Can i avail ltc twice in a year.

If you’re looking for can i avail ltc twice in a year images information linked to the can i avail ltc twice in a year keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

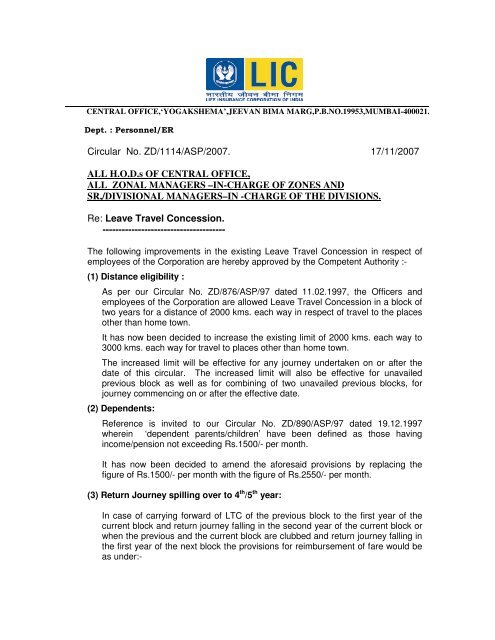

New Ltc Circular Pdf Nfifwi From yumpu.com

New Ltc Circular Pdf Nfifwi From yumpu.com

As per special LTC provisions an employee irrespective of his eligibility can travel by Air to places like Andaman Nicobar JK and North-East under anywhere in India fare. Because LTC will be considered on yearly base starting from 1st January of a year to 31st Decemeber of a year ending. Usually LTC can be availed twice in a block of a four calendar years. Finally tax laws do not bar you from claiming LTC every year.

Current block of years will be as below.

LTC Leave Travel Concession which is part of employee salary can be claimed twice in a block of 4 years. As per special LTC provisions an employee irrespective of his eligibility can travel by Air to places like Andaman Nicobar JK and North-East under anywhere in India fare. During the one year Grace Period. One is because of Grace Period for the previous block of 2016-2017 and second one is for the fresh LTC block of two years 2018-2019. One can avail LTC exemption twice in a block of 4 years.

Source: yumpu.com

Source: yumpu.com

One can avail LTC exemption twice in a block of 4 years. In other words in a block of 4 years a government at the maximum can either avail one home town LTC and one All India LTC or two home town LTC. Iii Employees who have already claimed LTA exemption twice for the block of 2018-2021 cannot claim an exemption under deemed LTC. Usually LTC can be availed twice in a block of a four calendar years. 6 Can the exemption be claimed in next financial year.

Yes he can avail it against All India LTC.

It is not same like Financial Year 1st April to 31st March. In other words in a block of 4 years a government at the maximum can either avail one home town LTC and one All India LTC or two home town LTC. If the Hometown LTC of the period 2018-19 is availed in grace period in 2020 in the same year Any Place in India LTC or Hometown LTC of the two year block of 2020-21 can be availed. Can be availed of during any leave including study leave casual leave and special casual leave.

Source: yumpu.com

Source: yumpu.com

You can take the course every 18 months. Can a Government Servant avail the benefit of visiting NER JK twice in a particular block of 4 years. One can avail LTC exemption twice in a block of 4 years. As per the OM No.

Source: businesstoday.in

Source: businesstoday.in

As per special LTC provisions an employee irrespective of his eligibility can travel by Air to places like Andaman Nicobar JK and North-East under anywhere in India fare. LTC Leave Travel Concession which is part of employee salary can be claimed twice in a block of 4 years. Finally tax laws do not bar you from claiming LTC every year. Employee could not avail LTC due for BLOCK 2010-11 by 31 st Dec 2011He may avail it by 31 st Dec 2012 ie.

Source: hindustantimes.com

Source: hindustantimes.com

As per the OM No. LTC is part of the CTC can be exempted from income tax as per rules laid down for claiming exemption of LTA. Employee could not avail LTC due for BLOCK 2010-11 by 31 st Dec 2011He may avail it by 31 st Dec 2012 ie. Thus it is very much possible to avail LTC twice during a single year.

Employee could not avail LTC due for BLOCK 2010-11 by 31 st Dec 2011He may avail it by 31 st Dec 2012 ie. 3101142007-Estt A dated 252008 all central government employees will be allowed conversion of one block of Home Town LTC into LTC for destination in NER. Can be availed of during any leave including study leave casual leave and special casual leave. Due to this carried forward LTC in 2018 there is a possibility of availing two concessions in a same calendar year.

Because LTC will be considered on yearly base starting from 1st January of a year to 31st Decemeber of a year ending.

If one cannot claim before 31 March 2021 it would expire and one need to pay income tax on their LTC LTA amount. And at your option you can even make both the journeys in a single year instead of spreading over 4 years. Yes a Government Servant can visit NER JK by conversion of his home town and also by availing LTC subject to validity period of the Scheme and fulfilling of other conditions. Hence if a fresh recruit does not avail of the LTC facility in any year his LTC will deem to have lapsed with the end of that year. The current block of 4 years to avail exemption is 1 st January 2018 to 31 st December 2021.

Source: hindustantimes.com

Source: hindustantimes.com

Current block is 2018 to 2021. Claiming LTALTC Benefit 1. And at your option you can even make both the journeys in a single year instead of spreading over 4 years. How it has been working. Can be availed of during any leave including study leave casual leave and special casual leave.

5 Whether the employee is required to avail Privilege Leave PL to avail the benefit. Family can travel in one or more groups. UPI cheque credit or debit card etc. LTC is part of the CTC can be exempted from income tax as per rules laid down for claiming exemption of LTA.

It is not same like Financial Year 1st April to 31st March.

I would contact the court and clarify that the judge is letting you do so. Availment of all India LTC previously by the employee in the same block year of 4 years. On completion of one year the Fresh recruit can be allowed 3 Home Town LTC and 1 All India LTC in each block of Four years in the first 8 years. Can a fresh recruit avail the benefit of Home.

Source: livemint.com

Source: livemint.com

If the Hometown LTC of the period 2018-19 is availed in grace period in 2020 in the same year Any Place in India LTC or Hometown LTC of the two year block of 2020-21 can be availed. In other words in a block of 4 years a government at the maximum can either avail one home town LTC and one All India LTC or two home town LTC. The current block of 4 years to avail exemption is 1 st January 2018 to 31 st December 2021. However such a situation is technically possible only during the first year of any block.

Source: pinterest.com

Source: pinterest.com

There is a possibility of an Employee availing LTC TWICE the CALENDAR YEAR. 6 Can the exemption be claimed in next financial year. On completion of one year the Fresh recruit can be allowed 3 Home Town LTC and 1 All India LTC in each block of Four years in the first 8 years. Read the full answer.

Source: weinvestsmart.com

Source: weinvestsmart.com

These two LTC can be availed in 2018 subject to fulfilling other stipulated conditions. Yes a Government Servant can visit NER JK by conversion of his home town and also by availing LTC subject to validity period of the Scheme and fulfilling of other conditions. During the one year Grace Period. Due to this carried forward LTC in 2018 there is a possibility of availing two concessions in a same calendar year.

This relaxation is irrespective of the.

In other words in a block of 4 years a government at the maximum can either avail one home town LTC and one All India LTC or two home town LTC. Family can travel in one or more groups. Two LTC in a calendar year is permissible. LTC is part of the CTC can be exempted from income tax as per rules laid down for claiming exemption of LTA. Hence if a fresh recruit does not avail of the LTC facility in any year his LTC will deem to have lapsed with the end of that year.

Source: yumpu.com

Source: yumpu.com

Claiming LTALTC Benefit 1. One can avail LTC exemption twice in a block of 4 years. 3101142007-Estt A dated 252008 all central government employees will be allowed conversion of one block of Home Town LTC into LTC for destination in NER. But each group should complete its return journey within six months from the date of its outward journey. In other words in a block of 4 years a government at the maximum can either avail one home town LTC and one All India LTC or two home town LTC.

The current block of 4 years to avail exemption is 1 st January 2018 to 31 st December 2021.

Read the full answer. Thus it is very much possible to avail LTC twice during a single year. Family can travel in one or more groups. Yes he can avail it against All India LTC.

Source: yumpu.com

Source: yumpu.com

Read the full answer. Sometimes a judge will allow you to take Defensive Driving twice in one year. 6 Can the exemption be claimed in next financial year. Yes he can avail it against All India LTC.

Can a Government Servant avail the benefit of visiting NER JK twice in a particular block of 4 years. You can take the course every 18 months. Can be availed of during any leave including study leave casual leave and special casual leave. The amount needs to be incurred between the specified period of 12 October 2020 to 31 March 2021 The payment should be incurred vide digital mode viz.

Source: hindustantimes.com

Source: hindustantimes.com

You can take the course every 18 months. Accordingly as you have joined in 2008 and have not availed any LTC till date you can avail LTC twice in 2012 one for 2010-11 carried forward and one for 2012-13. This relaxation is irrespective of the. These two LTC can be availed in 2018 subject to fulfilling other stipulated conditions.

Availment of all India LTC previously by the employee in the same block year of 4 years.

During the one year Grace Period. How it has been working. Accordingly as you have joined in 2008 and have not availed any LTC till date you can avail LTC twice in 2012 one for 2010-11 carried forward and one for 2012-13. This will reduce up to 4 points on your driving record. If the Hometown LTC of the period 2018-19 is availed in grace period in 2020 in the same year Any Place in India LTC or Hometown LTC of the two year block of 2020-21 can be availed.

Source: pinterest.com

Source: pinterest.com

However such a situation is technically possible only during the first year of any block. Claiming LTALTC Benefit 1. The employee may use any one of the LTC available in a block year. It is not same like Financial Year 1st April to 31st March. In this case what will be deemed fare.

Thus it is very much possible to avail LTC twice during a single year.

And at your option you can even make both the journeys in a single year instead of spreading over 4 years. Because LTC will be considered on yearly base starting from 1st January of a year to 31st Decemeber of a year ending. As per special LTC provisions an employee irrespective of his eligibility can travel by Air to places like Andaman Nicobar JK and North-East under anywhere in India fare. Due to this carried forward LTC in 2018 there is a possibility of availing two concessions in a same calendar year.

Source: yumpu.com

Source: yumpu.com

And at your option you can even make both the journeys in a single year instead of spreading over 4 years. Due to this carried forward LTC in 2018 there is a possibility of availing two concessions in a same calendar year. If one cannot claim before 31 March 2021 it would expire and one need to pay income tax on their LTC LTA amount. You can take the course every 18 months. On completion of one year the Fresh recruit can be allowed 3 Home Town LTC and 1 All India LTC in each block of Four years in the first 8 years.

Source: livemint.com

Source: livemint.com

Whether Dependent parents of fresh recruits can avail LTC for the journey from Home Town to Headquarters and back. Can a Government Servant avail the benefit of visiting NER JK twice in a particular block of 4 years. If one cannot claim before 31 March 2021 it would expire and one need to pay income tax on their LTC LTA amount. Family can travel in one or more groups. The employee may use any one of the LTC available in a block year.

Can a Government Servant avail the benefit of visiting NER JK twice in a particular block of 4 years. Because LTC will be considered on yearly base starting from 1st January of a year to 31st Decemeber of a year ending. But each group should complete its return journey within six months from the date of its outward journey. 6 Can the exemption be claimed in next financial year. LTC Leave Travel Concession which is part of employee salary can be claimed twice in a block of 4 years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i avail ltc twice in a year by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.