over five years. Can I borrow from 401k twice. Think twice or thrice before doing so though. Retirement plan loans are different from withdrawals and hardship distributions.

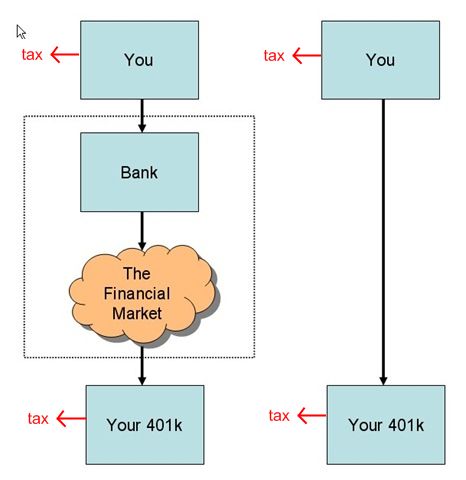

In other words the amount you borrow will be taxed twice.

First you need to understand the method of repayment. Is A 401k Loan Taxed Twice. This means they can borrow against 100000 or 100 of their account balance whichever is less. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. Borrow from the bank at a real interest rate of.

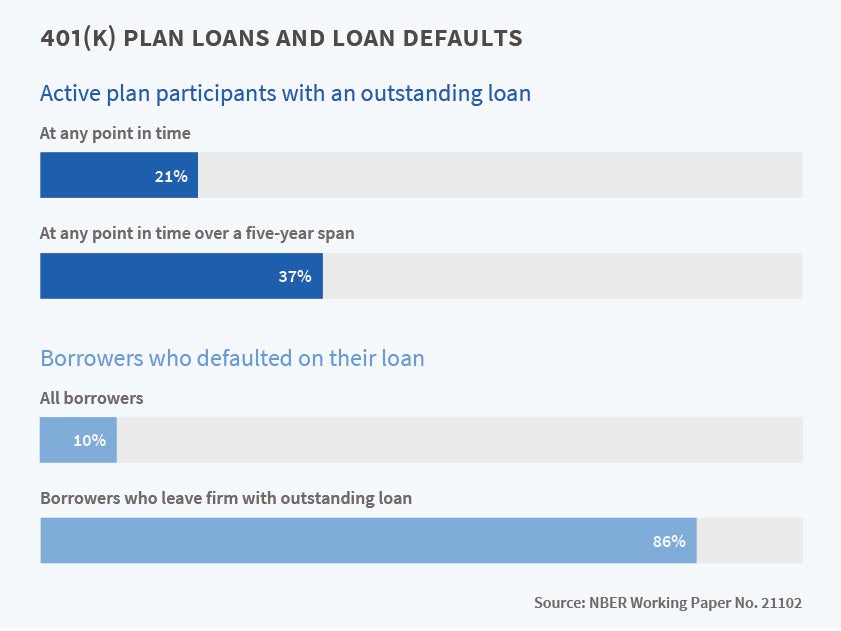

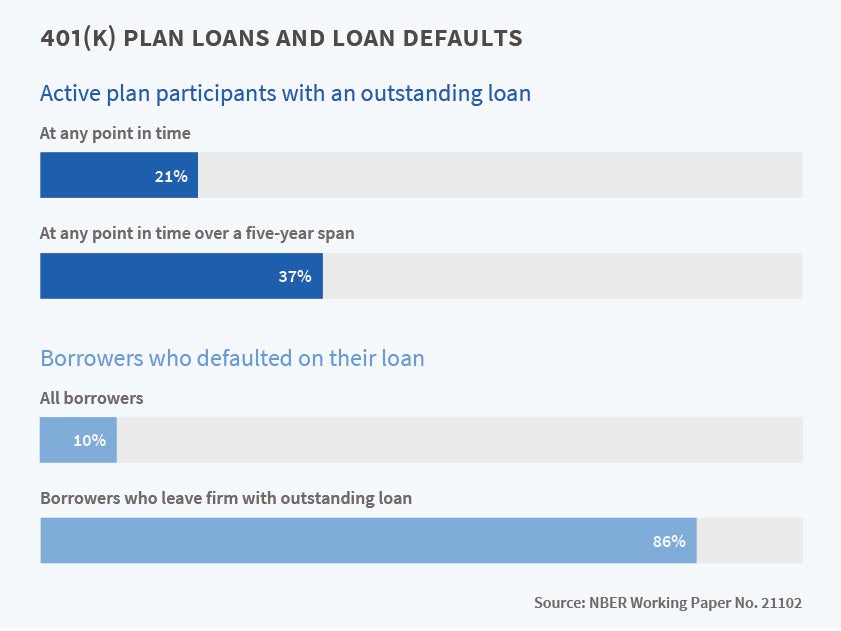

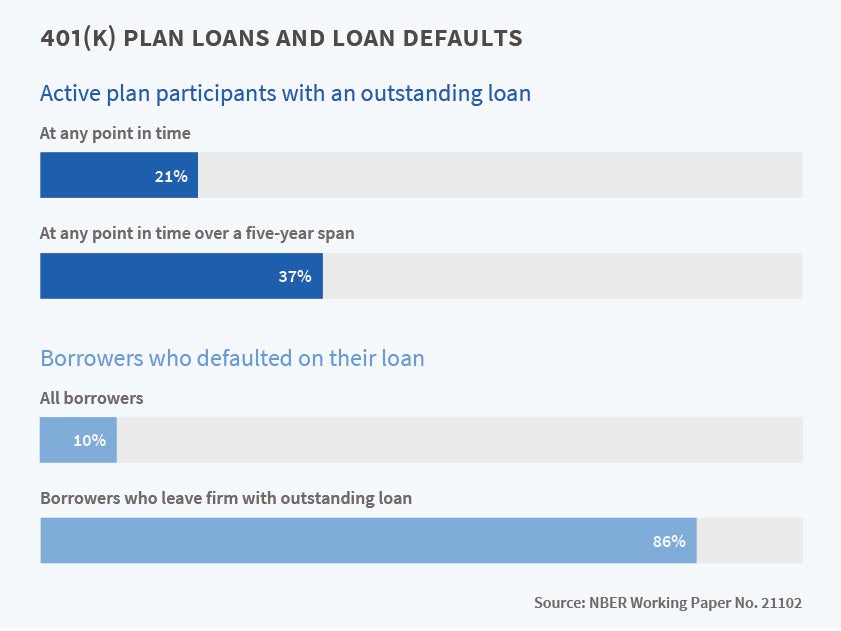

Source: nber.org

Source: nber.org

If youre like many Americans you borrowed from your 401k plan during the coronavirus pandemic. Borrowing limitations are placed on a 12-month period even if youve paid the amount back early. The taxation is exactly the same whether you. So yes you pay twice. Be sure to make both required payments though.

Borrowing from a 401 k is something that many people have considered and many.

And being twice taxed on interest from this kind of loan is likely to cost less than what it would cost to borrow money in another way. Can I borrow from 401k twice. Maximum 401k loan The maximum amount that you may take as a 401k loan is generally 50 of your vested account. If you have 200000 in your account youd only be able to borrow up to the maximum 50000.

The typical limits of 50000 or 50 of your account value. You repay your pre-tax 401-k with after-tax dollars. Is A 401k Loan Taxed Twice. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period.

Source: humaninvesting.com

Source: humaninvesting.com

Be sure to make both required payments though. Also never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period. With a 401 k loan you borrow money from your retirement savings account.

Source: thefinancebuff.com

Source: thefinancebuff.com

If you have 200000 in your account youd only be able to borrow up to the maximum 50000. You repay your pre-tax 401-k with after-tax dollars. Is A 401k Loan Taxed Twice. First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice.

When you borrow money from your 401 k plan you can pay it back over five years. Because you dont pay taxes on the money you put into a 401k when you pay back the loan which you must do within five years or 15 years if used to buy a home you pay it back with money you have paid taxes on. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period. At the time you take a 401 k plan loan you will not pay taxes on the amount you borrow if the loan meets certain criteria.

How many loans can you have out on your 401k.

Furthermore when you borrow money from a 401 k you must repay your loan within five years though some plans offer a longer repayment period if youre borrowing money to purchase a. Once as you repay the loan and then again when you withdraw it in retirement. Furthermore when you borrow money from a 401 k you must repay your loan within five years though some plans offer a longer repayment period if youre borrowing money to purchase a. You will be paying off the non-401k loan with after-tax income thats once and your earnings in your 401k you will have the dollars invested in something since you have not borrowed them will be tax at distribution thats twice. Borrowing limitations are placed on a 12-month period even if youve paid the amount back early.

Source: investopedia.com

Source: investopedia.com

When you borrow money from your 401 k plan you can pay it back over five years. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. Is A 401k Loan Taxed Twice. Be sure to make both required payments though. Furthermore when you borrow money from a 401 k you must repay your loan within five years though some plans offer a longer repayment period if youre borrowing money to purchase a.

First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice. You repay your pre-tax 401-k with after-tax dollars. With a 401 k loan you borrow money from your retirement savings account. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period.

I know that you are paying interest on yo.

Can I borrow from 401k twice. How many loans can you have out on your 401k. I know that you are paying interest on yo. The typical limits of 50000 or 50 of your account value.

Source: humaninvesting.com

Source: humaninvesting.com

Borrow from her 401 k at an interest rate of 4. You will be paying off the non-401k loan with after-tax income thats once and your earnings in your 401k you will have the dollars invested in something since you have not borrowed them will be tax at distribution thats twice. But in truth only the interest part of the repayment is treated that way. Borrowing limitations are placed on a 12-month period even if youve paid the amount back early.

Source: thefinancebuff.com

Source: thefinancebuff.com

Think twice or thrice before doing so though. How many loans can you have out on your 401k. Employees with 401k plans that allow loans can borrow twice as much as they could previously. Be sure to make both required payments though.

Source: nber.org

Source: nber.org

Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. How many loans can you have out on your 401k. As long as you dont exceed the maximum loan limits set by the IRS you can take out another 401k loan if your employer permits it. This means they can borrow against 100000 or 100 of their account balance whichever is less.

Can I borrow from 401k twice.

Maximum 401k loan The maximum amount that you may take as a 401k loan is generally 50 of your vested account. Borrowing from a 401 k is something that many people have considered and many. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. You will be paying off the non-401k loan with after-tax income thats once and your earnings in your 401k you will have the dollars invested in something since you have not borrowed them will be tax at distribution thats twice. So yes you pay twice.

Source: thefinancebuff.com

Source: thefinancebuff.com

Also never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Be sure to make both required payments though. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. In most cases youre allowed to borrow up to half of your account balance or 50000 whichever is less. But in truth only the interest part of the repayment is treated that way.

Maximum 401k loan The maximum amount that you may take as a 401k loan is generally 50 of your vested account.

If youre like many Americans you borrowed from your 401k plan during the coronavirus pandemic. The interest you pay goes back into your account. First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice. When you borrow money from your 401 k plan you can pay it back over five years.

The taxation is exactly the same whether you. If you have 200000 in your account youd only be able to borrow up to the maximum 50000. Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. First you need to understand the method of repayment.

Source: pinterest.com

Source: pinterest.com

First you need to understand the method of repayment. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period. The answer is no you do not pay any more taxes with a 401k loan than you would on any other type of loan. Because you dont pay taxes on the money you put into a 401k when you pay back the loan which you must do within five years or 15 years if used to buy a home you pay it back with money you have paid taxes on.

Source: thefinancebuff.com

Source: thefinancebuff.com

How many loans can you have out on your 401k. So if you have 40000 in your 401 k you should be able to borrow up to 20000. Think twice or thrice before doing so though. Be sure to make both required payments though.

The answer is no you do not pay any more taxes with a 401k loan than you would on any other type of loan.

But in truth only the interest part of the repayment is treated that way. Another myth is that when you borrow from your 401k you are being taxed twice because youre paying the loan back with after-tax money. At the time you take a 401 k plan loan you will not pay taxes on the amount you borrow if the loan meets certain criteria. Be sure to make both required payments though. Can I borrow from 401k twice.

Source: exchangecapital.com

Source: exchangecapital.com

Can I borrow from 401k twice. Be sure to make both required payments though. The IRS allows you to take a loan for half the vested value of your 401 k account or 50000 whichever amount is smaller. First you need to understand the method of repayment. As long as you dont exceed the maximum loan limits set by the IRS you can take out another 401k loan if your employer permits it.

Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

Once as you repay the loan and then again when you withdraw it in retirement. As long as you dont exceed the maximum loan limits set by the IRS you can take out another 401k loan if your employer permits it. So yes you pay twice. Well you might be tempted to borrow money from your 401 k.

Source: nber.org

Source: nber.org

So yes you pay twice. First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice. So if you have 40000 in your 401 k you should be able to borrow up to 20000. As long as you dont exceed the maximum loan limits set by the IRS you can take out another 401k loan if your employer permits it. Is A 401k Loan Taxed Twice.

Source: investopedia.com

Source: investopedia.com

This means they can borrow against 100000 or 100 of their account balance whichever is less. Borrowing limitations are placed on a 12-month period even if youve paid the amount back early. In most cases youre allowed to borrow up to half of your account balance or 50000 whichever is less. In other words the amount you borrow will be taxed twice. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

Thats twice the old limit of the lesser of 50000 or 50 of your balance. If you have 200000 in your account youd only be able to borrow up to the maximum 50000. Thats twice the old limit of the lesser of 50000 or 50 of your balance. This means they can borrow against 100000 or 100 of their account balance whichever is less. How many loans can you have out on your 401k.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you borrow from 401k twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.