Atm fee charged twice.

If you’re looking for atm fee charged twice pictures information linked to the atm fee charged twice keyword, you have pay a visit to the right site. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

A Must Know Information About Atm Withdrawal Charges You Will Be Charged If Withdraw More Than 5000 From kalingatv.com

A Must Know Information About Atm Withdrawal Charges You Will Be Charged If Withdraw More Than 5000 From kalingatv.com

Independently operated machines usually charge about 150 to 2 per transaction. Youll typically see this fee pop up on the ATM before you complete your transaction. For most large banks you are charged twice when you use ATMsfrom other banks. TD Bank still describes its free ATMs as of 2192011 on their website.

The average fee charged by the consumers own.

There has been a. Independently operated machines usually charge about 150 to 2 per transaction. When you use an ATM that isnt operated by your own bank to make withdrawals deposits or even simple balance inquiries you can run into a bundle of extra fees. The store owner is the one that benefits from that initial 2 transaction fee that youre warned about. Second youll be hit with a fee by the owner of the ATM.

Source: pinterest.com

Source: pinterest.com

Youll typically pay a fee of somewhere between 75 and 20 on whatever you withdraw. Yep you arent being charged twice by the same bank you are being charged once by each of the two banks involved in the transaction. First your bank will charge you between 2 and 3 for using a foreign ATM. Assume you withdraw the equivalent of 100 twice a week and you get hit with the following fees per withdrawal. Independently operated machines usually charge about 150 to 2 per transaction.

The new fee will deal a brutal blow to the elderly families and small businesses with the.

TD Bank still describes its free ATMs as of 2192011 on their website. Youll typically pay a fee of somewhere between 75 and 20 on whatever you withdraw. While most banks automate the process and. Heres how it generally works.

Source: kalingatv.com

Source: kalingatv.com

Youll typically see this fee pop up on the ATM before you complete your transaction. The vast majority are free. Your home bank will probably charge a withdrawal fee. An interchange fee is paid by the banks to the operator of the ATM.

Source: zeebiz.com

Source: zeebiz.com

Customers will be charged INR 21 per ATM transaction after exhausting limit of free transactions and The interchange fee for the ATM transactions for the Banks is increased from INR 15 to INR 17 for each financial transaction and for the non-financial transactions is increased from INR 5 to INR 6. Customers are charged twice. Once by the ATM where they withdraw and again by their own bank. The new fee will deal a brutal blow to the elderly families and small businesses with the.

Source: ublocal.com

Source: ublocal.com

If your debit card is charged twice for the same transaction or you discover any other incorrect charges notify your bank as soon as possible. While most banks automate the process and. Legally if you report an authorized debit card transaction within 48 hours of discovering it you will only be on the hook for a maximum of 50 though some banks may have more generous policies. If it wont ask the merchant to cover the fees since the overdraft stemmed from its mistake.

Second the ATM operator will also charge a small fee. The new fee will deal a brutal blow to the elderly families and small businesses with the. First your bank will charge you a surcharge for using a non-network machine. First your bank will charge you between 2 and 3 for using a foreign ATM.

Your home bank will probably charge a withdrawal fee.

Occasionally however having a charge deducted from your account twice can cause your account to go into the red triggering overdraft fees. If it wont ask the merchant to cover the fees since the overdraft stemmed from its mistake. What is interchange fee ATM. Legally if you report an authorized debit card transaction within 48 hours of discovering it you will only be on the hook for a maximum of 50 though some banks may have more generous policies. Your home bank will probably charge a withdrawal fee.

Source: kalingatv.com

Source: kalingatv.com

What is interchange fee ATM. An interchange fee is paid by the banks to the operator of the ATM. Bank ATM fees can vary from as low as 250 per transaction to as high as 5 or more depending on whether the ATM you use is out-of-network or even international. The store owner is the one that benefits from that initial 2 transaction fee that youre warned about. While most banks automate the process and.

The store owner is the one that benefits from that initial 2 transaction fee that youre warned about. Youll typically pay a fee of somewhere between 75 and 20 on whatever you withdraw. If it wont ask the merchant to cover the fees since the overdraft stemmed from its mistake. Second the ATM operator will also charge a small fee.

While most banks automate the process and.

The vast majority are free. These fees are over and above any fees charged by the UK ATM. There has been a. What is interchange fee ATM.

Source: pinterest.com

Source: pinterest.com

A typical case would be getting hit with two fixed feesone from your home bank and the other from the foreign bankand then a 1 charge from the ATM interbank network. Occasionally however having a charge deducted from your account twice can cause your account to go into the red triggering overdraft fees. There are two types of ATMs in the UK. Customers are charged twice.

Source: bankmillennium.pl

Source: bankmillennium.pl

There are two types of ATMs in the UK. The convenience fee charged by an ATM operator is in respect of a supply exempt under item 1 as dealing with money. What is interchange fee ATM. TD Bank still describes its free ATMs as of 2192011 on their website.

Source: abcnews.go.com

Source: abcnews.go.com

First your bank will charge you a surcharge for using a non-network machine. Yep you arent being charged twice by the same bank you are being charged once by each of the two banks involved in the transaction. The Bankrate data showed that the average ATM surcharge hit a new record for the 13th year in a row this autumn rising to 297 from 290 last year. Youll typically pay a fee of somewhere between 75 and 20 on whatever you withdraw.

You should also expect to pay a foreign exchange fee.

You should also expect to pay a foreign exchange fee. The store owner is the one that benefits from that initial 2 transaction fee that youre warned about. Occasionally however having a charge deducted from your account twice can cause your account to go into the red triggering overdraft fees. Heres how it generally works. While most banks automate the process and.

Source: kalingatv.com

Source: kalingatv.com

In the Tribunal case of Nationwide Anglia Building Society VTD 11826 it was. Firstly the owner of the ATM ie. Unfortunately out-of-network ATM transactions usually trigger two fees. Youll typically see this fee pop up on the ATM before you complete your transaction. Legally if you report an authorized debit card transaction within 48 hours of discovering it you will only be on the hook for a maximum of 50 though some banks may have more generous policies.

You should also expect to pay a foreign exchange fee.

The new fee will deal a brutal blow to the elderly families and small businesses with the. Customers will be charged INR 21 per ATM transaction after exhausting limit of free transactions and The interchange fee for the ATM transactions for the Banks is increased from INR 15 to INR 17 for each financial transaction and for the non-financial transactions is increased from INR 5 to INR 6. Unfortunately out-of-network ATM transactions usually trigger two fees. What is interchange fee ATM.

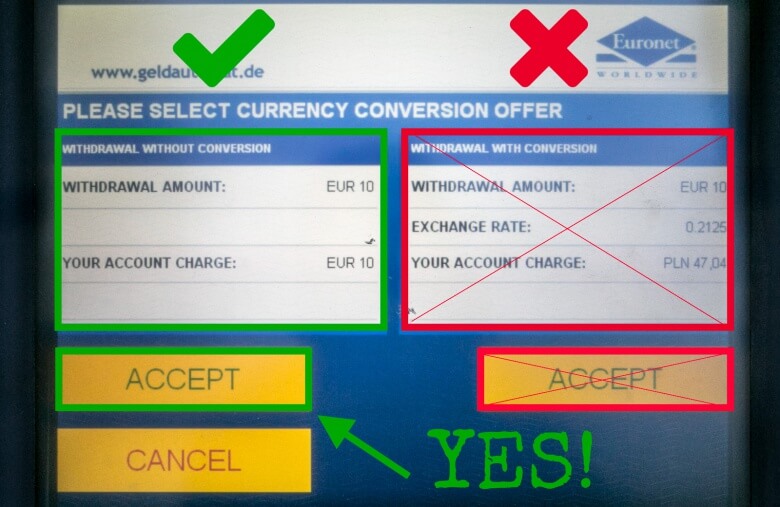

Source: thefamilywithoutborders.com

Source: thefamilywithoutborders.com

For most large banks you are charged twice when you use ATMsfrom other banks. Assume you withdraw the equivalent of 100 twice a week and you get hit with the following fees per withdrawal. Occasionally however having a charge deducted from your account twice can cause your account to go into the red triggering overdraft fees. Youll typically see this fee pop up on the ATM before you complete your transaction.

Source: pinterest.com

Source: pinterest.com

Thats the price of convenience. First your bank will charge you between 2 and 3 for using a foreign ATM. Second the ATM operator will also charge a small fee. Firstly the owner of the ATM ie.

Source: bankmillennium.pl

Source: bankmillennium.pl

Once by the ATM where they withdraw and again by their own bank. First your bank will charge you a surcharge for using a non-network machine. Legally if you report an authorized debit card transaction within 48 hours of discovering it you will only be on the hook for a maximum of 50 though some banks may have more generous policies. There has been a.

Bank ATM fees can vary from as low as 250 per transaction to as high as 5 or more depending on whether the ATM you use is out-of-network or even international.

When you use an ATM that isnt operated by your own bank to make withdrawals deposits or even simple balance inquiries you can run into a bundle of extra fees. Firstly the owner of the ATM ie. Unfortunately out-of-network ATM transactions usually trigger two fees. If it wont ask the merchant to cover the fees since the overdraft stemmed from its mistake. Bank ATM fees can vary from as low as 250 per transaction to as high as 5 or more depending on whether the ATM you use is out-of-network or even international.

Source: ublocal.com

Source: ublocal.com

Youll typically see this fee pop up on the ATM before you complete your transaction. Yep you arent being charged twice by the same bank you are being charged once by each of the two banks involved in the transaction. For most large banks you are charged twice when you use ATMsfrom other banks. When you use an ATM that isnt operated by your own bank to make withdrawals deposits or even simple balance inquiries you can run into a bundle of extra fees. Thats the price of convenience.

When you use an ATM that isnt operated by your own bank to make withdrawals deposits or even simple balance inquiries you can run into a bundle of extra fees.

Your home bank will probably charge a withdrawal fee. If your debit card is charged twice for the same transaction or you discover any other incorrect charges notify your bank as soon as possible. Customers are charged twice. A typical case would be getting hit with two fixed feesone from your home bank and the other from the foreign bankand then a 1 charge from the ATM interbank network.

Source: pinterest.com

Source: pinterest.com

Heres how it generally works. Once by the ATM where they withdraw and again by their own bank. These fees are over and above any fees charged by the UK ATM. Legally if you report an authorized debit card transaction within 48 hours of discovering it you will only be on the hook for a maximum of 50 though some banks may have more generous policies. AIB will charge a flat 450 quarterly fee 18 a year fee as well as a number of other charges including a 035 fee for ATM withdrawals and a 020 charge for chip and pin.

Source: kalingatv.com

Source: kalingatv.com

Notemachine will charge for many of its 10500 devices following changes to how the ATMs are funded. When you use an ATM that isnt operated by your own bank to make withdrawals deposits or even simple balance inquiries you can run into a bundle of extra fees. The convenience fee charged by an ATM operator is in respect of a supply exempt under item 1 as dealing with money. So lets look at a typical and rather conservative example. Firstly the owner of the ATM ie.

Source: zeebiz.com

Source: zeebiz.com

The store owner is the one that benefits from that initial 2 transaction fee that youre warned about. An interchange fee is paid by the banks to the operator of the ATM. There are two types of ATMs in the UK. Youll typically pay a fee of somewhere between 75 and 20 on whatever you withdraw. What is interchange fee ATM.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title atm fee charged twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.