Can i claim solar tax credit twice.

If you’re searching for can i claim solar tax credit twice images information related to the can i claim solar tax credit twice interest, you have pay a visit to the right blog. Our website frequently provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Solar And Wind Tax Credits Extended Again Tax Equity Times From taxequitytimes.com

Solar And Wind Tax Credits Extended Again Tax Equity Times From taxequitytimes.com

Jul 7 2017. However it cant technically be claimed under the residential solar tax credit. Instead generally you can carry the credit over to the following tax year. If you own more than one home with solar you may be eligible.

You are also eligible even if the solar energy system is not on your primary residence as long as you own the property and live in it for part of the year you can claim the solar tax credit.

Can I claim the tax. Do i qualify if i bought a property with solar. Credit not used in one year can be carried forward into the next years taxesEnergy Efficiency tax credits for homeowners were to expire in 2010 but were extended with a few changes. I was wondering how many times I can claim the solar tax credit. However it cant technically be claimed under the residential solar tax credit.

Source: visual.ly

Source: visual.ly

Filing requirements for solar credits If you end up with a bigger credit than you have income tax duea 3000 credit on a 2500 tax bill for instanceyou cant use the credit to get money back from the IRS. These are clearly explained on various government sites that list tax credit and how to apply for themThere ar. Watch out a lot more about itIn respect to this can you claim the solar tax credit more than once. 10000 system cost x 026 26 credit 2600 credit amount 2600 credit amount x 025 25 of the year 650 credit amount. Yes you can claim the tax credit on an investment property that you own and rent.

Can I claim the tax.

Can you claim the solar tax credit twice. Can you claim solar tax credit twicecan you claim solar tax credit twice - httpsrebrandly9grkg - There are lots of motivations for adding solar to your. More than twice as many solar installations occurred in 2019 than in 2018. If you live there for three months a year for instance you can only claim 25 of the credit.

Source: gosolargroup.com

Source: gosolargroup.com

In this case contact your tax professional to find out more. Do i qualify if i bought a property with solar. Can I still get a tax credit for a home improvement installed 2. For example suppose that I already claimed the 30 tax credit for a solar system that I installed.

Source: pinterest.com

Source: pinterest.com

Do i qualify if i bought a property with solar. As of 2021 the tax credit covers 26 percent. You are also eligible even if the solar energy system is not on your primary residence as long as you own the property and live in it for part of the year you can claim the solar tax credit. In this case contact your tax professional to find out more.

Source: in.pinterest.com

Source: in.pinterest.com

However you can carry over any unused amount of the credit to the next tax year for up to five years. If your federal tax liability is lower than the total amount of your ITC savings you can still take advantage of it by carrying over any remaining credits to the following year. The short answer is yes. If you own more than one home with solar you may be eligible.

Can you claim the solar tax credit twice. Would it make more sense to buy one in 2017 another in 2018 if that credit is not removed by congress. Now I want to upgrade the system adding a couple of more panels. However it cant technically be claimed under the residential solar tax credit.

Jul 7 2017.

Can you claim solar tax credit twicecan you claim solar tax credit twice - httpsrebrandly9grkg - There are lots of motivations for adding solar to your. Can you claim solar tax credit twice. You cannot technically claim the solar tax credit twice if you own a home. As of 2021 the tax credit covers 26 percent. A great number of people throughout Australia are taking advantage of the federal governments Solar Credit scheme which offers financial incentives for solar power installations on their homesMany people are also wondering if they can get additional Solar Credits for a second or third installation on the same propertylike on the roof of a granny flat.

Source: gosolargroup.com

Source: gosolargroup.com

Credit not used in one year can be carried forward into the next years taxesEnergy Efficiency tax credits for homeowners were to expire in 2010 but were extended with a few changes. Can you claim the solar tax credit twice. The federal solar investment tax credit itc is a tax credit that can be claimed on federal income taxes. Instead generally you can carry the credit over to the following tax year. Can you claim solar tax credit twice.

If you own more than one home with solar you may be eligible. However you can carry over any unused amount of the credit to the next tax year for up to five years. Keep in mind that even though you can claim multiple credits you also have to have enough tax liability to get the full amount. However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may be difficult to claim due.

There are actually two federal solar tax credits.

If the system cost 10000 the 26 credit would be 2600 and you could claim 25 of that or 650. However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may be difficult to claim due. Credit not used in one year can be carried forward into the next years taxesEnergy Efficiency tax credits for homeowners were to expire in 2010 but were extended with a few changes. The tax credits are for any qualifying solar systems placed at.

Source: gosolargroup.com

Source: gosolargroup.com

Would it make more sense to buy one in 2017 another in 2018 if that credit is not removed by congress. In this case contact your tax professional to find out more. Filing requirements for solar credits If you end up with a bigger credit than you have income tax duea 3000 credit on a 2500 tax bill for instanceyou cant use the credit to get money back from the IRS. Can you claim solar tax credit twice.

Source: sec.gov

Source: sec.gov

Meet The Team Borrower Loan Portal Log In You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have income tax liability which is what this incentive reduces Note if your 26 tax credit is 6000 total and you only have 5000 in personal income taxes one year you can rollover the remaining 1000 credit to your next years. Yes you can claim the tax credit on an investment property that you own and rent. On line 13 simply restate this amount unless you are adding any tax credits carried over from the previous year or the fuel cell tax credit lines 11 and 12. Jul 7 2017.

Source: ieefa.org

Source: ieefa.org

Filing requirements for solar credits If you end up with a bigger credit than you have income tax duea 3000 credit on a 2500 tax bill for instanceyou cant use the credit to get money back from the IRS. Generally homeowners can only claim one tax credit per solar system. You cannot technically claim the solar tax credit twice if you own a home. On line 13 simply restate this amount unless you are adding any tax credits carried over from the previous year or the fuel cell tax credit lines 11 and 12.

Can you claim the solar tax credit twice.

However you can carry over any unused amount of the credit to the next tax year for up to five years. It might be possible to claim the credit again if you install panels on another. At the time of this writing you can get up to 26 of your installation costs back by claiming the tax credit when you file with the IRS. The IRS states in Questions 25 and 26 in its QA on Tax Credits that off-site solar panels or solar panels that are not directly on the taxpayers home could still qualify for the residential federal solar tax credit under some circumstances. However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may be difficult to claim due.

Source: pinterest.com

Source: pinterest.com

Can You Claim Solar Tax Credit Twice. Can you claim solar tax credit twice. A complete system in place or service after january 1 2006 and in if you do not have enough tax liability to claim the entire credit in one year you can roll over the remaining credits into future years for as long as the tax credit is in effect. If the system cost 10000 the 26 credit would be 2600 and you could claim 25 of that or 650. Getting the maximum california solar tax credit and incentives is better than receiving a lower amount.

Getting the maximum california solar tax credit and incentives is better than receiving a lower amount.

You are also eligible even if the solar energy system is not on your primary residence as long as you own the property and live in it for part of the year you can claim the solar tax credit. I was wondering how many times I can claim the solar tax credit. Can you claim solar tax credit twicecan you claim solar tax credit twice - httpsrebrandly9grkg - There are lots of motivations for adding solar to your. The federal solar investment tax credit itc is a tax credit that can be claimed on federal income taxes.

Source: sec.gov

Source: sec.gov

The answer on the question above is - it depends on the tax credit. Credit not used in one year can be carried forward into the next years taxesEnergy Efficiency tax credits for homeowners were to expire in 2010 but were extended with a few changes. Can You Claim Solar Tax Credit Twice. However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may be difficult to claim due.

Source: pinterest.com

Source: pinterest.com

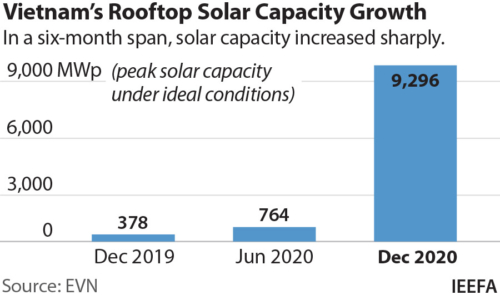

Meet The Team Borrower Loan Portal Log In You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have income tax liability which is what this incentive reduces Note if your 26 tax credit is 6000 total and you only have 5000 in personal income taxes one year you can rollover the remaining 1000 credit to your next years. The answer on the question above is - it depends on the tax credit. The federal solar investment tax credit itc is a tax credit that can be claimed on federal income taxes. More than twice as many solar installations occurred in 2019 than in 2018.

Source: gosolargroup.com

Source: gosolargroup.com

Would it make more sense to buy one in 2017 another in 2018 if that credit is not removed by congress. A great number of people throughout Australia are taking advantage of the federal governments Solar Credit scheme which offers financial incentives for solar power installations on their homesMany people are also wondering if they can get additional Solar Credits for a second or third installation on the same propertylike on the roof of a granny flat. However it cant technically be claimed under the residential solar tax credit. Can you claim the solar tax credit twice.

If you are unable to claim the entire 30 of your purchase for the above products in one year you can carry forward the unclaimed portion to future years.

The federal solar tax credit also known as the Solar Investment Tax Credit or ITC is the single most important solar incentive available in. The federal solar investment tax credit itc is a tax credit that can be claimed on federal income taxes. Can I claim the tax. It doesnt do you any good to claim 15K worth of credits against only a 10K tax liability youd be leaving 5K on the table. Getting the maximum california solar tax credit and incentives is better than receiving a lower amount.

Source: visual.ly

Source: visual.ly

I was wondering how many times I can claim the solar tax credit. If your federal tax liability is lower than the total amount of your ITC savings you can still take advantage of it by carrying over any remaining credits to the following year. It might be possible to claim the credit again if you install panels on another. Instead generally you can carry the credit over to the following tax year. Can I still get a tax credit for a home improvement installed 2.

Do i qualify if i bought a property with solar.

However it cant technically be claimed under the residential solar tax credit. Meet The Team Borrower Loan Portal Log In You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have income tax liability which is what this incentive reduces Note if your 26 tax credit is 6000 total and you only have 5000 in personal income taxes one year you can rollover the remaining 1000 credit to your next years. There are actually two federal solar tax credits. The short answer is yes.

Source: visual.ly

Source: visual.ly

Filing requirements for solar credits If you end up with a bigger credit than you have income tax duea 3000 credit on a 2500 tax bill for instanceyou cant use the credit to get money back from the IRS. Do i qualify if i bought a property with solar. Yes you can claim the tax credit on an investment property that you own and rent. More than twice as many solar installations occurred in 2019 than in 2018. The short answer is yes.

Source: sec.gov

Source: sec.gov

Can You Claim Solar Tax Credit Twice. There are actually two federal solar tax credits. Many residential home solar power systems are eligible for a federal investment tax credit or ITC. You cannot technically claim the solar tax credit twice if you own a home. Can you claim solar tax credit twice.

Source: sec.gov

Source: sec.gov

Do i qualify if i bought a property with solar. The tax credits are for any qualifying solar systems placed at. If you live there for three months a year for instance you can only claim 25 of the credit. As of 2021 the tax credit covers 26 percent. There are actually two federal solar tax credits.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i claim solar tax credit twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.