Are you taxed twice on 401k withdrawals.

If you’re searching for are you taxed twice on 401k withdrawals pictures information related to the are you taxed twice on 401k withdrawals interest, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

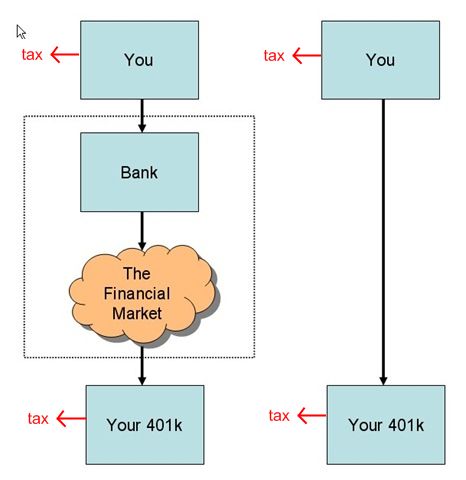

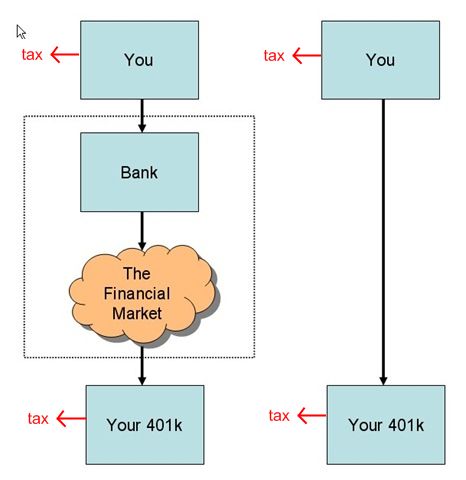

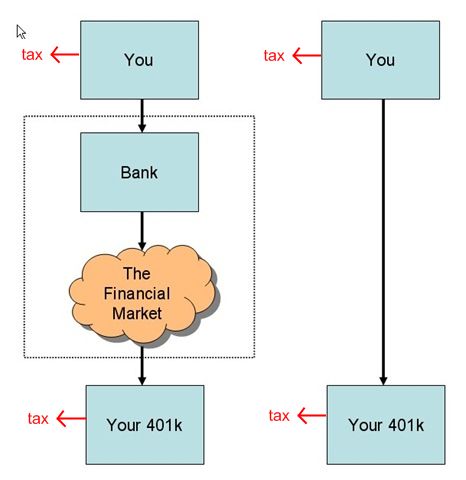

401k Loan Double Taxation Myth From thefinancebuff.com

401k Loan Double Taxation Myth From thefinancebuff.com

Try to only take withdrawals from your 401 k up to the earned income amount that will allow your long-term capital gains to be taxed at 0. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. With the 20 withholding on your distribution youre essentially paying part of your taxes upfront. At the very least youll pay federal income tax on the amount you withdraw each year.

Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

You must leave your funds in the 401 k plan to access them penalty-free. But no you dont pay taxes twice on 401k withdrawals. Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty. You must leave your funds in the 401 k plan to access them penalty-free. We see this question on occasion and understand why it may seem this way.

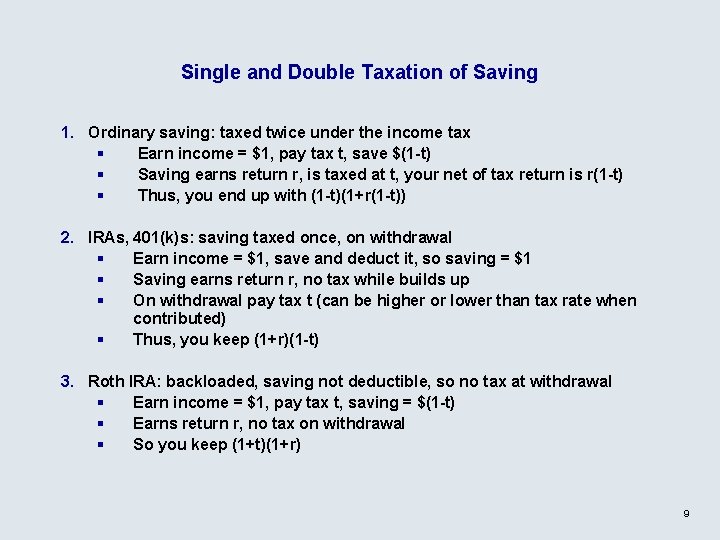

Source: slidetodoc.com

Source: slidetodoc.com

In this case your withdrawal is subject to the vesting reduction. The contributions you made to the account were made with pre-tax dollars. Normally any withdrawals from a 401 k IRA or another retirement plan have to be approved by the plan sponsor and they carry a hefty 10 penalty. But no you dont pay taxes twice on 401 k withdrawals. In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago.

You wont have to pay taxes twice on this withdrawal.

In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago. Then when you begin 401 k distributions you can elect to have both federal and state income taxes. As with any taxable income the rate you pay depends on the amount of total taxable income you receive that year. The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401k plans IRAs or pensions.

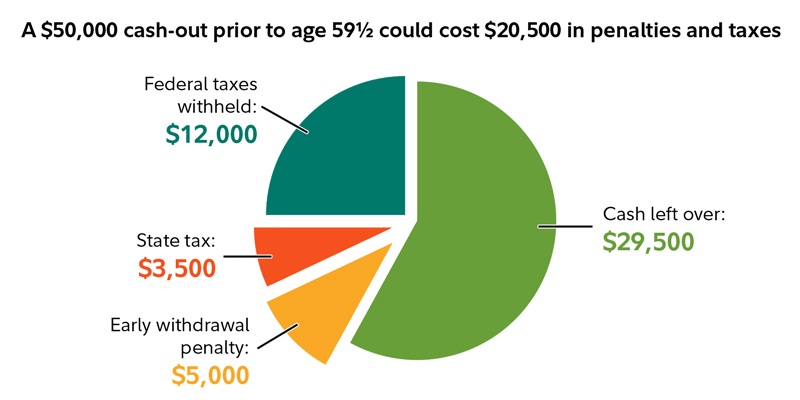

Source: wealthenhancement.com

Source: wealthenhancement.com

Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. Normally any withdrawals from a 401 k IRA or another retirement plan have to be approved by the plan sponsor and they carry a hefty 10 penalty. Early withdrawals might also be subject to an additional penalty taxas much as 25 under some circumstances. You wont have to pay taxes twice on this withdrawal.

Source: hrblock.com

Source: hrblock.com

We see this question on occasion and understand why it may seem this way. Depending on your tax situation the amount withheld might not be enough to cover your full tax liability. Whenever you withdraw retirement funds early from your IRA 401 k or another retirement savings plan you must generally include that money as taxable income on your tax return. The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401k plans IRAs or pensions.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

You will have to pay taxes on those funds though the income can be spread over three tax years. Deferring Social Security payments rolling over old 401ks setting up IRAs to avoid the mandatory 20 federal income tax and keeping your capital gains taxes low are among the best strategies for reducing taxes on your 401k withdrawal. With the 20 withholding on your distribution youre essentially paying part of your taxes upfront. Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty.

The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401k plans IRAs or pensions. You wont have to pay taxes twice on this withdrawal. You will need to say on your tax return that you made a transfer but you wont pay anything. So if you withdraw the 10000 in your 401k at age 40 you may get only about 8000.

The contributions you made to the account were made with pre-tax dollars.

You said youre also concerned that you will be taxed twice on the distributions but Maye said thats not the case. Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty. In this case your withdrawal is subject to the vesting reduction. You said youre also concerned that you will be taxed twice on the distributions but Maye said thats not the case. The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401k plans IRAs or pensions.

Source: thefinancebuff.com

Source: thefinancebuff.com

Deferring Social Security payments rolling over old 401ks setting up IRAs to avoid the mandatory 20 federal income tax and keeping your capital gains taxes low are among the best strategies for reducing taxes on your 401k withdrawal. The contributions you made to the account were made with pre-tax dollars. In this case your withdrawal is subject to the vesting reduction. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. Do you get taxed twice on 401k withdrawal.

Withdrawing Funds Between Ages 55 and 59 12 Most 401 k plans allow for penalty-free withdrawals starting at age 55. How can I avoid paying taxes on my 401k withdrawal. In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago. Normally any withdrawals from a 401 k IRA or another retirement plan have to be approved by the plan sponsor and they carry a hefty 10 penalty.

Normally any withdrawals from a 401 k IRA or another retirement plan have to be approved by the plan sponsor and they carry a hefty 10 penalty.

Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty. Deferring Social Security payments rolling over old 401ks setting up IRAs to avoid the mandatory 20 federal income tax and keeping your capital gains taxes low are among the best strategies for reducing taxes on your 401k withdrawal. When federal income tax is withheld on a retirement plan distribution it is reported on Form 1099-R. Any money you withdraw from your 401k is considered income and will be taxed as such alongside other sources of taxable income you may receive.

Source: investopedia.com

Source: investopedia.com

In this case your withdrawal is subject to the vesting reduction. You wont have to pay taxes twice on this withdrawal. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

But no you dont pay taxes twice on 401 k withdrawals. At the very least youll pay federal income tax on the amount you withdraw each year. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. You will have to pay taxes on those funds though the income can be spread over three tax years.

Source: thefinancebuff.com

Source: thefinancebuff.com

8 rows Once you start withdrawing from your 401k your withdrawals are taxed as ordinary income. You will have to pay taxes on those funds though the income can be spread over three tax years. The contributions you made to the account were made with pre-tax dollars. Withdrawing Funds Between Ages 55 and 59 12 Most 401 k plans allow for penalty-free withdrawals starting at age 55.

Then when you begin 401 k distributions you can elect to have both federal and state income taxes.

You said youre also concerned that you will be taxed twice on the distributions but Maye said thats not the case. In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. You must leave your funds in the 401 k plan to access them penalty-free. There are a few exceptions to the 10 percent penalty.

Source: thefinancebuff.com

Source: thefinancebuff.com

Deferring Social Security payments rolling over old 401ks setting up IRAs to avoid the mandatory 20 federal income tax and keeping your capital gains taxes low are among the best strategies for reducing taxes on your 401k withdrawal. If you transfer the money within 60 days you will not have to pay any taxes or penalties on your withdrawals. Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. 8 rows Once you start withdrawing from your 401k your withdrawals are taxed as ordinary income.

Updated March 31 2021.

Any COVID-related withdrawals made in 2020 though are penalty-free. If you transfer the money within 60 days you will not have to pay any taxes or penalties on your withdrawals. But no you dont pay taxes twice on 401k withdrawals. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

Source: wealthenhancement.com

Source: wealthenhancement.com

You will need to say on your tax return that you made a transfer but you wont pay anything. Then when you begin 401 k distributions you can elect to have both federal and state income taxes. There are a few exceptions to the 10 percent penalty. You wont have to pay taxes twice on this withdrawal.

Source: investopedia.com

Source: investopedia.com

How can I avoid paying taxes on my 401k withdrawal. You must have left your job no earlier than the year in which you turn age 55 to use this option. Withdrawals from those accounts are not taxed. Whenever you withdraw retirement funds early from your IRA 401 k or another retirement savings plan you must generally include that money as taxable income on your tax return.

Source: pensionparameters.com

Source: pensionparameters.com

Withdrawing Funds Between Ages 55 and 59 12 Most 401 k plans allow for penalty-free withdrawals starting at age 55. But no you dont pay taxes twice on 401k withdrawals. You must have left your job no earlier than the year in which you turn age 55 to use this option. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan.

Withdrawing Funds Between Ages 55 and 59 12 Most 401 k plans allow for penalty-free withdrawals starting at age 55.

Generally if you withdraw money from an IRA or 401 k before age 59½ or the normal retirement age as defined by your 401 k plan the money you withdraw is taxable income and you may have to pay a 10 percent additional tax penalty. You said youre also concerned that you will be taxed twice on the distributions but Maye said thats not the case. We see this question on occasion and understand why it may seem this way. Try to only take withdrawals from your 401 k up to the earned income amount that will allow your long-term capital gains to be taxed at 0. So if you withdraw the 10000 in your 401k at age 40 you may get only about 8000.

Source: hrblock.com

Source: hrblock.com

Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. You will need to say on your tax return that you made a transfer but you wont pay anything. We see this question on occasion and understand why it may seem this way. The contributions you made to the account were made with pre-tax dollars. Deferring Social Security payments rolling over old 401ks setting up IRAs to avoid the mandatory 20 federal income tax and keeping your capital gains taxes low are among the best strategies for reducing taxes on your 401k withdrawal.

How can I avoid paying taxes on my 401k withdrawal.

Early withdrawals might also be subject to an additional penalty taxas much as 25 under some circumstances. Withdrawing Funds Between Ages 55 and 59 12 Most 401 k plans allow for penalty-free withdrawals starting at age 55. So if you withdraw the 10000 in your 401k at age 40 you may get only about 8000. Updated March 31 2021.

Source: thefinancebuff.com

Source: thefinancebuff.com

Then when you begin 401 k distributions you can elect to have both federal and state income taxes. Whenever you withdraw retirement funds early from your IRA 401 k or another retirement savings plan you must generally include that money as taxable income on your tax return. Then when you begin 401 k distributions you can elect to have both federal and state income taxes. You wont have to pay taxes twice on this withdrawal. Try to only take withdrawals from your 401 k up to the earned income amount that will allow your long-term capital gains to be taxed at 0.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Traditional 401 k withdrawals are taxed at an individuals current income tax rate. We see this question on occasion and understand why it may seem this way. Updated March 31 2021. With the 20 withholding on your distribution youre essentially paying part of your taxes upfront. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

Source: investopedia.com

Source: investopedia.com

Traditional 401 k withdrawals are taxed at an individuals current income tax rate. Then when you begin 401 k distributions you can elect to have both federal and state income taxes. 8 rows Once you start withdrawing from your 401k your withdrawals are taxed as ordinary income. Whenever you withdraw money from a 401k you have 60 days to put the money into another tax-deferred retirement plan. Any COVID-related withdrawals made in 2020 though are penalty-free.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title are you taxed twice on 401k withdrawals by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.