Can i withdraw advance pf twice.

If you’re looking for can i withdraw advance pf twice pictures information related to the can i withdraw advance pf twice interest, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Epf Partial Withdrawals Advances Options Guidelines 2020 21 From relakhs.com

Epf Partial Withdrawals Advances Options Guidelines 2020 21 From relakhs.com

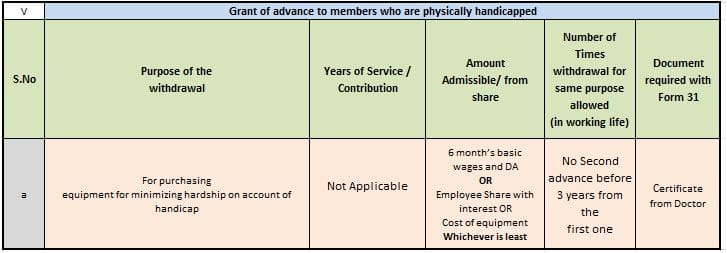

You can get your PF amount twice in a year only in the case of PF Settlement. READ ALSO EPFO update. There is no limit if EPF member withdraw PF for illness reason and for construction of house only 1 time and for the marriage 3 times and for higher education 3 times and for power cut only 1 time and for physically handicapped persons no 2nd advance will. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less.

How Many Times We Can Withdraw PF Advance Online in a Year.

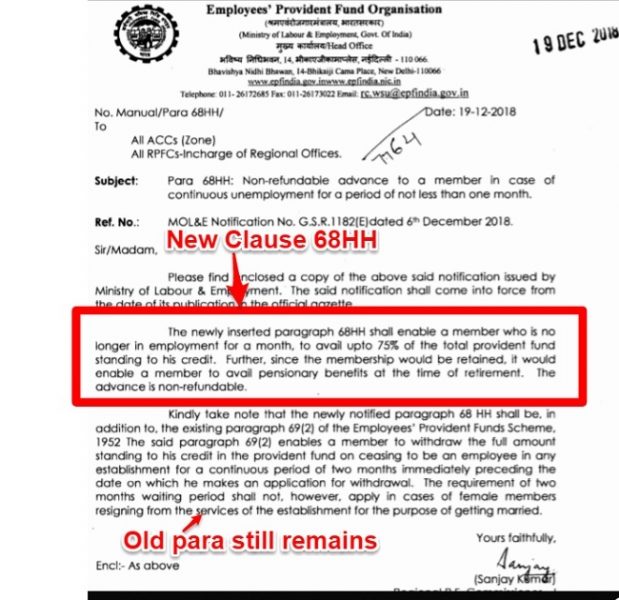

Click here for IndiaTodayins complete coverage of the coronavirus pandemic. Individuals allowed to withdraw 2nd Covid-19 advance from PF account Under the provision non-refundable withdrawal to the extent of the basic wages and dearness allowances for three months or up to 75 per cent of the amount standing to members credit in the EPF account whichever is less will be provided. The number of times that an EPF member can withdraw PF advance amount will vary with each reason of PF advance withdrawal. PF can be withdrawn maximum 23 times during service period on non-refundable basis. EPFO members can now withdraw up to 75 of the PF balances limited to 3 months wages as non refundable advance.

Source: basunivesh.com

Source: basunivesh.com

How Many Times We Can Withdraw PF Advance Online in a Year. EPF Partial Withdrawals should be your last resort. The asset land or house should be registered in your name your spouses or it could be a joint holding. How many Time Withdraw Advance PF. EPFO allows members second Covid advance withdrawal The labour ministry has announced that EPF members can now avail a second non-refundable advance from their EPF accounts in order to meet the coronavirus related financial emergencies.

With new relaxations EPF members can now withdraw either 75 of their PF balance or three months wages as non-refundable advance whichever is less.

If the employer approves the withdrawal request within the designated time the amount will be credited to your account in 15-20 days. The EPF has a facility to withdraw the contribution in advance. Withdraw Advance PF 2 Time Under 6 MonthHelp This Channel Use this Link to Buy anything from AmazonSuper. If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

EPF Partial Withdrawals should be your last resort. As of now the. How many Time Withdraw Advance PF. Members who have already availed the first COVID-19 advance can now opt for a second advance also.

Source: basunivesh.com

Source: basunivesh.com

EPF Advance Partial withdrawal from the fund for repayment of loans in special cases. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house. Members who have already availed the first COVID-19 advance can now opt for a second advance also.

Source: relakhs.com

Source: relakhs.com

Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account. EPF Advance Partial withdrawal from the fund for repayment of loans in special cases. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. The asset land or house should be registered in your name your spouses or it could be a joint holding.

How many Time Withdraw Advance PF. A person can apply for advance withdrawal if the individual has been a member of the EPFO for a minimum of five years. So think twice before you withdraw your PF money. If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

Earlier only a one-time advance was available for EPF members. Try out all the options and sources to fund your expenses or needs. PF can be withdrawn maximum 23 times during service period on non-refundable basis. The EPF has a facility to withdraw the contribution in advance. If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

Source: bemoneyaware.com

Source: bemoneyaware.com

Earlier only a one-time advance was available for EPF members. An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house. The withdrawal conditions are. As of now the. However one can borrow from PF account maximum six months gross pay on refundable basis through out service tenure.

An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house. Advance withdrawal is possible on only the PF and not on the pension or EDLI. How many Time Withdraw Advance PF. EPF Partial Withdrawals should be your last resort.

In this case the PF amount will be fully transferred to your bank account.

There should be a minimum gap of 6 months between two loans. Advance withdrawal is possible on only the PF and not on the pension or EDLI. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. How many Time Withdraw Advance PF.

The asset land or house should be registered in your name your spouses or it could be a joint holding. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. EPFO members can now withdraw up to 75 of the PF balances limited to 3 months wages as non refundable advance. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less.

Source: relakhs.com

Source: relakhs.com

PF can be withdrawn maximum 23 times during service period on non-refundable basis. You should have completed a minimum of 5 years in service. You can get your PF amount twice in a year only in the case of PF Settlement. Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account.

Source: relakhs.com

Source: relakhs.com

You can get your PF amount twice in a year only in the case of PF Settlement. Under this reason employees can withdraw PF advance only once and the amount is also 75 of employee employer contribution or last 3 months basic wage DA whichever is less. Yes as there are no such regulations in the PF guidelines. Try out all the options and sources to fund your expenses or needs.

In such trying times EPFO endeavours to lend a helping hand to its members by meeting their financial needs.

You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. So think twice before you withdraw your PF money. READ ALSO EPFO update. The asset land or house should be registered in your name your spouses or it could be a joint holding.

Source: basunivesh.com

Source: basunivesh.com

READ ALSO EPFO update. The withdrawal conditions are. Click here for IndiaTodayins complete coverage of the coronavirus pandemic. PF can be withdrawn maximum 23 times during service period on non-refundable basis. If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

A person can apply for advance withdrawal if the individual has been a member of the EPFO for a minimum of five years.

How Many Times We Can Withdraw PF Advance Online in a Year. An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house. How many Time Withdraw Advance PF. Earlier only a one-time advance was available for EPF members.

Source: basunivesh.com

Source: basunivesh.com

Advance withdrawal is possible on only the PF and not on the pension or EDLI. You should have completed a minimum of 5 years in service. You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. Withdraw Advance PF 2 Time Under 6 MonthHelp This Channel Use this Link to Buy anything from AmazonSuper.

Source: relakhs.com

Source: relakhs.com

The EPF has a facility to withdraw the contribution in advance. You can avail this facility twice once five years after the completion of the house and then 10 years after the completion of the house. In this case the PF amount will be fully transferred to your bank account. An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house.

Source: bemoneyaware.com

Source: bemoneyaware.com

Individuals allowed to withdraw 2nd Covid-19 advance from PF account Under the provision non-refundable withdrawal to the extent of the basic wages and dearness allowances for three months or up to 75 per cent of the amount standing to members credit in the EPF account whichever is less will be provided. Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account. PF can be withdrawn maximum 23 times during service period on non-refundable basis. However one can borrow from PF account maximum six months gross pay on refundable basis through out service tenure.

Latest Update 26-March-2020.

Try out all the options and sources to fund your expenses or needs. You can avail this facility twice once five years after the completion of the house and then 10 years after the completion of the house. Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account. In this case the PF amount will be fully transferred to your bank account. EPF Partial Withdrawals should be your last resort.

Source: bemoneyaware.com

Source: bemoneyaware.com

You should have completed a minimum of 5 years in service. As it is commonly mistaken that it is a loan but it is only an advance withdrew and not a loan. EPFO recently added this. She also stated that for the next three months the government will pay the EPF contribution of both the employee and the employer which comes around 24 of the employees basic salary. Click here for IndiaTodayins complete coverage of the coronavirus pandemic.

Withdraw Advance PF 2 Time Under 6 MonthHelp This Channel Use this Link to Buy anything from AmazonSuper.

The EPF has a facility to withdraw the contribution in advance. Members who have already availed the first COVID-19 advance can now opt for a second advance also. Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account. Earlier only a one-time advance was available for EPF members.

Source: basunivesh.com

Source: basunivesh.com

If the employer approves the withdrawal request within the designated time the amount will be credited to your account in 15-20 days. In such trying times EPFO endeavours to lend a helping hand to its members by meeting their financial needs. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. EPFO allows members second Covid advance withdrawal The labour ministry has announced that EPF members can now avail a second non-refundable advance from their EPF accounts in order to meet the coronavirus related financial emergencies. EPFO members can now withdraw up to 75 of the PF balances limited to 3 months wages as non refundable advance.

The withdrawal conditions are. There should be a minimum gap of 6 months between two loans. EPFO recently added this. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. The withdrawal conditions are.

A person can apply for advance withdrawal if the individual has been a member of the EPFO for a minimum of five years. As of now the. Now EPF members can withdraw their PF advance amounts from previous PF account without transferring them to the present PF account. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. If you have already taken PF advance amount under the outbreak of pandemic COVID 19 reason then next time you cant use the same reason for PF advance claim but you can withdraw your PF advance amount.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i withdraw advance pf twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.