Can i claim car insurance twice in a year.

If you’re looking for can i claim car insurance twice in a year images information related to the can i claim car insurance twice in a year keyword, you have pay a visit to the ideal site. Our site always gives you hints for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

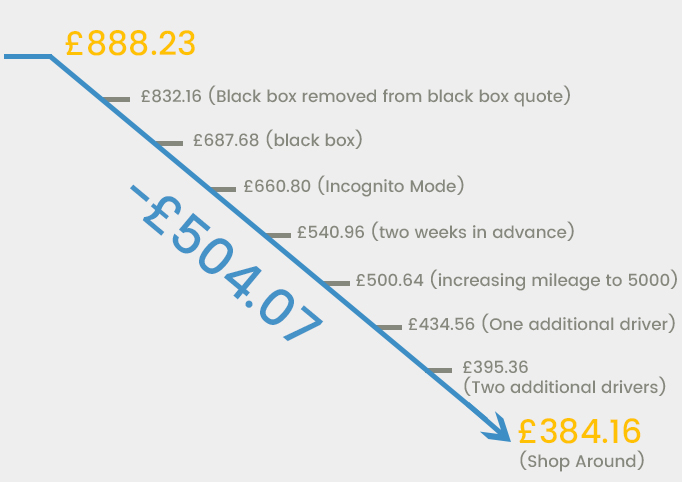

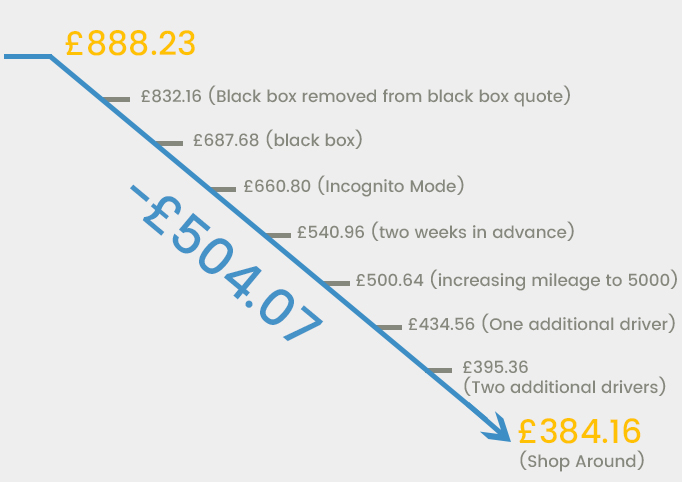

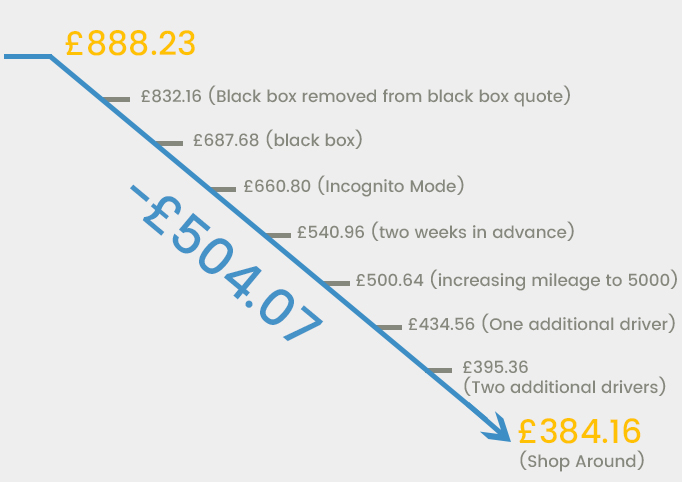

8 Simple Steps Reduced My Car Insurance By 57 In Only 20 Minutes Automotive News By Abd Co Uk From autobulbsdirect.co.uk

8 Simple Steps Reduced My Car Insurance By 57 In Only 20 Minutes Automotive News By Abd Co Uk From autobulbsdirect.co.uk

Ad We Dont Just Compare We Cut Prices To Get Better Car Insurance Deals. Thus it is suggested to think not twice but thrice before raising a claim. A claim could quite legitimately pay out from two policies. Filing double insurance claims for a single accident is insurance fraud - dont take the risk.

Filing double insurance claims for a single accident is insurance fraud - dont take the risk.

Multiple Claims and Deductibles It really does not matter if you have two car insurance claims within the same week or a year apart. You can have two auto insurance policies on one vehicle but its not recommended and will cost you more money. Unsurprisingly this figure increased when we added a claim from earlier this year. A claim will be classed as non-fault relating to you if the liability or blame lies entirely with the other party involved in the accident and your insurer is able to claim back the. No doubling up on your car insurance isnt illegal.

Source: confused.com

Source: confused.com

A claim could quite legitimately pay out from two policies. They paid the 2500 or so but then a week later paid the same amount again. Insurance company paid me twice on a claim. A own damage premium and b third party premium. Put Yourself in the Drivers Seat and Take Control of Your Finances.

Answered 3 years ago.

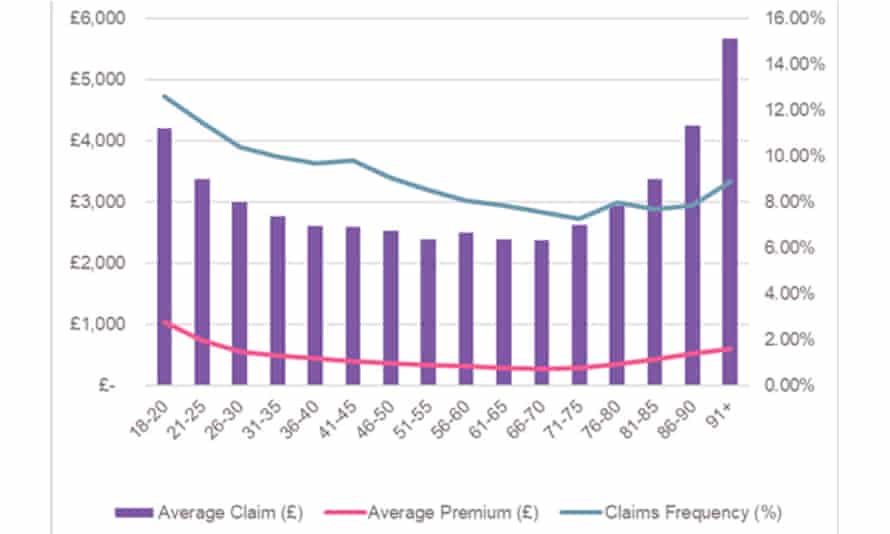

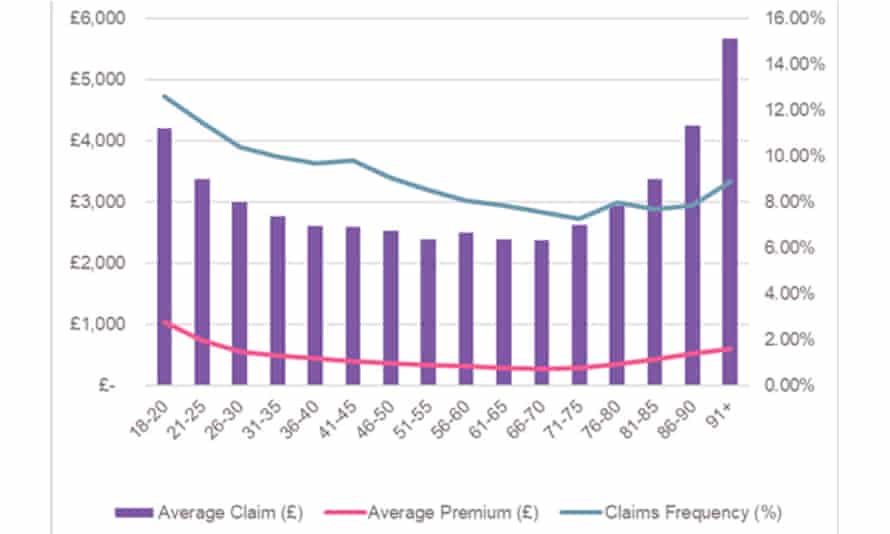

In 2018 a major insurance comparison study showed that at-fault drivers can expect their premium to go up an average of 136 after an accident whereas non-fault drivers will see an average increase of 102. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. Non-fault and at-fault claims.

Source: theguardian.com

Source: theguardian.com

But for two times zero Dept insurance can be claimed but for 3rd claim insurance payment will be on comprasenive basis. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. A claim will be classed as non-fault relating to you if the liability or blame lies entirely with the other party involved in the accident and your insurer is able to claim back the. No claim bonas will be laps after insurance claim.

Source: comparethemarket.com

Source: comparethemarket.com

This discount is known as no claim bonus or NCB. Insurers categorise claims in two ways. A claim will be classed as non-fault relating to you if the liability or blame lies entirely with the other party involved in the accident and your insurer is able to claim back the. Non-fault and at-fault claims.

Source: keithmichaels.co.uk

Source: keithmichaels.co.uk

One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. Filing double insurance claims for a single accident is insurance fraud - dont take the risk. Non-fault and at-fault claims.

Always read the terms and conditions to be aware of how your motor insurance policy works. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. I made a claim at the start of this year for damage caused to my house by a burst water pipe frozen. You usually have six months from the time you reach deadlock with the insurer in which to make a complaint.

Put Yourself in the Drivers Seat and Take Control of Your Finances.

However the accumulated discount can crash to zero if a claim is raised or the limit is breached in case of a long-term policy. Unsurprisingly this figure increased when we added a claim from earlier this year. Put Yourself in the Drivers Seat and Take Control of Your Finances. However the accumulated discount can crash to zero if a claim is raised or the limit is breached in case of a long-term policy. However doing so has its drawbacks.

Source: comparethemarket.com

Source: comparethemarket.com

There is no law to say you carnt insure your car twice but the insurance companys say its fraud but they would. All claims made within a span of three years will show as multiple claims on your claim history. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. No claim bonas will be laps after insurance claim. Every car insurance premium has two primary portions.

They paid the 2500 or so but then a week later paid the same amount again. Generally if you have not claimed your car insurance in the previous year youll get a discount of 20 on your next years premium. Multiple claims that occur close in time may bring up questions about deductibles. A non-fault claim is one where your insurer can recover the cost of the claim from a liable party.

Insurance companies usually require notice if you do not intend to renew your cover with them for the subsequent year.

Multiple claims that occur close in time may bring up questions about deductibles. We gathered online quotes from five of the largest car insurers for a 33-year-old Ford Fiesta driver living in south London. No doubling up on your car insurance isnt illegal. Ad We Dont Just Compare We Cut Prices To Get Better Car Insurance Deals.

Source: comparethemarket.com

Source: comparethemarket.com

These can affect how much you pay for car insurance in the future. In 2018 a major insurance comparison study showed that at-fault drivers can expect their premium to go up an average of 136 after an accident whereas non-fault drivers will see an average increase of 102. Always read the terms and conditions to be aware of how your motor insurance policy works. No claim bonas will be laps after insurance claim.

Source: keithmichaels.co.uk

Source: keithmichaels.co.uk

However many insurance policies renew automatically and if you dont cancel your original policy before taking out new cover then its possible you could pay twice for the same thing. Filing double insurance claims for a single accident is insurance fraud - dont take the risk. Given that most people pay their insurance on a monthly basis that would be an increase of 1130 per month if the accident is. A non-fault claim is one where your insurer can recover the cost of the claim from a liable party.

Source: autobulbsdirect.co.uk

Source: autobulbsdirect.co.uk

To learn more about car insurance and the claim process head to Royal Sundarams website. Multiple Claims and Deductibles It really does not matter if you have two car insurance claims within the same week or a year apart. Put Yourself in the Drivers Seat and Take Control of Your Finances. 96 of customers recommend us.

Doing so is considered fraud and that is illegal.

However the accumulated discount can crash to zero if a claim is raised or the limit is breached in case of a long-term policy. Non-fault and at-fault claims. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. Insurers categorise claims in two ways. Is what Ive discovered today upon opening a letter from my household insurer.

Source: autobulbsdirect.co.uk

Source: autobulbsdirect.co.uk

However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. No doubling up on your car insurance isnt illegal. A own damage premium and b third party premium. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. Given that most people pay their insurance on a monthly basis that would be an increase of 1130 per month if the accident is.

A claim could quite legitimately pay out from two policies.

Generally if you have not claimed your car insurance in the previous year youll get a discount of 20 on your next years premium. However many insurance policies renew automatically and if you dont cancel your original policy before taking out new cover then its possible you could pay twice for the same thing. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. They paid the 2500 or so but then a week later paid the same amount again.

Source: pinterest.com

Source: pinterest.com

Answered 3 years ago. Filing double insurance claims for a single accident is insurance fraud - dont take the risk. However if you make a claim from two insurance providers you cant try and claim for the full amount from each of them. Non-fault and at-fault claims.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Every car insurance premium has two primary portions. It would be rare to do so but several contribution agreeements exist such as PECA which covers items in. Another way you could end up doubling up on car insurance is with separate policies that cover the same items. Put Yourself in the Drivers Seat and Take Control of Your Finances.

Source: comparethemarket.com

Source: comparethemarket.com

Non-fault and at-fault claims. This discount is known as no claim bonus or NCB. A non-fault claim is one where your insurer can recover the cost of the claim from a liable party. A claim will be classed as non-fault relating to you if the liability or blame lies entirely with the other party involved in the accident and your insurer is able to claim back the.

Always read the terms and conditions to be aware of how your motor insurance policy works.

No claim bonas will be laps after insurance claim. We gathered online quotes from five of the largest car insurers for a 33-year-old Ford Fiesta driver living in south London. There is no problem for claiming insurance multiple times in year your idv will not be affected. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. In some cases a car will have two insurance policies running because of how automatic renewals work.

Source: comparethemarket.com

Source: comparethemarket.com

Non-fault and at-fault claims. However the accumulated discount can crash to zero if a claim is raised or the limit is breached in case of a long-term policy. In some cases a car will have two insurance policies running because of how automatic renewals work. In 2018 a major insurance comparison study showed that at-fault drivers can expect their premium to go up an average of 136 after an accident whereas non-fault drivers will see an average increase of 102. To learn more about car insurance and the claim process head to Royal Sundarams website.

Answered 3 years ago.

Insurance companies usually require notice if you do not intend to renew your cover with them for the subsequent year. In some cases a car will have two insurance policies running because of how automatic renewals work. To simulate the effect a claim could continue to have further down. Although you cant exactly be blamed for your own car being vandalised insurers usually consider vandalism an at-fault claim because its unlikely youll identify the vandal to recover any costs from them.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Every car insurance premium has two primary portions. However the accumulated discount can crash to zero if a claim is raised or the limit is breached in case of a long-term policy. Answered 3 years ago. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. To learn more about car insurance and the claim process head to Royal Sundarams website.

Source: confused.com

Source: confused.com

A non-fault claim is one where your insurer can recover the cost of the claim from a liable party. With no recent incidents the average annual premium quoted was 892. Another way you could end up doubling up on car insurance is with separate policies that cover the same items. One company will not insure the same vehicle twice and only one provider will pay in the event of an auto claim. Filing double insurance claims for a single accident is insurance fraud - dont take the risk.

Source: theguardian.com

Source: theguardian.com

I made a claim at the start of this year for damage caused to my house by a burst water pipe frozen. In 2018 a major insurance comparison study showed that at-fault drivers can expect their premium to go up an average of 136 after an accident whereas non-fault drivers will see an average increase of 102. Put Yourself in the Drivers Seat and Take Control of Your Finances. This discount is known as no claim bonus or NCB. No doubling up on your car insurance isnt illegal.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i claim car insurance twice in a year by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.