Can i apply for teacher loan forgiveness twice.

If you’re looking for can i apply for teacher loan forgiveness twice images information connected with to the can i apply for teacher loan forgiveness twice keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

Can You Apply For Teacher Loan Forgiveness Twice No But Student Loan Hero From studentloanhero.com

Can You Apply For Teacher Loan Forgiveness Twice No But Student Loan Hero From studentloanhero.com

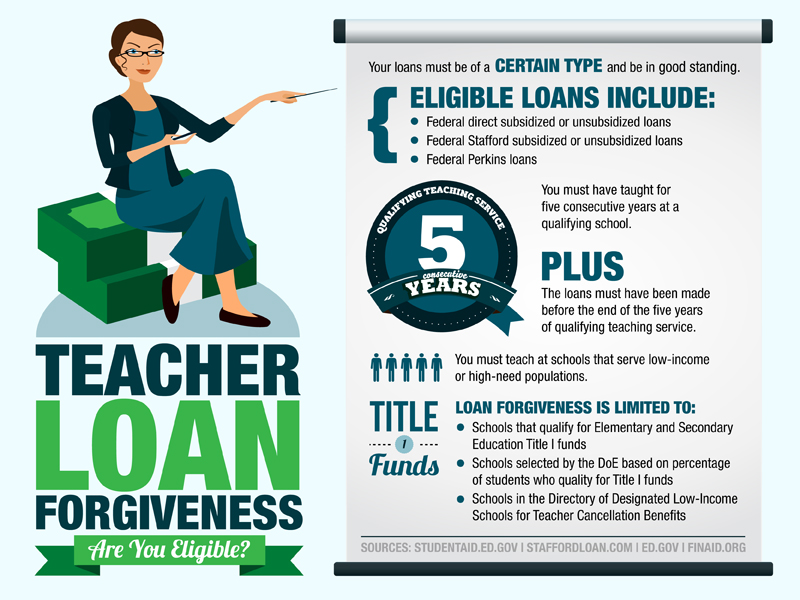

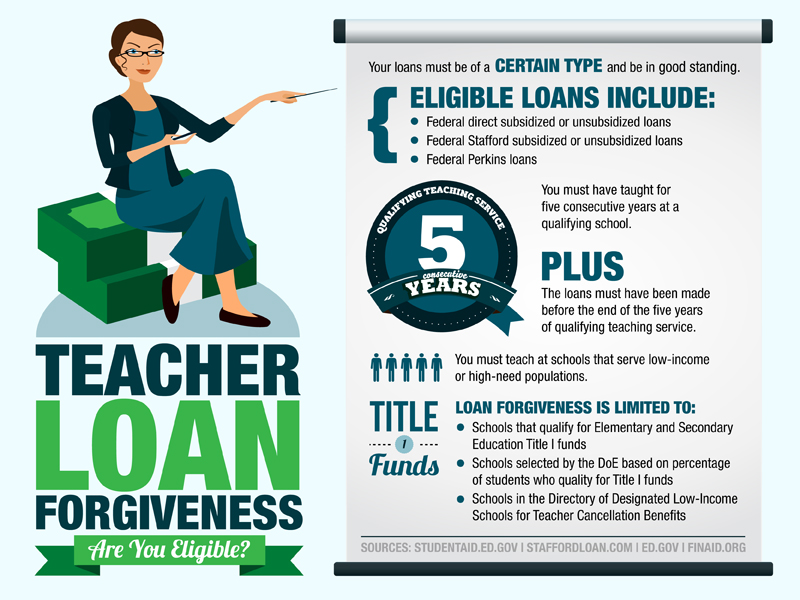

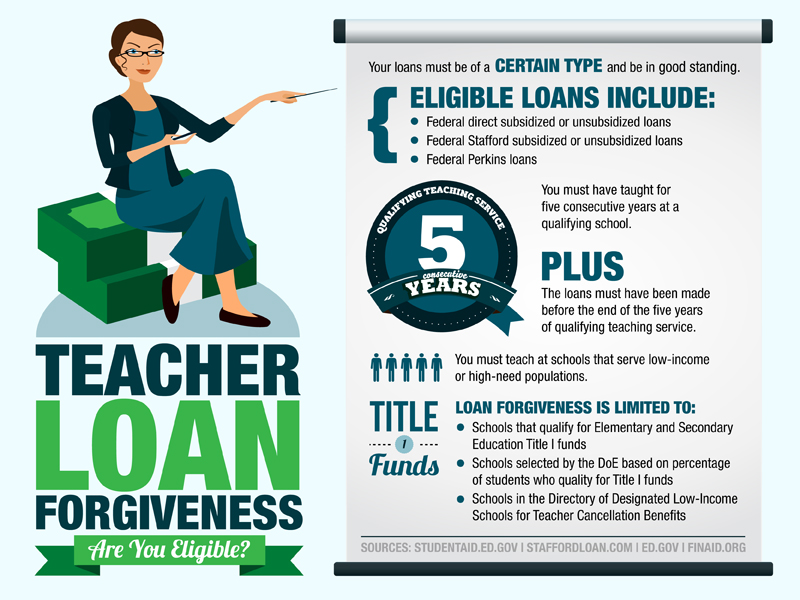

You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. Yes you can receive both Teacher Loan Forgiveness and Public Service Loan Forgiveness if you qualify for both. For example if you make payments on your loans during your five years of qualifying employment for Teacher Loan Forgiveness and then receive loan forgiveness for that service the payments you made during that five year. You have to be a teacher for five whole and continuous academic years after the 1997-1998 school year to pass for the for principal reduction in the Teacher Loan Forgiveness program.

The exact amount of student loan you repaid while employed as a teacher during the 2020 to 2021 financial year - you can get this from either logging into your student loan.

Service Completed Before Oct 30. Note that the situation for student loans has changed due to the impact of the. Additionally the loans you are seeking must have been made prior to the five-year period required to achieve loan forgiveness. Ford Federal Direct Loan Direct Loan Program Federal Family Education Loan FFEL Program OMB No. You apply for teacher loan forgiveness after you have completed the five-year teaching requirement.

Source: studentloanhero.com

Source: studentloanhero.com

The program was designed exclusively for people who have been unapproved for the loan by some loan providers due to prior fiscal issues. You have to be a teacher for five whole and continuous academic years after the 1997-1998 school year to pass for the for principal reduction in the Teacher Loan Forgiveness program. You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. You can have a portion of your loan canceled for each academic year you are employed. Note that the situation for student loans has changed due to the impact of the.

1845-0059 Form Approved Exp.

Then you need to apply for Public Service Loan Forgiveness. Additionally the loans you are seeking must have been made prior to the five-year period required to achieve loan forgiveness. While you may qualify for both programs youll. This is great news if you have accumulated a high degree of student loan debt and struggle to make payments on a teachers salary.

Source: studentloanhero.com

Source: studentloanhero.com

You may not receive a benefit under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program for the same period of teaching service. To get them both you need to get teacher loan forgiveness. Teacher Loan Forgiveness Application 2021 - In the event you will need fast loan approval the PPI loan forgiveness program is a terrific way to get dollars you need straight away. This is great news if you have accumulated a high degree of student loan debt and struggle to make payments on a teachers salary.

Source: tuition.io

Source: tuition.io

Note that the situation for student loans has changed due to the impact of the coronavirus outbreak and relief efforts from the government student loan lenders and others. Your years of work cant count toward both programs at the same time but you can take advantage of Teacher Loan Forgiveness and then start work toward PSLF. That said it may be possible to pursue the Public Service Loan Forgiveness PSLF program after you get Teacher Loan Forgiveness to cancel out the rest of your student debt. The cancelation schedule is as follows.

Source: studentloanhero.com

Source: studentloanhero.com

Ad Soft Search Shows your Chance of Approval without Harming Your Credit Score. You can have a portion of your loan canceled for each academic year you are employed. If you wish to be considered for student loan forgiveness for teachers you need to complete an application and submit it to your loan servicer once you have completed your five years of service. Check out our Student Loan Hero Coronavirus.

Additionally the loans you are seeking must have been made prior to the five-year period required to achieve loan forgiveness. This program is unique in that you do not have to be teaching for a certain number of years before you can take advantage of this loan forgiveness. You can apply for the Teacher Loan Forgiveness and Public Service Loan Forgiveness programs but youll need to teach full-time for 15 years to benefit from both. Note that the situation for student loans has changed due to the impact of the.

To get them both you need to get teacher loan forgiveness.

You apply for teacher loan forgiveness after you have completed the five-year teaching requirement. You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. If you have a much larger balance you could be better off with Public Service Loan Forgiveness. You can apply for the Teacher Loan Forgiveness and Public Service Loan Forgiveness programs but youll need to teach full-time for 15 years to benefit from both. While you may qualify for both programs youll.

Source: forgetstudentloandebt.com

Source: forgetstudentloandebt.com

You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. Year 1 and 2. You may not receive a benefit under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program for the same period of teaching service. If your five continuous years of teaching started before Oct 30 2004 you have a few choices. Public Service Loan Forgiveness.

Our Eligibility Checker Tool Will Show you Loan Deals Without Harming Your Credit Score. Teacher Loan Forgiveness offers a one-time reward. Teacher Loan Forgiveness Application 2021 - In the event you will need fast loan approval the PPI loan forgiveness program is a terrific way to get dollars you need straight away. The program was designed exclusively for people who have been unapproved for the loan by some loan providers due to prior fiscal issues.

Our Eligibility Checker Tool Will Show you Loan Deals Without Harming Your Credit Score.

Ford Federal Direct Loan Direct Loan Program Federal Family Education Loan FFEL Program OMB No. You have to be a teacher for five whole and continuous academic years after the 1997-1998 school year to pass for the for principal reduction in the Teacher Loan Forgiveness program. You may not receive a benefit under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program for the same period of teaching service. No you cant - but what you can do if you work for 15 years is apply for Public Service Loan forgiveness httpsstudentaidedgovrepay-loansforgiveness-cancellationchartspublic-service You cant count the five years you use for TLF towards PSLF so depending on your income and debt level you may be better off just doing pslf 5 level 2.

Source: studentloanhero.com

Source: studentloanhero.com

1845-0059 Form Approved Exp. The exact amount of student loan you repaid while employed as a teacher during the 2020 to 2021 financial year - you can get this from either logging into your student loan. This program is nearly the same as other government financial loans. No you cant - but what you can do if you work for 15 years is apply for Public Service Loan forgiveness httpsstudentaidedgovrepay-loansforgiveness-cancellationchartspublic-service You cant count the five years you use for TLF towards PSLF so depending on your income and debt level you may be better off just doing pslf 5 level 2.

Source: studentloanhero.com

Source: studentloanhero.com

If you wish to be considered for student loan forgiveness for teachers you need to complete an application and submit it to your loan servicer once you have completed your five years of service. Teacher Loan Forgiveness offers a one-time reward. Year 1 and 2. That said it may be possible to pursue the Public Service Loan Forgiveness PSLF program after you get Teacher Loan Forgiveness to cancel out the rest of your student debt.

Source: forgetstudentloandebt.com

Source: forgetstudentloandebt.com

Any time you spent teaching to receive benefits through AmeriCorps cannot be counted toward your required five years of teaching for Teacher Loan Forgiveness. What You Should Know You can receive forgiveness under the PSLF and the Teacher Loan Forgiveness Program. If you have a much larger balance you could be better off with Public Service Loan Forgiveness. That said it may be possible to pursue the Public Service Loan Forgiveness PSLF program after you get Teacher Loan Forgiveness to cancel out the rest of your student debt.

Though there is no cap for the debt amount.

The exact amount of student loan you repaid while employed as a teacher during the 2020 to 2021 financial year - you can get this from either logging into your student loan. This program is unique in that you do not have to be teaching for a certain number of years before you can take advantage of this loan forgiveness. Ad Soft Search Shows your Chance of Approval without Harming Your Credit Score. Service Completed Before Oct 30. This is great news if you have accumulated a high degree of student loan debt and struggle to make payments on a teachers salary.

Source: tuition.io

Source: tuition.io

While you may qualify for both programs youll. For example if you make payments on your loans during your five years of qualifying employment for Teacher Loan Forgiveness and then receive loan forgiveness for that service the payments you made during that five year. You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. Note that the situation for student loans has changed due to the impact of the. Check out our Student Loan Hero Coronavirus.

Loan forgiveness for teachers is offered through the federal government through three main programs.

Our Eligibility Checker Tool Will Show you Loan Deals Without Harming Your Credit Score. That said it may be possible to pursue the Public Service Loan Forgiveness PSLF program after you get Teacher Loan Forgiveness to cancel out the rest of your student debt. Year 1 and 2. Year 3 and 4.

Source: tuition.io

Source: tuition.io

Year 1 and 2. You may not receive a benefit under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program for the same period of teaching service. While you may qualify for both programs youll. That makes it even more important to plan ahead to make sure youre on the right track.

Source: thebalance.com

Source: thebalance.com

Any person who knowingly makes a. Teachers cannot apply for loan forgiveness until they have taught at a qualifying school or schools for at least five years. You can apply for the Teacher Loan Forgiveness and Public Service Loan Forgiveness programs but youll need to teach full-time for 15 years to benefit from both. You can have a portion of your loan canceled for each academic year you are employed.

Source: forgetstudentloandebt.com

Source: forgetstudentloandebt.com

Though there is no cap for the debt amount. Then you need to apply for Public Service Loan Forgiveness. Teachers cannot apply for loan forgiveness until they have taught at a qualifying school or schools for at least five years. Additionally the loans you are seeking must have been made prior to the five-year period required to achieve loan forgiveness.

Those five years must be complete and consecutive.

Technically students can apply for both of these programs and get accepted. If you have a much larger balance you could be better off with Public Service Loan Forgiveness. The cancelation schedule is as follows. Though there is no cap for the debt amount. For example if you make payments on your loans during your five years of qualifying employment for Teacher Loan Forgiveness and then receive loan forgiveness for that service the payments you made during that five year.

Source: studentloanhero.com

Source: studentloanhero.com

To get them both you need to get teacher loan forgiveness. The program was designed exclusively for people who have been unapproved for the loan by some loan providers due to prior fiscal issues. The cancelation schedule is as follows. Your years of work cant count toward both programs at the same time but you can take advantage of Teacher Loan Forgiveness and then start work toward PSLF. You have to be a teacher for five whole and continuous academic years after the 1997-1998 school year to pass for the for principal reduction in the Teacher Loan Forgiveness program.

If your five continuous years of teaching started before Oct 30 2004 you have a few choices.

You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. Note that the situation for student loans has changed due to the impact of the. Any time you spent teaching to receive benefits through AmeriCorps cannot be counted toward your required five years of teaching for Teacher Loan Forgiveness. That makes it even more important to plan ahead to make sure youre on the right track.

Source: studentloanplanner.com

Source: studentloanplanner.com

Teachers can have their loans forgiven. You must have taught for five consecutive years. You cant apply for Teacher Loan Forgiveness twice after an additional five years of service. Year 1 and 2. Though they cannot obtain forgiveness from both of these programs in the same period of teaching.

Source: studentloanhero.com

Source: studentloanhero.com

What You Should Know You can receive forgiveness under the PSLF and the Teacher Loan Forgiveness Program. Additionally the loans you are seeking must have been made prior to the five-year period required to achieve loan forgiveness. You apply for teacher loan forgiveness after you have completed the five-year teaching requirement. TEACHER LOAN FORGIVENESS APPLICATION William D. Teachers can have their loans forgiven.

Source: studentloanhero.com

Source: studentloanhero.com

If you have a much larger balance you could be better off with Public Service Loan Forgiveness. Teachers cannot apply for loan forgiveness until they have taught at a qualifying school or schools for at least five years. You may not receive a benefit under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program for the same period of teaching service. If you have a much larger balance you could be better off with Public Service Loan Forgiveness. Then you need to apply for Public Service Loan Forgiveness.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i apply for teacher loan forgiveness twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.