401k loans taxed twice.

If you’re looking for 401k loans taxed twice images information connected with to the 401k loans taxed twice interest, you have pay a visit to the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

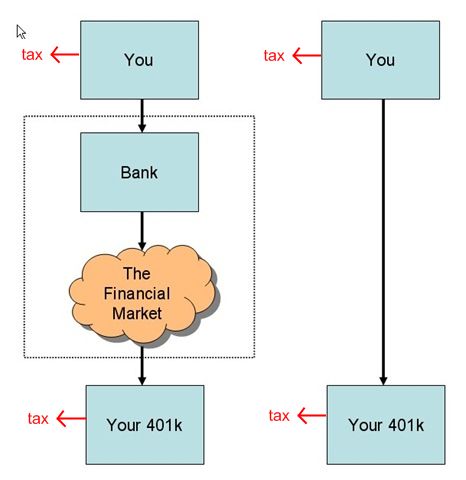

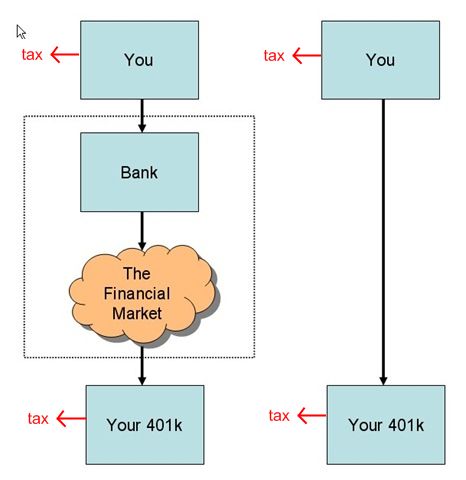

401k Loan Double Taxation Myth From thefinancebuff.com

401k Loan Double Taxation Myth From thefinancebuff.com

But in truth only the interest part of the repayment is treated that way. Do you pay income tax twice when you take out a 401k plan loan. Short and sweet answer. Although interest rates on 401k loans are typically low and you make interest payments back into your own account every day that your retirement money isnt in your account generating interest or capital gains makes it harder for you to reach your retirement savings goals.

Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes.

Do you pay income tax twice when you take out a 401k plan loan. However that statement greatly exaggerates the tax costs of taking a 401 k loan. The loan amount is not taxed twice but the interest you pay is definitely double taxed. If you get a raise a tax refund or any other type of bonus money put it toward your 401k loan. Rates From 337 Simple Application - Apply Now.

Source: pinterest.com

Source: pinterest.com

In January or February the pension plan administrator for the 401 k. The ONLY money that is taxed twice is the INTEREST that you pay to your 401 k on the loan. Rates From 337 Simple Application - Apply Now. If you get a raise a tax refund or any other type of bonus money put it toward your 401k loan. Here is what you can expect.

Unlike your 401K contributions the interest you pay on the loan even though it is going into your own 401K account is from your after tax earnings.

Ad Mortgage Holders Only. You pay the interest with after-tax money and it becomes pre-tax money when paid to the 401 k. Do you pay income tax twice when you take out a 401k plan loan. This has been well-explained here here and here.

Source: thefinancebuff.com

Source: thefinancebuff.com

The loan amount is not taxed twice but the interest you pay is definitely double taxed. First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice. Ad Mortgage Holders Only. 401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k.

Source: pinterest.com

Source: pinterest.com

The only money taxed twice in the transaction is the interest paid. Ad Mortgage Holders Only. Therefore double taxation. Rates From 337 Simple Application - Apply Now.

Source: pinterest.com

Source: pinterest.com

Here is what you can expect. It is only significant when the amount borrowed is large and is repaid over several years. This has been well-explained here here and here. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes.

The only money taxed twice in the transaction is the interest paid. Weve been repaying the loan back to the 401 k but still have some ways to go. Do you pay income tax twice when you take out a 401k plan loan. Short and sweet answer.

Therefore double taxation.

The ONLY money that is taxed twice is the INTEREST that you pay to your 401 k on the loan. However 401 k interest rates are typically modest so double taxation has a negligible impact. If a home equity line of credit or a personal loan option is pursued it is generally recommended that the individual work with a financial professional who can provide careful and thorough analysis of potential legal tax and estate implications. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes. Here is what you can expect.

Source: pinterest.com

Source: pinterest.com

The only money taxed twice in the transaction is the interest paid. Weve been repaying the loan back to the 401 k but still have some ways to go. But the analysis does not take into account that the 10000 of pre-tax money was received without paying any taxes. The ONLY money that is taxed twice is the INTEREST that you pay to your 401 k on the loan. It is only significant when the amount borrowed is large and is repaid over several years.

But in truth only the interest part of the repayment is treated that way. But the analysis does not take into account that the 10000 of pre-tax money was received without paying any taxes. So if you took out a 10000 loan and only spent 6000 you will have to repay the 6000 you spent with after-tax dollars but could return the unspent 4000 before-tax dollars. 401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k.

Weve been repaying the loan back to the 401 k but still have some ways to go.

Rates From 337 Simple Application - Apply Now. Dear Robert You do not need to worry about being taxed twice on this transaction. Rates From 337 Simple Application - Apply Now. If you get a raise a tax refund or any other type of bonus money put it toward your 401k loan.

Source: thefinancebuff.com

Source: thefinancebuff.com

As you know the loan repayments themselves are taxed and the eventual withdrawals get taxed. It is only significant when the amount borrowed is large and is repaid over several years. If a home equity line of credit or a personal loan option is pursued it is generally recommended that the individual work with a financial professional who can provide careful and thorough analysis of potential legal tax and estate implications. Ad Mortgage Holders Only.

Source: investopedia.com

Source: investopedia.com

But the analysis does not take into account that the 10000 of pre-tax money was received without paying any taxes. And being twice taxed on interest from this kind of loan is likely to cost less than what it would cost to borrow money in another way. Here is what you can expect. If a home equity line of credit or a personal loan option is pursued it is generally recommended that the individual work with a financial professional who can provide careful and thorough analysis of potential legal tax and estate implications.

Source: pinterest.com

Source: pinterest.com

In January or February the pension plan administrator for the 401 k. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes. However that statement greatly exaggerates the tax costs of taking a 401 k loan. It is only significant when the amount borrowed is large and is repaid over several years.

Rates From 337 Simple Application - Apply Now.

And being twice taxed on interest from this kind of loan is likely to cost less than what it would cost to borrow money in another way. Ad Mortgage Holders Only. Here is what you can expect. Rates From 337 Simple Application - Apply Now. The only money taxed twice in the transaction is the interest paid.

Source: investopedia.com

Source: investopedia.com

So if you took out a 10000 loan and only spent 6000 you will have to repay the 6000 you spent with after-tax dollars but could return the unspent 4000 before-tax dollars. 401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k. First the loan repayments are made with after-tax income thats once and second when you take those payments out as a distribution at retirement you pay income tax on them thats twice. Rates From 337 Simple Application - Apply Now. Here is what you can expect.

401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k.

Here is what you can expect. The author purports that merely because the loan repayments are made with after tax dollars that the comp needed to repay the loan represents a double taxation ie because of every dollar of loan payments 133 of comp. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes. If a home equity line of credit or a personal loan option is pursued it is generally recommended that the individual work with a financial professional who can provide careful and thorough analysis of potential legal tax and estate implications.

Source: investopedia.com

Source: investopedia.com

Unlike your 401K contributions the interest you pay on the loan even though it is going into your own 401K account is from your after tax earnings. 401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k. As you know the loan repayments themselves are taxed and the eventual withdrawals get taxed. Dear Robert You do not need to worry about being taxed twice on this transaction.

Source: pinterest.com

Source: pinterest.com

Although interest rates on 401k loans are typically low and you make interest payments back into your own account every day that your retirement money isnt in your account generating interest or capital gains makes it harder for you to reach your retirement savings goals. Here is what you can expect. Rates From 337 Simple Application - Apply Now. If you get a raise a tax refund or any other type of bonus money put it toward your 401k loan.

Source: exchangecapital.com

Source: exchangecapital.com

401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k. Do you pay income tax twice when you take out a 401k plan loan. The loan amount is not taxed twice but the interest you pay is definitely double taxed. AnswerIt is often claimed that one of the reasons that you should not do a 401k plan loan is that you will pay income tax twice on the amount.

Another myth is that when you borrow from your 401k you are being taxed twice because youre paying the loan back with after-tax money.

Ad Mortgage Holders Only. The author purports that merely because the loan repayments are made with after tax dollars that the comp needed to repay the loan represents a double taxation ie because of every dollar of loan payments 133 of comp. Short and sweet answer. Although interest rates on 401k loans are typically low and you make interest payments back into your own account every day that your retirement money isnt in your account generating interest or capital gains makes it harder for you to reach your retirement savings goals. The ONLY money that is taxed twice is the INTEREST that you pay to your 401 k on the loan.

Source: thefinancebuff.com

Source: thefinancebuff.com

But in truth only the interest part of the repayment is treated that way. It is only significant when the amount borrowed is large and is repaid over several years. But in truth only the interest part of the repayment is treated that way. The ONLY money that is taxed twice is the INTEREST that you pay to your 401 k on the loan. 401 k Loans Are Not Double-Taxed Please note however that 401 k loan PRINCIPAL is not double-taxed only the interest paid on that loan is taxed twice once when you earned it at your job and again when it is withdrawn from the 401 k.

Here is what you can expect.

Short and sweet answer. So if you took out a 10000 loan and only spent 6000 you will have to repay the 6000 you spent with after-tax dollars but could return the unspent 4000 before-tax dollars. But in truth only the interest part of the repayment is treated that way. However that statement greatly exaggerates the tax costs of taking a 401 k loan.

Source: pinterest.com

Source: pinterest.com

So if you took out a 10000 loan and only spent 6000 you will have to repay the 6000 you spent with after-tax dollars but could return the unspent 4000 before-tax dollars. Dear Robert You do not need to worry about being taxed twice on this transaction. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes. Rates From 337 Simple Application - Apply Now. This has been well-explained here here and here.

Source: pinterest.com

Source: pinterest.com

However that statement greatly exaggerates the tax costs of taking a 401 k loan. AnswerIt is often claimed that one of the reasons that you should not do a 401k plan loan is that you will pay income tax twice on the amount. The only money taxed twice in the transaction is the interest paid. However that statement greatly exaggerates the tax costs of taking a 401 k loan. Weve been repaying the loan back to the 401 k but still have some ways to go.

Source: thefinancebuff.com

Source: thefinancebuff.com

You pay the interest with after-tax money and it becomes pre-tax money when paid to the 401 k. Rates From 337 Simple Application - Apply Now. As you know the loan repayments themselves are taxed and the eventual withdrawals get taxed. The author purports that merely because the loan repayments are made with after tax dollars that the comp needed to repay the loan represents a double taxation ie because of every dollar of loan payments 133 of comp. Ad Our Eligibility Checker Will Show You Loans Most Likely To Say Yes.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 401k loans taxed twice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.